An enterprise exists in eternal pursuit of maximising profits. Electronics industry is no exception. And perhaps it exists in most dynamic environment, be it technology or manufacturing process or adaptation of business model to survive and be ahead of competition per se.

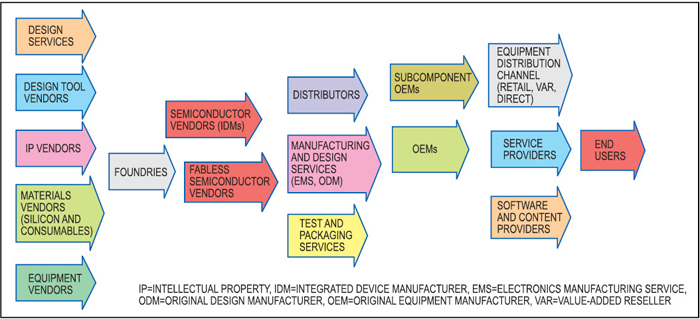

Role of semiconductor component distributors (also referred to as authorised distributors, franchised distributors and simply distributors in this article) is pivotal for enterprises engaged in electronics business. Let us look at the semiconductor value chain in Fig. 1.

This article talks about distributors shown in the middle just after the semiconductor vendors and before original equipment manufacturers (OEMs).

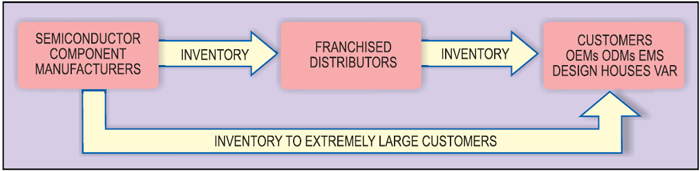

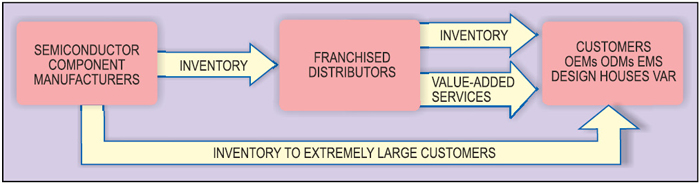

In most simplistic way, one may understand the distributors as entities that acquire components from chip-component manufacturers and deliver them to OEMs on agreed terms for logistics. Whilst doing so, they ensure that stock in their own warehouse is minimum (see Fig. 2). The appropriate basic understanding about electronics distributors is depicted in Fig. 3.

There are three major tiers of semiconductor and electronic products sales:

Tier 1. First tier is most simple yet covers almost all large opportunities. These are sales directly done by semiconductor component manufacturers such as Intel, Philips, Texas Instruments, Vishay, AMD, Sharp, etc to OEMs like HP Compaq, Dell, Nokia, Ericson, Sony, Huawei, etc. The OEMs, in turn, use the components to manufacture end-user products.

Tier 2. Second tier comprises franchised distributors. They market and distribute electronic parts and products predominantly to OEMs on behalf of the semiconductor component manufacturers. Distributors refer semiconductor component manufacturers as principals and often as vendors.

Tier 3. The third tier comprises all other selling and distribution channels. It includes independent distributors, stockists, surplus sellers, obsolete part sellers and value-added resellers (VARs). They, in turn, sell to OEMs, contract manufacturers and other distributors and resellers.

Tier 1 is simply a business reality that where big opportunity exists, there is no place for a mediator. Manufacturers would like to interact, manage and service directly in order to keep the costs to the minimum and relationship degree at the highest.

Second big chunk of sales are done to OEMs whose size is smaller than the above-said mega OEMs. Here, the number of customers is high. They are spread over different geographies, cultures and judiciaries. It is not viable for manufacturers to open their own offices, expand infrastructure and take credit exposure everywhere. Distributors fit well here. They carry franchise for several manufacturers, thereby making business potential overall large in a territory for them.

Independent distributors (tier 3) generally stock products, offer credit terms to their customers, provide value-added services such as kitting, pass on manufacturers’ warranties, provide rejected material acceptance (RMA) services and quality assurance to some degree.

Franchised distributors have sound business agreements with their vendors for prices, allocation of quantities, lead times, geographies and other aspects. They restrict themselves to the broad yet limited product lines they are franchised for. On the bottom of tier 3 lie the brokers and retailers.

Value-added services for the supply chain

Supply chain consulting. Can propose various options for the supply chain with pros and cons and help arrive at a customised solution. For large projects, logistics involving two or more parties and legal agreements between them are suggested.

Economies of scale, augmentation and ability to handle mega accounts. Distributors are well aligned with their principals and major customers as far as strategies and plans are concerned. They have financial muscle and bandwidth to augment the supplies when projects blossom.

Labelling/packaging. Under special agreements with customers, customised labelling and packaging can be offered which facilitates the manufacturing.

Consolidated shipments and consolidated invoicing. Normally, distributors avoid entertaining the cases involving components and products which they are not franchised for. As a special service, an agreement can be reached for clubbing the non-franchised items which can be either sourced by the distributor or arranged by the customer at distributor warehouse. A consolidated shipment is then made to the customer under a single invoice.

Electronic data interchange (EDI). Whilst distributors have systems to keep all their customers informed on the status of execution of their orders, they provide access to EDI facility to select customers. Customers can then track and monitor their order status in real time.

E-commerce. Many distributors have extended EDI for facilitating B2B and other e-commerce. In emergency, customers can go to a distributor’s website on-line, purchase components using credit and debit cards besides electronic fund transfers.