Explore India’s surge in semiconductor imports, the pressing need for self-reliance, and the strategic pillars reshaping the nation’s technological destiny.

India’s semiconductor imports have surged significantly in recent years, reflecting the country’s growing demand for these essential components in various sectors. The latest data highlights a substantial increase in semiconductor chip imports, underscoring the financial impact and the urgent need for domestic semiconductor manufacturing capabilities.

In 2021, according to OEC, India imported $5.38 billion worth of semiconductor devices, ranking as the 7th largest importer globally. Most of these imports were from China, amounting to $4.2 billion. This large scale of imports indicates a heavy reliance on foreign semiconductor sources. Furthermore, India’s semiconductor chip imports witnessed a dramatic 92% surge over the last three years.

The considerable growth in semiconductor imports and the substantial financial outlay highlight India’s urgent need to develop its semiconductor manufacturing capabilities. This development is crucial for reducing import dependency and enhancing India’s technological self-reliance and economic stability in a globally competitive sector.

Recognising this critical need, India has embarked on an ambitious journey to build a robust semiconductor manufacturing ecosystem and has devised several incentives to foster it.

However, incentives only help to a certain extent, beyond which laser-focused roadmap and planning around it is the need of the hour. This roadmap should foster India-centric investment in semiconductor manufacturing and enable the development of a sustainable and long-term ecosystem for semiconductor manufacturing.

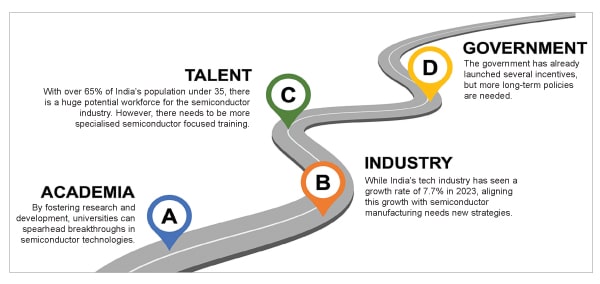

The four semiconductor manufacturing pillars India needs to focus on

Academia

Academia is not just a knowledge hub but a cradle for future semiconductor experts. By fostering R&D, universities can spearhead breakthroughs in semiconductor technologies. However, data shows that India’s current R&D expenditure is only 0.7% of its GDP, significantly lower than the global average of 2.23% (World Bank). A substantial increase in this investment is necessary for nurturing talent and innovation, apart from bridging the gaps in the curriculum concerning semiconductor manufacturing.

Industry

The role extends beyond investment. It is about turning academic research into market-ready technologies. While India’s tech industry has seen a growth rate of 7.7% in 2023, aligning this growth with semiconductor manufacturing needs targeted strategies. Collaborations with academia and focusing on industry-specific skill development are critical to this alignment.

Talent

India’s demographic dividend is its biggest asset. With over 65% of its population under 35, there’s a huge potential workforce for the semiconductor industry. However, there needs to be more specialised training. To bridge this gap, initiatives like the Skill India campaign must incorporate semiconductor manufacturing-specific modules.

Government

The government has already launched several incentives, but more targeted policies are needed. For instance, the Production-Linked Incentive (PLI) scheme, which aims to incentivise large-scale electronics manufacturing, could increase the incentives to more than 10%. This would enable better alignment with the semiconductor FABs and OSATs that will come up during this time in India.

So far, out of the above four pillars, the only positive activity that has been introduced is by the government. Both state and central governments have come up with focused semiconductor manufacturing incentives. However, apart from this, a lot needs to be done on the other three pillars (academia, industry, and talent).

Together, these elements can create a sustainable ecosystem, driving India’s ambition to become a leader in semiconductor manufacturing, contributing to its technological independence, and enhancing its position in the global market.

Country-specific FABs

Tailoring FABs to meet India’s specific semiconductor needs is essential. Given the country’s vast consumer electronics market, focussing on FABs that support mature (above 40nm) semiconductor nodes can fulfil domestic demand and drive exports. Then, India can build on the success of matured node FABs to enter the advanced node (40nm and below).

Assembly and test ecosystem

A semiconductor FAB is not isolated. It is part of an extensive ecosystem. Leveraging policies to support outsourced semiconductor assembly and test (OSAT) companies can create a comprehensive manufacturing environment. India has already taken steps towards this. However, the one high-scale assembly and test facility coming up in Gujarat is part of an IDM and probably will not cater to outsourced business. Thus, there is a need to set up facilities that cater to different types of semiconductor fabless companies.

Cluster approach near academic hubs

India can learn from global semiconductor hubs by developing clusters near academic institutions. This proximity facilitates knowledge transfer and resource sharing, which is vital for sustained innovation. Whether it is the US, EU, Taiwan, or even China, almost all these have mega to giga semiconductor manufacturing facilities and are closer to top world-renowned universities. India still needs to develop such a cluster and should spend time and money. Otherwise, the spread of the ecosystem into multiple small regions will lead to the distribution of resources, potentially enabling slower-than-expected development.

Long-term collaborations

The semiconductor industry thrives on long-term planning and partnerships. India must foster an environment encouraging government, academia, and industry collaboration. It should align with academia and industry requirements and cater to the workforce’s future job and training requirements.

Securing India’s future in the global semiconductor landscape

The blend of government policy, industry participation, academic innovation, and talent development forms the cornerstone of this decadal plan. By focusing on strategic investments, tailoring infrastructure, and fostering a culture of collaboration and innovation, India will not just aim to meet its current technological needs, it can also position itself as a pivotal player in the global semiconductor manufacturing arena.

This journey towards self-reliance in semiconductor manufacturing is more than an economic goal. It is a step towards technological sovereignty, ensuring India remains at the forefront of the digital revolution. If India can follow a set semiconductor manufacturing focused plan throughout the next decade, it can certainly transform country’s semiconductor economic landscape and will directly enhance its global standing, and secure its semiconductor driven technological future.

Chetan Arvind Patil, Senior Product Engineer at NXP USA Inc.