Electronics is at the heart of all modern warfare systems and, presently, the country is at the cusp of transforming the import bill in electronics that is fast competing to surpass the oil bill, presenting an opportunity for Indian companies.

India with the second largest armed forces in the world is identified as the seventh largest aerospace and defence (A&D) market globally with a sizeable budget spreading across the requirements of the country’s army, navy and air force. Large-scale modernisation of defence forces and indigenisation of manufacturing have emerged as focus areas.

Emerging technologies will reshape modern-day warfare by harnessing the power of electronics. This, in turn, will make the Indian strategic electronics sector, mainly comprising A&D, a vibrant industry in India over the next decade. This is an opportune time to embark upon a new phase of self-reliance in the sector by manufacturing technologically-advanced equipment within India.

Opportunities galore

The defence sector in the country has been growing at a modest pace for the past few years. The segment has received a push under Make in India programme. The concept of import substitution is being gradually accepted by stakeholders.

Considering the Indian government is looking to achieve a turnover of ₹ 1.7 trillion and export of ₹ 350 billion in military goods and services by 2025, the strategic partnership (SP) model in defence production will boost Make in India programme to a great extent. Moreover, high acquisition plans of the three armed forces will help the industry acquire capital assets worth ₹ 15 trillion in the next ten years.

Defence production in India is gradually heading towards private sector participation. As per ‘India’s Defence Market Outlook 2019-2025’ report, published by Market Research, between 2015-2016 and 2018-2019, out of a total 188 contracts, 121 contracts have been signed with Indian vendors, including defence public sector undertakings, public sectors undertakings, Ordnance Factory Board and private vendors for capital procurement of defence equipment.

The next decade is likely to see an exponential growth in combat systems as well as non-platform-based programmes facilitating smart battalion. Therefore opportunity for electronics in India stems across both standalone systems (as part of platforms) as well as at sub-system level for other systems. According to experts, key factors that will influence growth are:

- Modernisation of weapon platforms

- Induction of state-of-the-art weapons by the armed forces

- Impact of indigenisation and Make in India by the government

Electronics is at the heart of all modern warfare systems and, presently, the country is at the cusp of transforming the import bill in electronics that is fast competing to surpass the oil bill, presenting an opportunity for Indian companies. Prospects of growth of Indian companies will also be driven by defence procurement and offset policies, Make in India and other key initiatives.

Most of the recent upgradation on the military side show a huge scope for electronics, including upgrades for Jaguar, Ilyushin aircraft, MIG 29, T-90 tanks and more. In addition, new ventures of LCA Tejas, AMCA,C-295 W production with Tatas, single-engine aircraft production from SAAB (Gripen), any other chosen OEM, FICV project, missile development, new aircraft carriers, submarines, MCMV, and others, all point to an increased focus on electronics. Critical avionics, night-vision devices for the armed forces, missile electronics, electronic warfare (ground-based and airborne), software-defined radios, robotics, radars of all kinds, UAVs, electronic navigation systems, weapon sensors, air defence systems and so on are the much-publicised favourites. According to experts, key demand-generating applications are:

- Weapons control systems

- Avionics

- Digitalisation of displays

In addition to that, single-board computers (new technology), advanced PCB design technology, cables and harnesses to meet aerospace standards are also in demand.

Security is a key concern for any defence application. Therefore huge demand exists for holistic security networks and indigenously developed security devices. Despite huge opportunities, there is a demand-versus-supply gap in the strategic electronics sector with respect to availability of indigenous electronic components, products and solutions. Most components, products and solutions are still imported. Indian companies are not able to supply as per requirement, which involves low volume, high technology and high investment.

Electronic products and solutions required in India in volume will be in the areas of:

- EMS/build-to-print/line replaceable units for Indian programmes such as LCA, LCH, drones, Kamov helicopters, etc

- Rugged displays, PDAs, laptops, etc for BMS project

- Electronics components, products and solutions used in vehicles for projects like FICV, self-propelled guns and so on

Moreover, domestic capabilities are in demand to sustain and upgrade existing systems through innovative maintenance, repair and operational (MRO) solutions. Opportunities related to defence offset will be on the rise. However, there will be de-emphasis on hardware and a disproportionately larger emphasis on embedded intelligence. This will be India’s second coming in the domain of software, but in terms of high value-added smart systems and analytics. Companies in India that are ready to leverage this will grow tremendously. So, offsets will have to be defined in terms of service offerings rather than hardware, to take advantage quickly.

Tectonic shift in technology

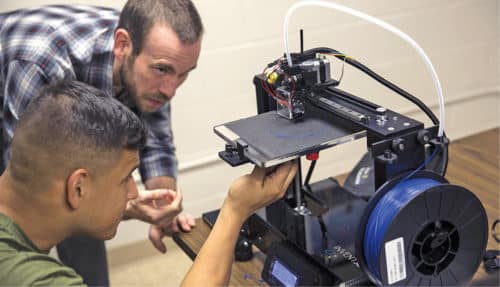

The A&D industry around the globe will focus more on disruptive technologies and fourth industrial revolution technologies, such as artificial intelligence (AI), 3D printing, fuel cells and so on.

AI is becoming prevalent across new naval technologies—missiles, navigation and aircraft—and this trend is set to increase, with intelligence increasingly devolved from platforms and systems, and injected into weapons. Recent developments in AI in the A&D domain also include research initiatives in the field of navigation techniques for drone swarms, cognitive electronic warfare, detection and signal processing in sensors, and dynamic spectrum allocation for radar/radio equipment in the congested radio frequency (RF) spectrums.

3D printing will gain importance as a low-cost parts manufacturing option, particularly in remote environments such as forward-deployed locations. As engineering improves either through component design or the way powders and filaments are developed, it will be utilised as a point to reduce cost over traditional fabrication methods.

Defence industry leaders are also investing in the development of new-generation diesel electric submarines with high endurance capability. The fuel cell technology will enable these submarines to generate power without surfacing to charge their batteries. Various companies, such as ThyssenKrupp Marine Systems (TKMS), Naval group and DRDO, are developing new-generation air-independent propulsion (AIP) technologies for that purpose.

Unmanned underwater vehicles (UUV) are on the way to show their genuinely disruptive potential as reconnaissance and weapon systems. With reports of Russia testing Poseidon system (earlier named Status -6) in December 2018, a nuclear powered-nuclear armed UUV with theoretically unlimited range and endurance, threat perception has become real. This will have an impact on the present development of such weapons, as well as defences against them, likely starting a new range of weapons.

The industry will see an accelerating development of counter-unmanned air systems (C-UAS). Vehicle-mounted C-UASes are still under testing and have limited usage; however, usage is expected to increase in the coming days.

Command, control, communications, computers, intelligence, surveillance and reconnaissance (C4ISR) is another domain that will undergo significant technological innovation and development. Influence of C4ISR will be seen in the following areas:

- Multifunction RF systems consolidating several RF functions like radar, electronic support, electronic attack and datalink communications within a shared set of electronics and antenna apertures using active electronically scanned array (AESA) technology

- Satellite constellation signifying a paradigm shift in space-based electro-optical and infrared (EO/IR) sensors

- Anti-access area denial (A2/AD) threats driving the development of aerial network alternatives to satellite communications (SATCOM)

- Use of gallium-nitride indicating a shift towards non-silica-based semiconductors, in the field of power electronics in defence applications, such as amplifiers for radar-based applications

- Application of short-wave infrared (SWIR) sensors for crucial surveillance and reconnaissance missions, as well as applications in medium-sized turrets, targeting pods and portable systems

- Cyber-security concerns impacting procurement schedules and boost funding, particularly of commercial off-the-shelf (COTS) wireless technology

- Tactical cloud-based applications reducing reliance on data centres, and offering a rapidly available and powerful battlefield cloud where tactical devices can be seamlessly connected

Focusing on Design in India

Despite huge opportunities, the Indian strategic electronics sector is still far from achieving self-reliance due to inadequate amalgamation of research and development (R&D) with manufacturing and absence of an integrated approach.

In the last few years, the defence sector has got a policy boost through the amendment of the defence procurement policy (DPP). DPP 2016 includes a special category called Buy Indian – Indigenously Designed, Developed and Manufactured, or Buy Indian-IDDM, which will get the highest priority in the defence procurement process—above all other categories, namely, Buy and Make Indian, Buy and Make, and Buy Global, in that order.

Inclusion of this new procurement category—Buy Indian-IDDM—will provide a greater thrust to Make in India initiative in defence production focusing on Design in India products and solutions.

This would promote in-house design capacity and higher localisation, strengthening the role of the domestic industry, especially the private sector, in defence production. However, it is to be noted that responsibility to prove an indigenous design rests with the industry, while the final approval would come from the government. This, in turn, would offer unique opportunities to companies that are operating or would like to operate within the defence industry, specifically in the areas of electronics system design, original design manufacturing (ODM), etc.

The government has already launched some programmes and schemes to facilitate R&D activities in this field. Technology Development Fund (TDF) and recently-opened Army Design Bureau are worth mentioning here. TDF is bound to enable and enhance R&D activities through the expansion of industry-academia partnership, and will be a big push for Make in India programme in the defence sector. And, Army Design Bureau can work in sync with Defence Research and Development Organisation (DRDO) and the private industry to achieve modernisation and indigenisation. This, in turn, will enhance opportunities for public-private partnership.

DRDO labs are practically the sole R&D agencies for design of defence weapons and equipment. Products designed by them are invariably transferred to defence PSUs for manufacture. The private sector gets very little transfer of technology from DRDO labs. This needs to change. The private sector, including MSMEs, needs to be given a fair share of technologies for product development by DRDO labs. They could be involved in the design stage, which would ensure seamless transfer of technology. Where the private sector lacks infrastructure and test facilities, these should be provided by the DRDO/DPSUs. This will ultimately help in the creation of a viable defence manufacturing capability in the private sector and promote self-reliance in the defence sector.

It is also recommended that prototype development by the private sector be funded, preferably with funds from the budget of the user defence service, which will create a sense of ownership. The recipient service would then closely monitor the development process and may even be able to suggest modifications, if required.

Policy boost

In the last few years, the strategic electronics sector got enough policy boost through the amendment of DPP, which included the removal of 49 per cent foreign direct investment (FDI) limit in the defence sector. Key provisions of DPP 2016 are:

- Inclusion of Buy (Indian-IDDM) procurement category

- Higher but flexible rule for indigenous content requirement

- Revamped procedures for Make projects

- Institutionalisation of RFI process

- Introduction of L1-T1 methodology for selecting final bidder

- Increased threshold limit for offsets

Removal of 49 per cent FDI limit in the defence sector has opened up avenues for significant investments and has given the much required impetus for many SMEs to have access to finance and technology. The liberalised FDI regime permits up to a hundred per cent (up to 49 per cent through the automatic route and beyond that through Foreign Investment Promotion Board, or FIPB, route) foreign equity in the defence sector, as India looks ahead to increase indigenous manufacturing in defence under Make in India programme.

However, FDI policy cannot become the only instrument to attract investment. It will be successful only if foreign OEMs can derive the necessary confidence in the system from an operational point of view. Moreover, foreign OEMs are less likely to create intellectual property (IP) in India. Therefore Design in India concept will not be promoted through joint ventures with higher FDI.

The Indian Ministry of Defence (MoD) has issued a new policy on May 13, 2019, to allow private industrial units and PSUs to self-certify the quality of products that are supplied to Indian Armed Forces. After ensuring the demonstration of the manufacturer’s capability of consistently producing defect-free products over a period of time, responsibility of self-certification will be delegated by Department of Defence Production (DDP), government of India.

Presently, except a few vendors, who have earned the self-certification status, all supplies are subjected to quality assurance by Directorate General of Quality Assurance (DGQA), an organisation under Department of Defence Production in the MoD. All items purchased by the defence forces are subject to trials and evaluation. This policy will bring a major change in the process, as it says, “In light of the government reiterating self-reliance in the manufacture of defence products, the self-certification scheme assumes greater significance.”

Moving forward

To ensure the Indian industry makes full use of this opportunity and creates world-class companies and capabilities that address not only India’s opportunities but also integrate into the global value chain of OEMs, there is a concrete need for the government to address some issues. Moreover, following challenges need to be resolved:

- Complex buying process and delay in completion of tendering process

- Inadequate government funding for R&D projects

- Inadequate provision for technical superiority to score over L1

- Absence of a level-playing field for Indian private sector players, especially SMEs with respect to PSUs and overseas vendors

- No self-reliance in critical technologies

- Absence of indigenous product development capacity

Successful resolution of the above-mentioned issues with absorption of transfer of technology for niche equipment, proper understanding of offset obligations and having a methodology to handle the same, understanding and executing international collaborations and international joint venture models along with proper emphasis on IPR and patents will help this sector explore full growth potential.

Also, this is the right time to explore export potential for space technology. India has substantial cost advantage in the global market for these technologies. It is worth mentioning that recently, Bharat Electronics Ltd (BEL), the largest DPSU in the country, has identified space electronics as a growth area. After successfully assembling and building one satellite for ISRO, BEL is now going ahead with building future satellites by partnering with the Indian industry. The company has bought 121,406sqm (30 acres) in Devanahalli, near Bengaluru, to build a separate facility specially to cater to ISRO’s satellite needs.

Sudeshna Das is director at ComConnect Consulting