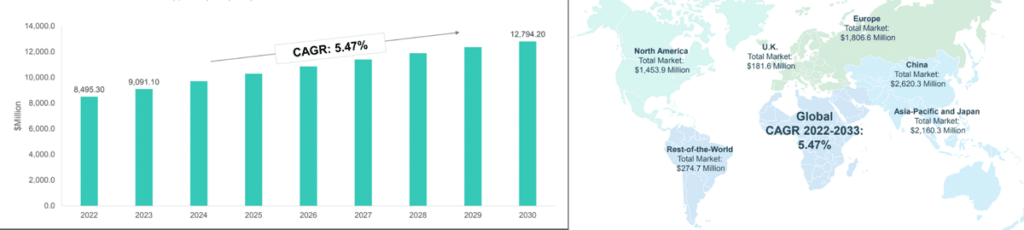

From electric vehicles (EVs) to autonomous vehicles, discover the challenges, key players, and market segments driving a $136 billion industry revolutionising vehicles and the transportation landscape.

In the fast-paced world of automotive electronics, where innovation is the name of the game, businesses need to stay ahead of the curve to remain competitive. This exploration delves into the intricate world of automotive electronics, shedding light on key trends, challenges, and opportunities shaping the industry. The focus here centres on two critical components: sensors and power electronics, both of which play a pivotal role in the development of modern vehicles.

Prominent trends and drivers of growth

The automotive electronics industry has undergone a remarkable transformation in recent years. It has witnessed a surge in demand for electric vehicles (EVs), with regions like India and Northern Europe catching up with the trend. This shift towards EVs brings with it a unique set of challenges, particularly concerning battery management. To ensure the efficient operation and safety of EVs, many sensors are required to monitor factors such as battery charge, health, and temperature.

The industry is experiencing a growing demand for connected and software-defined vehicles. Features like vehicle-to-everything (V2X) communication, vehicle-to-grid (V2G), and vehicle-to-infrastructure (V2I) are becoming increasingly essential. These developments have led to a surge in demand for various electronic components to support these advanced features.

Increasing usage of electronics

The adoption of EVs and the integration of advanced features in modern vehicles have led to a substantial increase in the usage of electronic components in each automobile.

Growing number of connected vehicles

As vehicles become more connected, the demand for sensors and electronic systems to support connectivity features continues

to rise.

Focus on safety and automotive regulations

Governments worldwide are imposing stricter regulations to ensure the safety of vehicles, especially in areas like battery safety in EVs. This has led to a push for innovation within automotive electronics.

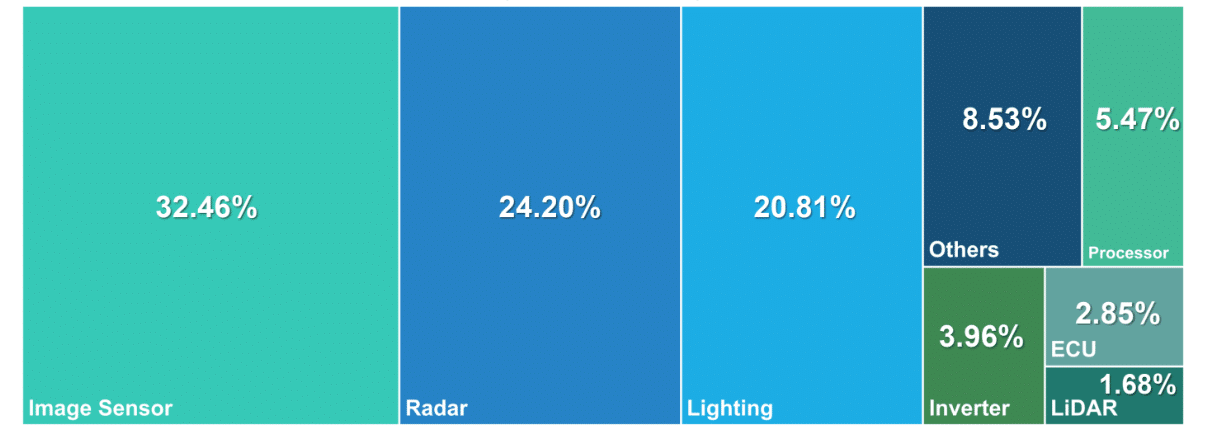

Autonomous vehicles

The development of autonomous vehicles introduces a whole new array of sensors and electronics, including lidars, advanced image sensors, radars, and ultrasonics. The level of autonomy directly impacts the number and complexity of sensors required.

Demand for connectivity and infotainment features

Consumers increasingly seek connected and infotainment features in their vehicles, further driving the demand for automotive electronics.

The future of automotive technology hinges on the perfect synergy between software precision and essential hardware components. While software excellence is crucial, sensors like lidar, advanced image sensors, radar, and ultrasonics play a vital supporting role.

As vehicles advance from autonomy levels one to five, the demand for sensors skyrockets. This surge is a significant growth driver, aligning with the increasing demand for connectivity and advanced infotainment in the automotive sector.

| Influence of patents on sensor technologies and automotive electronics |

Global industry leaders are heavily investing in research and development, particularly in sensor technologies and automotive electronics. The following chart shows the number of patents published. Total patents published by leading automotive electronics companies: 1,300+ (2018 onwards) • Patents play a crucial role in sensor technologies and automotive electronics, accounting for 34.9% of vital patents in the industry. • Focus areas for innovation include sensors that drive advancements in autonomous vehicles, with a range of cutting-edge technologies like image sensors, radar systems, lidar, and various automotive processes. • A significant portion (approximately 60% to 65%) of these patents have been filed in China since 2018, indicating a substantial shift in the industry’s innovation landscape toward this region. These statistics highlight the key technological domains and innovation areas where leading companies concentrate their research and development efforts. |

Challenges in the automotive electronics industry

Please register to view this article or log in below. Tip: Please subscribe to EFY Prime to read the Prime articles.