As India accelerates towards automotive excellence, semiconductor innovation fuels the journey, promising a future where Indian-made chips drive the wheels of progress worldwide

According to the Ministry of Heavy Industries statistics, India’s automotive sector ranks fourth globally in production. By the end of 2023, India emerged as the world’s third-largest car market based on sales, and the valuation of India’s automobile industry positioned the country fourth worldwide. Overall, the sector contributes 7.1% to India’s GDP.

These statistics highlight critical aspects of India’s automotive industry and its domestic and international significance. So much so that in the next couple of years, India has an ambitious plan to double its automotive industry growth and become a world leader in automotive within a decade.

The key to this growth relies on semiconductor components, which, over the past decade, have become the backbone of all modern vehicles. These tiny silicon chips enable various features, ranging from safety, communication, entertainment, and efficiency. Automotive customers in India and globally realise how important safety features are, which are only possible if smart silicon chips are used.

Thus, the semiconductor industry will inevitably drive automotive growth in India and become more crucial for government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which encourages the adoption of eco-friendly vehicles through subsidies and incentives. The core of such vehicles is the numerous silicon products, as they are crucial enablers for all the alternate fuel (non-internal combustion engines) technologies where efficiency management becomes critical.

Furthermore, the Indian government’s push towards establishing a comprehensive electric charging infrastructure and its plan to ensure that 30% of all vehicles on the road are electric by 2030 also shows how crucial semiconductor components will be, which are, by default, needed to enable intelligent charging infrastructure.

Indian automotive semiconductor landscape

Modern vehicles require anywhere from 500 to 1500 semiconductor chips per vehicle. Advancements in safety features, infotainment systems, and autonomous driving technologies, among other things, drive this demand.

As vehicles become more sophisticated with features like advanced driver assistance systems (ADAS), electric vehicles (EVs), and connected car technologies, the demand for semiconductors in the automotive sector is surging. This trend will continue to gain traction, with semiconductor content per car projected to increase significantly, highlighting the sector’s importance in driving the future of automotive technology.

Despite the ambitious plans and the substantial growth of India’s automotive industry, the country faces significant challenges in automotive semiconductor manufacturing, a critical component of modern automotive technology. As of now, India’s efforts in semiconductor manufacturing are in the nascent stages, with the country working towards establishing its first semiconductor fabrication plants (fabs) capable of producing chips with 28nm technology. This technology, while a leap forward for India’s semiconductor ambitions, is still behind the cutting-edge processes used in leading semiconductor manufacturing countries, where fabs can produce chips as small as 5nm or even 3nm, which even automotive semiconductor companies have started to adopt. India’s automotive industry can still benefit from Tata-PSMC’s 28nm technology, which will require several years of close coordination with India-based automotive companies.

Until then, the Indian automotive industry entirely relied on importing semiconductor automotive products, making it, among other sectors, vulnerable to global supply chain disruptions, as vividly demonstrated during the Covid-19 pandemic. The global chip shortage highlighted the precarious position of industries reliant on semiconductors, with many automotive manufacturers forced to cut production, leading to significant financial losses and delays in delivering new vehicles.

Therefore, the establishment of a domestic semiconductor manufacturing facility catering to the automotive industry is not just a matter of industrial policy but a strategic necessity for India’s two major sectors: automotive and semiconductor. This is especially true as semiconductors are becoming more crucial for supporting the automotive sector’s growth ambitions and ensuring its resilience against global supply chain vulnerabilities.

Cost of automotive semiconductor

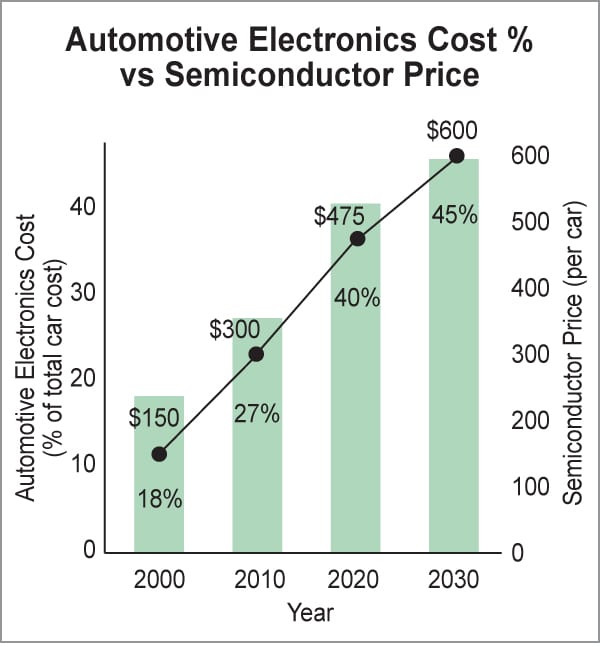

The rising cost of semiconductor content in automotive electronics is another angle that shows how crucial it is to the growth trajectory of India’s automotive industry.

Like the global shift towards electric, autonomous, and technologically advanced vehicles, the Indian market is also experiencing increased demand for vehicles equipped with advanced safety, infotainment, connected solutions, 360-degree view cameras, and many other driving assistance systems. This evolution elevates the role of semiconductors, the critical components at the heart of these electronic systems, thereby increasing the cost per vehicle.

From 2013 to the present, the semiconductor content cost per vehicle has significantly risen, jumping from approximately US$312 to around US$400, and projected to approach US$600 by 2024. This increase is indicative of the greater quantity of semiconductors required per vehicle and the industry’s move towards more sophisticated technologies-driven trends. These systems require high-end processors, sensors, and power control units, emphasising the shift towards higher performance and more complex semiconductor devices.

For the Indian automotive industry, these rising costs present both challenges and opportunities. On the challenge side, the increased cost of semiconductors contributes to higher overall vehicle prices, which could impact consumer affordability and the rate of technology adoption. However, this also presents a significant opportunity for Indian manufacturers to distinguish their offerings through cutting-edge technology, potentially capturing a larger share of domestic and international markets.

Addressing these challenges requires a multi-faceted approach. Indian manufacturers and suppliers must innovate in semiconductor technology development while finding ways to manage costs effectively. It could involve achieving economies of scale, improving operational efficiencies, and forming strategic partnerships to secure better pricing and supply chain reliability. Moreover, the industry is looking towards alternative materials and designs, such as compound semiconductors like silicon carbide (SiC) and gallium nitride (GaN), which offer better performance and could lead to cost savings over the long term despite higher initial investment. To help this cause, the government of India has already laid out an incentive plan to set up compound semiconductor-based semiconductor fabrication facilities in India.

Furthermore, the strategic importance of semiconductors in India’s automotive growth underscores the need for investment in domestic semiconductor manufacturing capabilities. Developing a local semiconductor industry could reduce import dependence, mitigate supply chain risks, and support the automotive sector’s ambition to become a global leader.

In summary, the escalating cost of semiconductor content underscores electronics’ critical role in the modern automotive industry, particularly for India’s growth ambitions. As the country advances towards more connected, autonomous, and electrified vehicles, effectively managing semiconductor costs and bolstering domestic production will be vital to sustaining innovation and competitiveness in the global automotive landscape.

| semiconductor manufacturing | |

| Strategy | Description |

| Investment in semiconductor fabs | Prioritise investments in fabs specialising in automotive-grade semiconductors, meeting high-reliability standards for automotive applications, and focusing on compound semiconductor fabrication and testing facilities |

| Partnerships with global semiconductor companies | Establish joint ventures or partnerships with global automotive semiconductor companies to gain access to advanced manufacturing technologies, expertise, and supply chains |

| Focus on specialised automotive semiconductors | Identify and focus on niches within the automotive semiconductor market where India can develop a competitive edge, like EV battery management systems, ADAS chips, or connectivity modules |

| R&D and innovation ecosystems | Invest in R&D to foster innovation in automotive semiconductor technology, supporting universities, startups, and research institutes. Many of these activities are already in place. Now, the focus should be on semiconductor-driven automotive |

| Skilled workforce development | Develop specialised education and training programs to create a skilled workforce in semiconductor manufacturing that caters to automotive electronics |

| Government incentives and policies | Implement favourable policies and incentives to encourage investment in automotive semiconductor manufacturing, including tax breaks and subsidies for R&D. Further enhance the compound semiconductor-based incentives |

| Supply chain and logistics support | Develop a robust supply chain and logistics infrastructure for automotive semiconductor manufacturing, including raw materials and advanced equipment |

| Focus on sustainability | Incorporate sustainability into the semiconductor manufacturing process, aligning with global automotive sustainable standards |

| Market alignment and forecasting | Continuously monitor global and domestic automotive (and semiconductor) markets to align manufacturing capabilities with current and future demand |

| International collaboration | Engage in international automotive semiconductor collaborations and standard-setting bodies to ensure interoperability of Indian-made automotive semiconductors in the global market |

How India can speed up automotive growth with semiconductor manufacturing

India can strategically plan semiconductor manufacturing to cater to its automotive industry demand through several logical steps as shown in the table.

By systematically addressing these areas, India can effectively plan and establish a semiconductor manufacturing ecosystem that supports its every-green automotive industry, ensuring self-reliance and a strong position in the global automotive market.

Future course of automotive semiconductor in India

The future course of automotive semiconductors in India is poised at an exciting juncture. Converging several key trends and strategic initiatives drives significant growth and innovation potential.

As the Indian automotive industry continues to evolve towards electrification, connectivity, and autonomy, the role of semiconductors will become increasingly central, offering a unique opportunity for India to establish itself as a critical player in the global automotive semiconductor market.

In conclusion, the future course of automotive in India is marked by opportunities for growth, innovation, and global leadership in semiconductor. By focusing on semiconductor design and manufacturing that caters to new-age automotive requirements, India can navigate the complexities of the worldwide semiconductor market and carve out niche self-reliance in the automotive sector, too.

The journey will require coordinated efforts across the government, industry, and academia, but the potential rewards for economic growth, technological advancement, and strategic autonomy are substantial.

Chetan Arvind Patil, Senior Product Engineer at NXP USA Inc.