Sodium-ion batteries (SIBs) are gaining attention as one of the most viable next-generation alternatives to lithium-ion batteries (LIBs) due to the abundance of material resources and low cost.

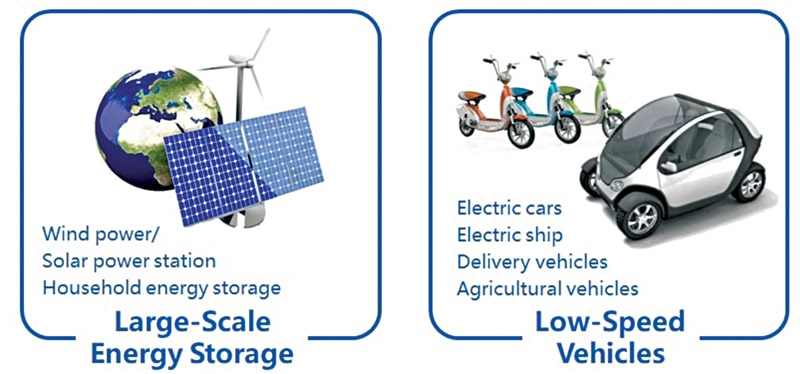

Rechargeable lithium-ion batteries (LIBs) have unmatched energy density and versatility. From electronic gadgets to electric vehicles (EVs), they are widely used, and their popularity is increasing day by day as they provide fast-charging rates and long life cycle. However, their ever-increasing application, global demand, and rising cost due to the declining availability of lithium and other raw materials such as cobalt, copper, and nickel are causing unprecedented pressure on the supply chain. Sodium-ion batteries (SIBs) are emerging as the most promising technology for replacing LIBs, as they share the same fundamental working principle, cell construction, power delivery characteristics, and wide application due to their low charging time, greater life cycle, and low cost. SIBs use raw materials that are abundant, cheaper, have a reduced impact on the environment, and provide better safety during operation and transportation. Additionally, they can be discharged completely to zero volts, causing no risk of thermal runaway, and perform effectively at temperatures ranging from as low as minus 20 degrees Celsius to as high as plus 65 degrees Celsius. Therefore, sodium-ion batteries (SIBs) are emerging as a viable technology on the cusp of commercialisation. Presently, SIBs are considered most suited for applications such as short-range electric vehicles and large-scale energy storage systems. They also have the potential to store renewable energy generated from sources like solar and wind power and can serve as a more cost-effective choice for electric vehicles.

Evolution of the sodium-ion batteries technology

Although SIBs have been studied since the early 1970s, their development somewhat slowed down due to the increasing popularity and high demand for LIBs. However, research was revived in earnest during the late 1990s as the prices of LIBs started to increase due to rising raw material costs and supply chain issues. Additionally, serious concerns were being raised about the adverse impact on the environment and increasing safety issues during operation. The first sodium-ion cell using hard carbon was demonstrated way back in 2003, showing an average voltage of 3.7V during discharge. The development gained momentum only during the last decade as SIBs were found to be the most promising alternative to LIBs. Efforts are now underway to establish scalable production technology capable of meeting the commercial targets of a lifetime cost less than £0.1/kWh, deep discharge cycle life greater than 10,000 cycles, capital expenditure less than £250 (usable kWh installed), volumetric energy density greater than 20kWh per cubic metre, and lifetime over 10 years. While initially, Japanese scientists made crucial advances, Chinese companies are now leading in commercialising the technology. It is expected that in the next two years, China will have nearly 95 percent of the world’s capacity.

Recently, China-based HiNa Battery Technology demonstrated an electric test car using a 140Wh/kg SIB. The world’s biggest battery manufacturer, CATL, has announced that it will begin mass production in 2023. However, commercially available EVs using sodium-ion batteries are not yet available.

How SIBs work?

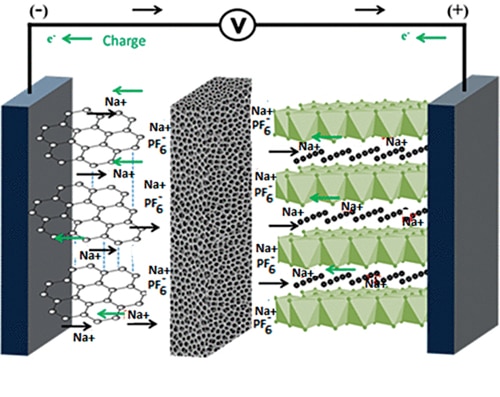

A sodium-ion battery is made up of an anode (not necessarily a sodium-based material), a cathode made of a sodium-containing material, a porous separator, liquid electrolyte containing dissociated sodium salts in polar protic or aprotic solvents, and two current collectors—one positive and one negative. Polar protic solvents, such as alcohols and water, have acidic protons, while polar aprotic solvents, like acetone and crown ethers, do not have acidic protons. The anode and cathode store the sodium, while the electrolyte carries charged ions from the anode to the cathode and vice versa through the separator. The movement of sodium ions creates free electrons in the anode, creating a charge at the positive current collector. The current then flows from the current collector through the device being powered by the battery, such as a smartphone, to the negative current collector. The separator blocks the flow of electrons inside the battery. During discharging, the anode releases sodium ions to the cathode, generating a flow of electrons from one side to the other. During charging, sodium ions move from the cathode to the anode, while electrons travel through the external circuit.

Electrode materials

Electrode materials for SIBs can be classified into three basic categories based on the reaction mechanism: insertion, alloying, and conversion. Insertion materials insert the host sodium ion (Na+) into the interstitial space; alloying materials form an alloy with the host material during the electrochemical reaction; conversion materials react with host ions to form another compound that can be recovered upon reverse reaction.

Anode materials

Insertion anode graphite, commonly used in LIBs with carbonate-based electrolytes, does not work in SIBs due to the larger size of the Na+ ions. Hard carbon is the only insertion anode material being used commercially. Other insertion anode materials, such as sodium titanate and sodium titanium phosphate, are also being studied for future use. The limited specific capacity in insertion materials poses serious concerns. Alloying anodes, such as Sn and Sb, can provide higher specific capacity. However, the severe volume change during the alloying reaction due to the large size of Na+ ultimately leads to cell failure. Recently, research has shifted from alloying and insertion materials to conversion materials, such as metal oxides, metal sulphides, and metal selenides. Conversion materials facilitate fast kinetics with a higher potential (lower overall voltage) compared to alloying and insertion anodes and provide the highest power density compared to alloying and insertion materials. Insertion materials are the most energy dense, followed by alloying and conversion materials. The fast reaction in conversion materials favours power density, while the lower potential (higher overall voltage) of insertion anode materials favours energy density. It is essential to optimise between power density and energy density in the electrode chemistries. Research on organic anode materials, another class of anodes, is still in the nascent stage.

Cathode materials

Cathode materials play a critical role in the performance of SIBs. The four main types of insertion cathodes, categorised by structure, are sodium transition metal oxide, polyanionic, Prussian blue analogue, and organic-based cathodes. Amongst the insertion materials, sodium iron hexacyanoferrate has been found to be the most promising in terms of energy density, and phosphate-based sodium vanadium in terms of fast charging. Sodium analogue cathodes, specifically metal oxides and polyanionic materials, perform adequately with energy densities above 100Wh/kg and voltages over 3.0V. Many start-ups are working on Prussian blue analogues to avoid the use of cobalt in the cathodes. The nanostructuring of the materials can alleviate most of the limitations, enhancing performance in terms of capacity and rate capability. However, there are certain concerns such as structural instability, limited ionic movement, and low electrical conductivity that need to be addressed. The formation of materials with a carbon framework that has nanostructuring helps in this regard.

Electrolytes

The choice of electrolytes is important, and both aqueous and non-aqueous electrolytes are used in SIBs. Aqueous electrolytes provide limited electrochemical stability, lower voltages, and energy densities. Non-aqueous carbonate ester polar aprotic solvents such as ethylene carbonate, dimethyl carbonate, diethyl carbonate, and propylene carbonate can extend the voltage range. Sodium hexafluorophosphate is added to a mixture of these solvents to stabilise the anode and cathode during cycling. Mixed organic carbonate solvents provide optimal discharge and charge over a wide temperature range, thermal stability, high-rate capability, long cycle life, and shelf life.

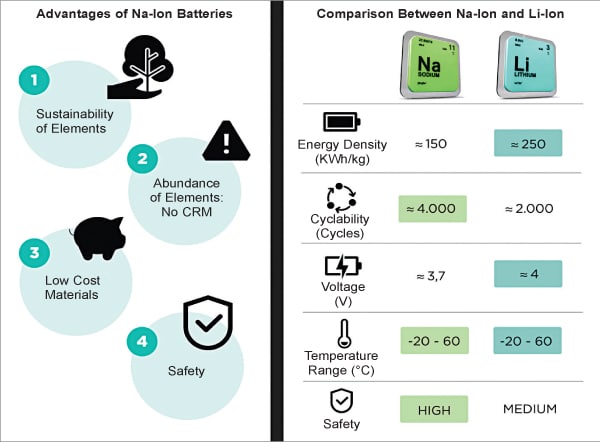

How SIBs compare with LIBs?

SIBs are a promising alternative to LIBs, the most widely used rechargeable batteries. The build and performance of both LIBs and SIBs are almost similar. Both have similar power delivery characteristics and use liquid electrolyte to store and transfer electrical energy with different types of ions. The lower dissolving energy for sodium ions, i.e., 157kJ/mol compared to 218kJ/mol for lithium ions, enhances the kinetics in SIBs, allowing for faster charging rates and a longer cycle life. SIBs have slightly lower energy density but better safety characteristics. The biggest advantage of SIBs is the high natural abundance of sodium, which is 23,600 ppm compared to lithium’s 20 ppm in the Earth’s crust, and the lower cost of extraction and purification. Unlike lithium batteries, sodium batteries retain almost all the charge when temperatures fall below freezing point, resulting in a more sustainable and environmentally friendly performance. However, due to their relatively lower energy density by both weight and volume, SIBs are not suitable for use in electric cars where size and weight are critical parameters. The figure on previous page summarises the key differences between SIBs and LIBs.

The key SIB players in the world

Most major companies manufacturing LIBs are showing an interest in manufacturing SIBs since their existing infrastructure can be adapted with a few alterations. The market size is expected to reach around US$3.2 billion by 2027 based on the growing demand for laptops, mobiles, remote access devices, and other electronic products. Several players, including Contemporary Amperex Technology (CATL), Faradion, HiNa Battery Technology, TIAMAT, Natron Energy, and Altris AB, are active in the field.

CATL

CATL, the battery manufacturing giant of China and the world’s largest manufacturer of LIBs, is going to launch large-scale production of SIBs during 2023 using Prussian blue analogue for the positive electrode and porous carbon for the negative electrode. The batteries will provide a specific energy density of 160Wh/kg and cost less than LIBs. CATL is also developing a compact battery pack that combines sodium cells and lithium cells, leveraging the weather resistance properties of sodium cells with the extended range of lithium cells.

Faradion

Faradion, a UK-based startup working on SIB technology for several years, has been acquired by India’s Reliance Industries (RIL). Faradion has developed pouch cells using oxide cathodes, hard carbon anodes, and a liquid electrolyte. The batteries provide an energy density of 160Wh/kg, a cycle life of 300 (100% depth of discharge) to over 1,000 cycles (80% depth of discharge), and can be transported in the shorted state (0V), reducing the risk during movement.

HiNa Battery Technology

HiNa Battery Technology, a China-based company carved out from the Chinese Academy of Sciences (CAS), focuses on the development and production of next-generation SIBs that are longer-lasting, low-cost, and provide better energy density. HiNa has developed three types of SIBs: one with cylindrical cells and two with square cells, with gravimetric energy densities of 140Wh/kg, 145Wh/kg, and 155Wh/kg, respectively. The batteries are based on Na-Fe-Mn-Cu oxide cathodes and anthracite-based carbon anodes. In 2019, HiNa became the first company to install a 100kWh SIB in an electric test car, Sehol E10X, in partnership with Jianghuai Automobile Co (JAC).

Tiamat

Tiamat, a Swedish company, has developed 18650-format cylindrical SIB cells based on polyanionic materials, which are suitable for fast charge and discharge applications such as mobility and stationary energy storage. The batteries provide an energy density between 100 and 120Wh/kg, a power density between 2 and 5kW/kg, a 5-minute charging time, and a lifetime of 5000+ cycles to 80% of capacity.

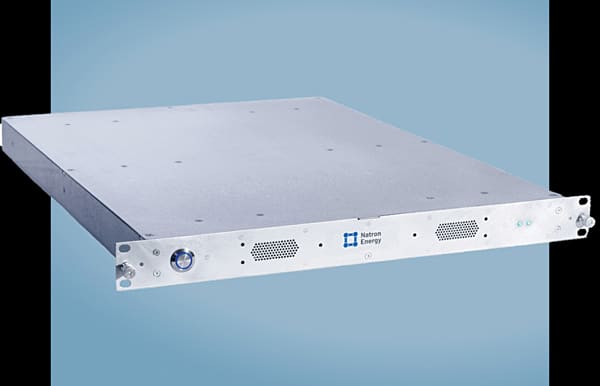

Natron Energy

A California-based company, Natron, in partnership with Clarios, is going to mass-manufacture rack-mounted sodium-ion battery systems for industrial use in large data centers’ backup power, EV charging stations, and other industrial applications such as forklifts. The batteries use Prussian blue analogues for both the anode and cathode with an aqueous electrolyte and can achieve an energy density of 70 watts per kilometre per kilogram. The batteries offer strong volumetric power density, an 8-minute charging time, a lifespan of over 50,000 cycles, and thermal stability for safe transportation.

Altris AB

Altris AB is a Swedish company that has developed a technology for mass production of Prussian white, known as Fennac. Fennac is considered the ideal material for use as cathodes in SIBs. SIBs utilising Fennac cathodes, along with a hard carbon anode and a patented non-flammable electrolyte, can achieve a maximum capacity of 170mAh/gm and an average voltage output of 3.2V.

The SIB bright sparks in India

India, as the largest importer of oil in the world, aims to reduce its import burden by promoting the adoption of electric vehicles that rely on LIBs. At the COP26 summit, India committed to meeting 50% of its energy requirement from renewable sources and increasing non-fossil fuel power generation capacity to 500GW by the end of the decade. Renewable energy sources, such as wind and solar, utilise battery energy storage systems (BESS) to ensure reliable and uninterrupted energy supply. Currently, LIBs fulfill the demand for BESS in India, with the market estimated at US$4,300 million and expected to grow to US$25,300 million by 2030. To reduce dependence on imports from China, the Indian government has initiated plans and investments in the development and commercialisation of SIBs. Several companies and organisations have invested or are in the process of investing in SIB development. Here are some major players:

Reliance New Energy Solar (RNES)

RNES, a part of the Indian conglomerate Reliance, has acquired the UK startup Faradion with a US$135 million investment. RNES is establishing a Giga-scale manufacturing facility using Faradion’s technology, with a production capacity of 1GWh. This acquisition is considered a strategic move to accelerate indigenous SIB production for electric vehicles, mobile applications, and BESS, reducing India’s reliance on China. As of June 2023, RNES is the only company manufacturing SIBs in India.

Sentient Labs

Sentient Labs, a Pune-based research and technology company, is developing sodium-ion batteries that are expected to cost approximately half of what LIBs cost.

Bharat Heavy Electricals Limited (BHEL)

BHEL, a Navratna Public Sector Undertaking (PSU) and one of the largest government-owned engineering and manufacturing companies in India, is actively involved in SIB research and development. They have developed prototypes for trials in renewable energy applications.

Amara Raja Batteries

Amara Raja Batteries, based in Hyderabad, is a leading manufacturer of conventional batteries in India. They are exploring the development of sodium-ion batteries for energy storage applications.

Other organisations

Several other organisations are also engaged in SIB technology development in India, including Bharat Energy Storage Technology (BEST), Indo-US MIM Tech Technology, Central Electrochemical Research Institute (CECRI), and Amrita Centre for Nano Sciences and Molecular Medicine (ACNSMM). Additionally, IIT Kharagpur and several startups, such as KPIT Technologies, Indi Energy, and Sodium Energy, are actively working on SIB development. IIT Kharagpur has made advancements in nano-materials and supercapacitors for next-generation energy storage technologies, with plans for industrial-scale production.

But China dominates the market

China holds a dominant position in the global lithium-ion battery market, accounting for approximately 60% of the market share, with 80% of the largest battery manufacturers based there. China controls the lithium supply chain, possessing 61% of the global lithium refining capacity. The country has made significant progress in mining rare materials, training engineers, and establishing large factories to meet the rising demand for batteries. Chinese companies are also leading the race in developing SIB manufacturing technology. The Chinese 14th Five-Year Plan for Scientific and Technological Innovation in the Energy Sector, which extends until 2025, emphasises research on SIBs to promote the use of renewable energy. CATL, the world’s largest battery manufacturer, is at the forefront and plans to mass-produce and supply SIBs in 2023 at a lower cost compared to LIBs. In the next two years, China is expected to hold nearly 95% of the world’s SIB manufacturing capacity. However, China faces challenges as it cannot rely on importing soda ash from the US due to sanctions. Soda ash is a primary industrial source of sodium, and the US accounts for over 90% of the world’s mined reserves. As a result, China is compelled to produce synthetic soda ash, which poses a serious risk of hazardous water pollution. Recent incidents, such as the collapse of a pile of alkali slag contaminating a major river in China, highlight the environmental concerns associated with synthetic soda ash production.

Future challenges

While SIBs offer a promising alternative to the widely used LIBs, their development is still in its nascent stage compared to LIBs. The increasing demand for lithium, cobalt, graphite, nickel, and manganese presents significant environmental and health risks. Given the scarcity of rare earth metals and the heavy reliance on China for the global supply chain, it is crucial to establish effective alternatives. SIBs, with their abundance of sodium, faster charging capabilities, wider temperature range, non-flammability, and lower cost, present a viable solution. However, there are several challenges to address. These include limitations in flexibility, as SIBs cannot be shaped into various forms like prismatic or cylindrical; lower energy density and storage capacity compared to LIBs; a typical cycle life of 5,000 cycles, significantly lower than the 8,000-10,000 cycles of LIBs; the lack of a well-established supply chain for raw materials; and the need for commercial-scale production. SIBs face limitations in applications such as deep-sea exploration, aerospace technology, and operation of military equipment at very low temperatures due to sluggish electrochemical reactions and unstable interfacial reactions caused by extremely low operating temperatures.

Overcoming these challenges requires continuous research and development efforts, with a focus on improving electrolytes for high charge and discharge rates over a wide temperature range, extending cycle life and shelf life, and gaining a deeper understanding of ion transport relationships in sodium intercalation electrodes.

SIBs have shown suitability for applications such as electric two-wheelers, three-wheelers, and low-speed short-range EVs. However, the larger size of sodium batteries compared to lithium batteries with the same electric charge poses a challenge for electric cars, which have limited space. Battery energy storage systems and power backup in electric utilities are other applications where energy density demands are less stringent. Intensive research is required to achieve specific energies approaching 200Wh/kg, a deep discharge cycle life exceeding 10,000 cycles, volumetric energy density greater than 20kWh per cubic metre, and a lifetime of over 10 years for high-voltage grid-scale applications. Therefore, further research and development are necessary to overcome these challenges and establish SIBs as a backbone of the rechargeable battery industry. Optimisation of performance and durability, improvements in materials and electrode designs, and enhancements in energy density and cycle life will determine when SIBs become commercially feasible and widely adopted.

Dr Deepak Halan, the author is currently Associate Professor with Jaipuria Institute of Management, NOIDA