Is the end of the era of internal combustion engine-powered cars imminent? With this transition, what implications does it have for the component manufacturers serving the automotive industry? Moreover, is there space for new entrants to join the fray?

The Kia Seltos, Sonet, Carens, Tata Nexon, Safari, Harrier, and numerous other cars unveiled in 2023 showcase what the industry terms as connected lights at the rear and front. These traverse from pillar to pillar, linking the two taillights. While determining the cost at which vehicle OEMs acquire these from their suppliers is nearly impossible, the costs in the aftermarket can be easily explored, thanks to the lower-end variants of these cars.

For example, the rear connecting taillights for Maruti Fronx are available in the aftermarket, with prices starting at ₹8000. In contrast, Mahindra’s Bolero Neo, accommodating seven people, comes equipped with rear lights that cost only ₹1200 per pair. And this is just the tip of the iceberg named ‘automotive electronics’!

Sunil Bohra, Executive Director, Group CFO, and CEO of Safety & Comfort Systems at Uno Minda, recently shared with EFY, “When we introduced LED headlamps, they were approximately 3x the cost of halogen ones. Today, they are considerably more expensive. Tail lamps have become more intricate and costly than headlamps. In many instances, the cost of tail lamps has surged by 8x to 10x. This escalation is a consequence of the extensive integration of electronics into these components.”

“Thanks to a lot of competition in the country, evolving consumer needs, the entry of new players, and government impetus, the use of automotive electronics is on the rise in India,” explains Manish Manek, Chief VLE, MG Motor India.

Manek adds, “We are far from reaching the saturation point. Various aspects such as ADAS, connected features, telematics, and more have not realised even half of their potential. All these require robust electronic support to function. Let me reiterate we are far from reaching the ceiling!”

The automotive electronics iceberg

The Automotive Component Manufacturers Association (ACMA) of India recently released a report titled ‘Auto-Electronics Manufacturing: Conquering the Next Frontier.’ Conducted with Grant Thornton, the report identifies electronic automotive components as a market opportunity worth over $540-650 billion by 2032.

Products like reverse parking guide, DC-DC converter, charger system, tire pressure monitoring system, controller, telematics unit, navigation system, electronic power steering, power distribution module, thermal management system, and engine control system are highlighted for their high potential and ease of manufacturing. Coupled with nine more products, these are projected to grow from a current $9.3 billion opportunity to $56.4 billion in 2032.

Vineet Sahni, CEO and Director of FIEM Industries, informs EFY, “The electronic content in cars has grown 20 times. The rate of change has been exponential and is still increasing.”

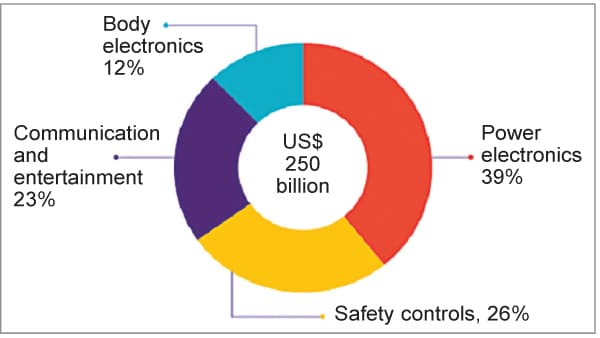

On a global scale, the automotive electronics market is expected to grow at a CAGR of 8–10%, reaching $540-650 billion in 2032 from $250 billion in 2022. According to Statista, India’s automotive parts exports were valued at around $19 billion in the financial year 2022, marking a significant increase from the previous year. Europe and North America were the primary export markets for India’s auto components industry.

Additionally, the increasing number of electric vehicles (EVs) presents an opportunity. EVs share many components with their internal combustion engine (ICE) counterparts, including infotainment systems, LED lights, window glass motors, and more.

According to MG’s Manek, “These are excellent opportunities for electronics component makers based in India. We have witnessed traditional component makers, previously strong in the mechanical components vertical, diversifying into electronic components.”

He adds, “In ICE cars and EVs, several components come from the same family. This represents a natural extension for an existing component maker.”

Even in the latest electric scooter launch from TVS, the focal point was not its powertrain, battery size, or futuristic looks, but the 26cm tilt screen loaded with infotainment features. Similarly, Yamaha, Honda, Suzuki, Bajaj, and Hero have begun offering LED displays as infotainment screens. Previously, these were only available in high-end motorcycles in developed markets like Europe and the United States.

The lowest hanging fruits

India, as confirmed by ACMA, heavily relies on imports to meet the demand for auto-electronic products, with around 64% of the total demand being imported. Furthermore, the domestic market for automotive electronics (OEM+Aftermarket) is expected to reach $63.7 billion by 2032.

While electronics used in exhaust gas circulation, electronic power steering, airbag electronics, anti-lock braking systems, and fully automatic temperature control are in high demand, the electronic content used in safety controls currently has the highest demand in the country.

This is followed by power electronics, communication electronics in entertainment consoles, and body electronics. Within power electronics, power electronics of internal combustion engine cars currently dominate the market.

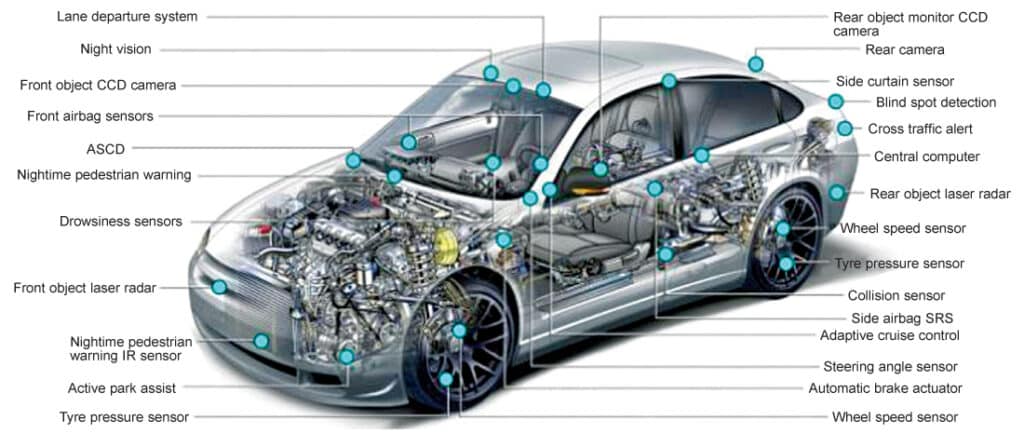

Bohra tells EFY, “Almost every component in a vehicle now has a sensor. The centre console is completely electronic, and the instrument cluster is electronic; many cars now display driver information electronically. Even smaller components such as window switches, gloveboxes, switches, mirror door switches, and more are becoming electronic. ADAS and telematics are becoming significant in cars, and car brands increasingly want these features in their vehicles.”

He adds, “A plethora of electronics is entering the ICE vehicle industry. In fact, we often jest cars, once primarily regarded as mechanical components, are now electro-mechanical equipment.”

He also notes that depending on the segment, there may be additional features, and the overall ticket size of electronic components is increasing. For example, in an A-segment car, a wireless charger may or may not be present, but in a C- or D-segment, it will be standard. We have not even come close to the ceiling of electronic components being equipped in vehicles. “This will only escalate from here,” he states.

Among the list of components Pioneer is looking to procure locally from India, camera sensors, systems on chips (SoCs), memories, and displays rank at the top. Until now, the company has been selling products made outside India in the Indian market.

Dr Siva Subramanian, Chief Innovation Officer at Pioneer Corporation, mentions in a conversation with EFY, “Our plan is to start manufacturing products for the Indian and global markets in India right away. We have already begun collaborating with Indian design and manufacturing partners. Given the growth potential, there is a strong possibility that we will establish a manufacturing facility in India in the future.”

A report by Mordor Intelligence highlights that the ‘India Passenger Car Market’ size will be an estimated $39.82 billion in 2024 and is expected to reach $53.04 billion by 2029, growing at a CAGR of 5.90% during the forecast period (2024-2029).

Focus on the child parts

Whether it is PCBs, heat exchangers, thin-wall casings, or thermoplastics, manufacturers of components usually have to depend on imports to meet their needs. In the true sense, thin-wall casing used in electric control units (ECUs) accounts for 20% to 25% of this component’s value. Additionally, heat exchangers contribute a 20% share in a thermal management system.

If ACMA is to be believed, then making these two parts locally in India can reduce the country’s import bill by $275 million by 2032. Also referred to as child parts, these find usage not only in the automotive industry but in other industries as well, including drones, robotics, consumer electronics, and more! Focusing on child parts makes more sense because the automotive industry’s evolution from ‘parts per million to parts per billion’ is kept in consideration.

Bohra explains, “There was a time when there was a tolerance for quality issues whenever you were buying from a supplier. The same would be noticed on an assembly line. Today, that tolerance is referred to as parts per billion instead of parts per million. For example, earlier, one part per million was supposed to be okay if there was an issue. Today, even that is not expected.”

According to him, export is also a significant opportunity for India. At the same time, domestic demand is skyrocketing in India. “It will take some time for the Indian industry to grow its international share of revenue because it cannot compromise on the delivery targets set by the domestic players,” he said.

Manek suggests that software is not just a layer added to electronics used in cars but also an opportunity for India’s software industry. Notably, a majority of automotive electronics products with medium to high software requirements are currently imported.

He says, “From a local vendor base, it is a significant opportunity. Many OEMs are vouching for these opportunities. Now the question is how do we capitalise on these opportunities for everyone’s benefit.”

Mukul Yudhveer Singh is the Editor for electronicsb2b.com