As technology advances, batteries evolve. From aerogels to CTP designs, what are the latest breakthroughs in battery safety and performance?

Thermal runaway in electric vehicle (EV) batteries is a critical safety concern that demands careful attention. This phenomenon can occur due to various factors, such as overheating or internal and external short circuits. When thermal runaway occurs, it triggers a rapid increase in temperature and the release of volatile gases, potentially leading to a dangerous cascade effect if it spreads to other cells within the battery pack. Such incidents can result in temperatures exceeding a thousand degrees, and the highly volatile gases can ignite upon contact with high voltages, posing significant risks.

The fire risks associated with EVs differ markedly from those in combustion engine vehicles, where flammable liquids like petrol and diesel are the primary concern. In EVs, energy storage devices contain materials such as lithium, necessitating unique fire safety considerations. The potential for gas venting in confined spaces, such as garages, can create explosive conditions, and EV fires may take longer to extinguish. Moreover, the evolving nature of regulations for EVs, which often lag technological advancements, adds complexity to safety measures.

As demand for EVs continues to rise and safety regulations become more stringent, the need for advanced fire protection materials becomes increasingly critical. The expanding EV market has prompted companies to adapt existing products or develop new ones specifically designed for EV safety. This burgeoning sector has attracted a growing number of players, all vying for a share of the market and aiming to meet the rising demand for effective fire protection solutions in EVs.

Battery cell formats and design flexibilities

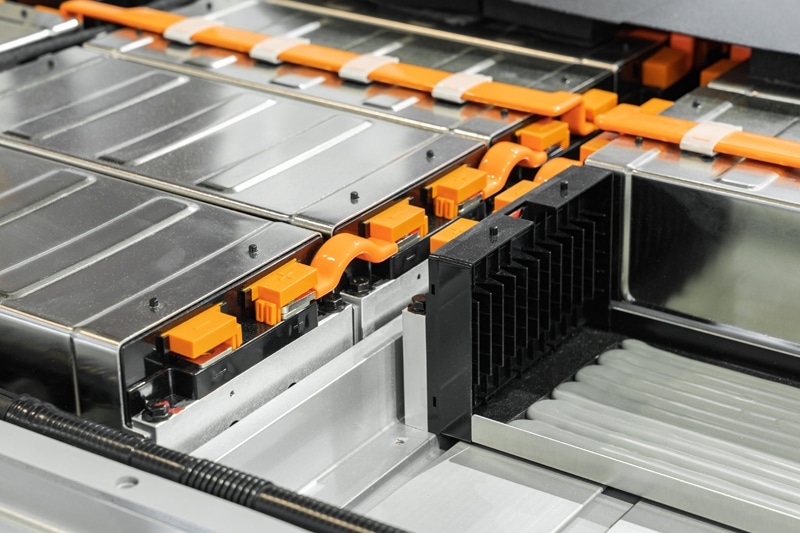

In the EV industry, the choice of battery cell formats is a critical consideration, with prismatic, cylindrical, and pouch cells being the primary options. Prismatic cells are favoured for their ease of stacking and suitability for incorporating insulating materials. This makes them a popular choice in markets like China. Major cell suppliers such as CATL have adopted this format, while others like LG Chem prefer the pouch format for its superior energy density.

Pouch cells, despite their higher energy density, present challenges in pack construction due to their expansion and contraction during operation and across their lifespan. Manufacturers like GM have developed battery packs that can accommodate different cell formats, including prismatic and pouch cells, with cylindrical cells announced for the future, providing flexibility in design and sourcing. Cylindrical cells, on the other hand, offer more flexibility in pack design but require more individual connections, making the pack structure more complex.

Tesla’s shift from smaller cylindrical cells to larger ones has simplified manufacturing and enabled a cell-to-pack approach, influencing the industry’s adoption of cylindrical cells. However, each cell format has its advantages and disadvantages, affecting the design and performance of EV battery packs. Prismatic cells are easier to construct into a pack, cylindrical cells provide flexibility in design, and pouch cells offer the highest energy density but require careful management of their expansion and contraction.

EV manufacturers are exploring various strategies to accommodate different cell types, with trends towards cell-to-pack designs that eliminate modules, reducing materials and complexity. This diversity in cell formats allows for more options in battery pack design and supply but also presents challenges in designing battery packs for different models. Ultimately, the choice of cell format depends on the specific requirements of the EV, including energy density, safety, and manufacturing efficiency.

| Unique challenges of the Indian EV market |

| The Indian EV market, especially in the micro-mobility segment, faces distinct challenges due to its unique environment and consumer preferences. Safety concerns are heightened as these smaller vehicles, such as scooters, two-wheelers, and three-wheelers, are often charged inside homes, increasing the risk to owners in the event of a battery issue. Key challenges include: Prevalence of micro-mobility. Scooters and two-wheelers are more common, leading to different safety and infrastructure needs compared to larger EVs Battery quality concerns. Lower-cost vehicles have raised questions about battery quality, prompting government regulations to ensure safety High ambient temperatures. With temperatures reaching 40-50°C, the lack of active cooling strategies in these vehicles poses a significant challenge for thermal management Cost sensitivity. Providing adequate protection while meeting the low price points expected in the Indian market is a major hurdle Despite these challenges, there is a push towards innovative solutions like encapsulation and phase change materials to improve thermal management without active cooling systems. Companies such as Ola, Pure EV, and Okinawa have faced recalls due to fire risks, highlighting the urgent need for enhanced safety measures. As the market evolves, ensuring the safety and reliability of EVs in India’s unique conditions will be crucial for widespread adoption and consumer trust. |

Fire safety in EV batteries

The primary objective of fire protection materials in EV batteries is to prevent or delay the spread of thermal runaway events within the battery pack, rather than merely extinguishing fires. Once a cell undergoes thermal runaway, the focus shifts to containing the event and preventing it from affecting adjacent cells. The choice of materials for this purpose varies depending on the cell type and design considerations. Historically, ceramic blankets and mica have been popular choices for their fire protection properties, despite some drawbacks such as dustiness and brittleness, respectively.

Recent trends have seen a shift towards alternative materials like aerogels, which offer the dual benefits of fire protection and thermal insulation while being lighter than traditional options. In battery packs with cylindrical cells, encapsulating foams are commonly used to provide insulation and structural support, as well as to reduce the oxygen available for combustion within the pack.

The role of encapsulating foams extends beyond insulation, as they also contribute to electrical safety by preventing arcing and the ignition of vented gases. There is a tactical shift towards designs that eliminate the module housing, necessitating fire protection materials that can conform to the shape of the cells and provide effective thermal insulation.

Aerogels are particularly appealing in this context due to their excellent thermal insulation properties and lightweight nature, which can enhance the energy density of the battery. However, their application has been limited by factors such as cost and brittleness, which are being addressed through innovations like polymer encapsulation.

The industry relies on a variety of material suppliers to meet these evolving needs. For example, Aspen and IBIH are key players in the aerogel market, while Dow and HB Fuller provide encapsulating foams. Other suppliers, such as Asheville Mica and Morgan Advanced Materials, offer mica and ceramic blankets, respectively. This diverse supplier landscape is instrumental in advancing the safety and performance of EV batteries.

Cell-to-pack designs

Cell-to-pack (CTP) designs in EVs are an innovative approach to battery configuration, where individual cells are directly assembled into a pack, eliminating the need for modules. This design simplifies the manufacturing process and reduces costs but also presents challenges in fire protection. Since modules are no longer present, fire protection must be applied at the cell or pack level.

In CTP designs, the materials used for fire protection are critical, as they generally need to be placed between the cells. As manufacturers aim to make battery packs less complex and lighter, the ideal fire protection materials should serve multiple functions. They should not only provide fire protection but also offer thermal and electrical insulation. This multifunctionality means that fewer individual materials are required, leading to a more streamlined and efficient design.

When it comes to thermal management and safety, CTP designs require a different approach. Safety materials are more commonly placed between cells and at the pack level, either above or below the cells. This is a significant shift from traditional designs that often relied on module-level protection. For thermal management, keeping cells at their optimal operating temperature is still a priority. The construction may be simpler, as seen in the BYD Blade battery pack, which uses a single large cold plate across all cells. Tesla’s 4680 battery pack, with fewer individual cells, can utilise fewer coolant channels. However, the overall thermal management strategy remains similar to previous designs.

With the advent of CTP designs, the focus is on developing fire protection materials that are multifunctional, providing not only safety but also contributing to the thermal management of the battery pack. This approach is crucial in ensuring the safety and efficiency of EVs as they continue to evolve.

How much is just right

Estimating the amount of fire protection material required in EV batteries is a complex process that involves analysing the specific battery design and meeting specific performance characteristics. This process helps determine the necessary quantity of materials like aerogels, considering the space available for fire protection.

One challenge in this estimation is the variability in material thickness and dimensions across different manufacturers, leading to some tolerance in the calculations. For example, while a 1.5-millimetre thick aerogel may be adequate for some designs, others might require a slightly different thickness.

These estimations are crucial for enhancing EV battery safety, as they provide a basis for comparing the amount of material needed per kilowatt-hour of battery capacity. This comparison allows for assessing the trade-offs between material lightness and protection requirements. By evaluating the mass and cost, battery makers can identify the most cost-effective fire protection solution that meets performance standards.

The density of the fire protection material is another important consideration. Ideally, a material should be as light as possible while still offering adequate protection, as a lighter material contributes to higher energy density and greater range for the battery. However, the relationship between density and fire protection capability is not straightforward and depends on the specific properties and performance of the material.

Ultimately, the challenge for battery manufacturers lies in balancing cost, weight, and protection when selecting materials. Fire protection is typically considered in the later stages of battery design, after the cell format and overall structure have been established. The final decision involves finding a balance between the required properties and cost-effectiveness to achieve the desired battery performance.

| Green focus in EV fire protection |

| Environmental and sustainability considerations are increasingly influencing the choice of fire protection materials in EVs. As EVs are viewed as a green technology, there is a growing focus on the sustainability of the materials used in their construction. Sourcing of materials. The sustainability of materials like mica, used for fire protection, is under scrutiny due to concerns about mining practices. Efforts are being made to ethically and sustainably source these materials, such as the Responsible Mica Initiative. Recyclability. Most fire protection materials are not recyclable, which poses a challenge for sustainability. Recycling is currently focused on valuable components like nickel, cobalt, and lithium, while other materials are often overlooked. Supplier initiatives. Suppliers are working to enhance the sustainability of their products, but it is difficult to rank materials based on sustainability due to various factors involved. It is also not always the primary decision factor in material selection. In conclusion, while environmental and sustainability considerations present challenges, they also drive innovation in the development of fire protection materials for EVs. The focus on sustainability is leading to the exploration of new materials and practices that balance safety, performance, and environmental impact. |

Rules for better escape

Regulations governing EVs are in a state of flux, struggling to keep pace with rapid technological advancements. A key example is the regulation surrounding thermal runaway, a potential safety hazard in EV batteries.

China was the pioneer in implementing specific regulations for thermal runaway, requiring vehicles to allow five minutes from the start of a thermal event for occupants to safely exit the vehicle. This standard became a benchmark for many regions.

However, as technology progresses, so do safety standards. Future regulations in Europe and the US are expected to become even more stringent, possibly requiring escape times of 10, 15, or even 30 minutes. This shift is driven by the recognition that in certain scenarios, such as being trapped in a tunnel, five minutes might not be sufficient for a safe escape.

The initial adoption of these regulations in China led to increased use of materials that could provide longer protection times. Now, as other regions move towards similar standards, original equipment manufacturers (OEMs) are focusing on providing materials that meet these extended safety requirements.

It is important to note that while regulations are driving the adoption of certain materials, they do not specify any particular material. Instead, they focus on ensuring that materials used in EVs allow for the required escape times in case of a thermal event. This approach promotes innovation and the adoption of safer materials across the industry.

The market for fire protection materials in EVs is currently dominated by established options, such as ceramic blankets, mica sheets, and encapsulating foams. These materials are expected to continue playing a significant role in the industry. However, as we look towards the future, there is a clear trend towards the adoption of more innovative alternatives, such as aerogel materials and compression pads with fire protective additives. These emerging solutions are gaining traction within vehicles, offering enhanced performance and safety.

The growing EV market, particularly in China, which holds the largest market share, is set to drive a substantial increase in demand for fire protection materials. This growth is not limited to China; it is a global trend, with significant activity from companies worldwide, including those in Asia, Europe, and the US. As the industry evolves, the focus will remain on finding the most effective and sustainable solutions to ensure the safety and reliability of EVs, with China leading the demand due to its vast vehicle market.

Dr James Edmondson BSc MPhys MSc PhD is a Research Director at IDTechEx. Having started in 2019, he specialises in the field of market research for materials and thermal management across markets such as EVs, robotics, and telecommunications

The Co-author, Nidhi Agarwal is a journalist at EFY. She is an Electronics and Communication Engineer with over five years of academic experience. Her expertise lies in working with development boards and IoT cloud. She enjoys writing as it enables her to share her knowledge and insights related to electronics with like-minded techies.