Ripple, a blockchain based technology startup, is sitting on a venture capital of US$ 93 million, sourced from an interesting mix of funders ranging from Google Ventures and Seagate Technology to a horde of banks like Standard Chartered. Ripple’s network already has 15 global banks, and 10 more are waiting to board the train. Shanghai Huarui Bank, a privately-owned bank in China, is working with Ripple to implement a commercial cross-border payment service, so customers can transfer money internationally in real time. The bank feels it will help Chinese families to send money to their children studying abroad.

What is Ripple’s offering that promises such confidence in the network? What is this technology, which interests not just banks but Web giants and the tech industry as well? In two words, the answer is blockchain technology.

Bank investment in blockchain technology is expected to reach US$ 400 million by 2019. This is because of the confidence that blockchain technology has the potential to ensure completely secure and tamper-proof transactions, in scenarios ranging from smart contracts and real-time international money transfer to contactless payments. Early blockchain systems had their share of problems like settlement lag and lack of privacy, but the current generation of startups is bent upon delivering enterprise-grade blockchain.

Demystifying the blockchain

You do not have to feel bad if you have already Googled for blockchain and not made head or tail of it. Even finance and tech experts take some time to understand this concept, and even more time to explain it confidently. As with most nascent technologies, it is difficult to differentiate the technology from its applications, and understand it for what it really is, what it is currently used for and what else it can do.

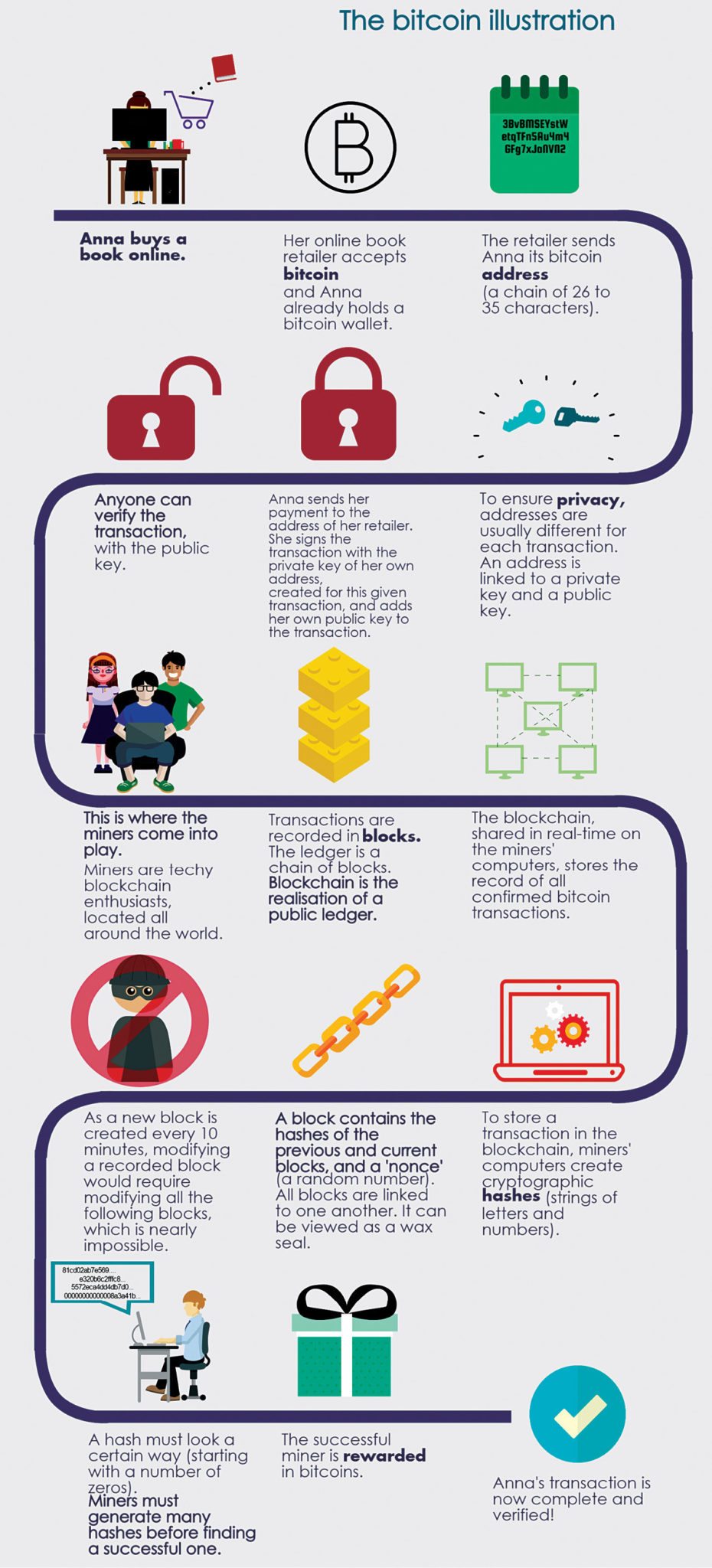

A blockchain is a decentralised, distributed public ledger that records, validates and secures transactions in a system. As is obvious from the name, a blockchain is made of several blocks. Each block contains encrypted data pertaining to a transaction, along with a hash that draws upon the previous block in the chain.

This way of connecting each cryptographically-hashed block with the previous one ensures that all data in the chain remains secure and unchanged. There is no single owner of any transaction—each transaction is authorised and backed by thousands of computers (called miners)—and so there is no single point that can be attacked or hacked.

That is what makes blockchain based transactions secure and tamper-proof. Using blockchain technology, it is possible to carry out peer-to-peer transactions over the Internet, without requiring middlemen like payment gateways to authorise transactions.

“The block records some or all of the current transactions, and once it is completed, the block is time-stamped and hashed into the permanent database or blockchain.

“The blocks are linked to each other in a linear, chronological order where each new block contains the hashed details of the previous block. This creates a chain of transactional information, so that every block that is added protects information in the previous one,” explains Kumar Abhishek, founder and CEO of ToneTag, a sound based proximity communication provider that enables contactless proximity communication, mobile payments, location based services, customer engagement services and more. The company recently adopted blockchain technology to make its transactions more secure.

Do Bitcoin, blockchain and distributed ledger technology (DLT) mean the same?

People tend to use these terms interchangeably, much like they use Xerox to mean photocopier, but these are not the same.

A distributed ledger refers to a consensus of replicated, shared and synchronised data that is distributed across multiple locations, often spanning several institutions and individuals across the globe.

Bitcoin is one of the most well-known and earliest proven applications of DLT. It is a decentralised digital currency that enables you to make instant payments to anyone, anywhere in the world, without requiring any middlemen.

It is decentralised, that is, transaction management and money issuance are carried out collectively by the network. This is where the blockchain comes in. Devised as a method to keep track of all confirmed Bitcoin transactions, the blockchain is one type of distributed ledger in which data is distributed as blocks that form a linear chain with each one connected to the previous.

As explained in Bitcoin wiki, “Bitcoin uses public-key cryptography, peer-to-peer networking and proof-of-work to process and verify payments. Bitcoins are sent (or signed over) from one address to another with each user potentially having many, many addresses. Each payment transaction is broadcast to the network and included in the blockchain so that the included bitcoins cannot be spent twice. After an hour or two, each transaction is locked in time by the massive amount of processing power that continues to extend the blockchain. Using these techniques, Bitcoin provides a fast and extremely reliable payment network that anyone can use.”

There are applications other than Bitcoin that use blockchain technology. And that blockchain is not the only form of DLT; there are others like Ethereum, Ripple, Hyperledger and MultiChain. But, by virtue of being the earliest and most famous example, Bitcoin, blockchain and DLT are used synonymously by many, and that is not always right.

In fact, blockchain technology can be used to develop apps more advanced than just supporting digital currency. This evolution is often known as Blockchain 2.0.

ToneTag’s blockchain approach.

“Blockchain was implemented as a way to keep record of all Bitcoin transactions. The payment system enables users to pay each other directly, without having to rely on a third party. Since Bitcoin is a digital cryptocurrency, it cannot be contained physically. There had to be an effective way to manage all transactions in the system, without giving control to any single party. This is where blockchain comes in. It is a distributed public ledger that records all transactions in a particular system,” says Abhishek.

ToneTag follows a similar approach to Bitcoin blockchain, but the application varies. The way in which payment transactions are recorded at present is inefficient. The current system involves many entities and players, which leaves greater room for fraud. Every year hundreds of billions of dollars are lost due to fraudulent transactions. To address these security issues, ToneTag introduced blockchain technology to contactless payments.

Blockchain technology has the potential to completely redefine the way transactions take place, as it brings unprecedented advancements in fraud prevention.

“ToneTag payments are tokenised, where a unique identifier replaces sensitive transaction information and none of the actual customer or merchant transaction information is revealed or shared, hence making the entire process highly-secure and fraud-proof,” says Abhishek.

ToneTag enables contactless payments that are traceable, transparent and secure. Every party involved in the transaction is protected by the blockchain since it maintains a public record of every transaction that ever took place in the system. While paying through ToneTag, customers can identify whether the merchant outlet they are dealing with is exposed to risks or if it has witnessed fraudulent transactions in the past. Similarly, merchants can ensure whether a customer is genuine or not. Further, all transactions are validated to ensure these are authorised.

Miners, the quiet workers

We keep saying that, in a distributed ledger, data is stored in a distributed, decentralised way, spanning multiple digital locations across the globe. What makes this possible? The answer is mining.

Mining is the distributed computational review process performed on each block of data in a blockchain, which allows a consensus to be achieved despite each party not knowing or trusting the other.

Let us take the example of Bitcoin to understand this better. In order to conduct a transaction, a Bitcoin user has to sign it with his private key or seed. This helps prove that the transaction has been initiated by the right person, and also prevents third parties from altering the transaction in any way. After this, the transaction is confirmed through a process of mining and then included in the blockchain.

According to Bitcoin, “To be confirmed, transactions must be packed in a block that fits very strict cryptographic rules that are verified by the network. These rules prevent previous blocks from being modified because doing so would invalidate all the following blocks.

“Mining also creates the equivalent of a competitive lottery that prevents any individual from easily adding new blocks consecutively in the block chain. This way, no individuals can control what is included in the blockchain or replace parts of it to roll back their own spends.”

Mining makes computer hardware do mathematical calculations for the Bitcoin network to confirm transactions and increase security. Any computer across the world can be a miner. As a reward for sharing their computational power, miners get a fee for each transaction confirmed by them, along with newly-created bitcoins. The reward depends on the amount of mining done. There are strict rules and procedures for this, and mining is not to be thought of as an easy way to make money.

Blockchain mining hardware.

The blockchain mining process is mostly software based. In reality, anybody can become a miner using their personal computer. However, the speed and reliability demanded by upcoming mining protocols pose an opportunity for hardware innovation. We now have industrial-grade mining hardware (servers in data centres) and specialised application-specific integrated circuits (ASICs) for mining.

Antminer, Avalon6, SP20 Jackson and 21 Bitcoin Chip are some well-known ASICs for mining. Experts say you have to look at hash rate, efficiency and price when selecting a mining chip. Hash rate is the number of hashes per second that the Bitcoin miner can make. Usually, if the hash rate is more, the price will be higher. So you have to balance it with efficiency, which measures the electricity usage. This is important because miners usually consume a lot of power. Remember, we told you it is not an easy way to make money!21 Inc. has come up with something more than ASICs. 21 Bitcoin computer is claimed to be the first computer with native hardware and software support for Bitcoin protocol. According to the company, it has the hardware to mine a stream of small amounts of Bitcoins for development purposes, and the software to make that Bitcoin useful for buying and selling digital goods. It can be used by developers and individual miners to create Bitcoin based apps, services and devices.

Embedded blockchain mining is a very nascent idea, which involves embedding mining chips into different kinds of Internet-connected devices. Last year, 21 Inc. revealed its plans to develop a chip (called 21 BitShare) that can be embedded into mobile phones, enabling them to silently mine in the background.

Another innovation from 2015, by Patric Lanhed and Juanjo Tara, is a chip that can be implanted in your hands for Bitcoin bio-payment. They have gone a bit overboard, but it might be a glimpse of what the future holds. You never have to worry about forgetting your purse or phone at home, when tapping your hand can complete a payment.

Bit more than Bitcoin

Undoubtedly, Bitcoin, allegedly invented by Satoshi Nakamoto in 2008, is one of the best-known names in distributed ledger and blockchain technologies, but it is not the only one. Of late, there has been a lot of interest in this space, and many alternatives have come up. Here is a quick look at some of the contenders:

Ethereum.

Ethereum is a decentralised platform that runs smart contracts. These are apps that run on a custom-built blockchain, with a platform-specific cryptographic token called Ether. The blockchain can move value as well as represent ownership of property. According to the company, “This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middle man or counter-party risk.”

Online reviews show that Ethereum transactions are confirmed in seconds compared to minutes for Bitcoin.

Another key difference is that Ethereum uses ethash, while Bitcoin uses secure hash algorithm SHA-256.

The two platforms also differ in purpose. While Bitcoin was intended to be an alternative to regular money, Ethereum is meant as a platform that facilitates peer-to-peer contracts and applications via its own currency vehicle. The focus of Ethereum is not to replace regular money but to facilitate and monetise the working of Ethereum to enable developers to build and run distributed applications.

Ripple.

Ripple aims to be a global settlement network to facilitate instant, certain, low-cost international payments. According to the company, Ripple’s distributed network allows foreign exchange to be externally sourced from a competitive foreign exchange marketplace or an internal foreign exchange trading desk via Ripple’s FX Market Making Solution.

The backbone of Ripple’s network is Ripple Consensus Ledger (RCL), a secure distributed ledger that uses the consensus process to settle transactions. Like other blockchain technologies, it does not require a middleman, and is very secure. The RCL holds the order book with bid/ask offers from payment initiators and market makers. Its path-finding algorithm enables it to find the lowest foreign exchange rate across all order books and currency pairs. It is basically a DLT, but with a specific purpose, which makes it more enterprise-ready.

Ripple aims to solve specific problems, which banks are likely to have with other public ledger based systems, such as delay in confirming transactions and lack of privacy. Ripple takes just three to five seconds to confirm a transaction through consensus among validators, as it does not use a proof-of-work method.

To solve the privacy problem, it advocates the use of Interledger Protocol (ILP), which can work with any bank or non-traditional payment network, regardless of its underlying technology.

ILP is an emerging standard that provides all benefits of public and private blockchains, while also ensuring that transaction data remains private to only the transacting parties. Ripple feels that ILP is a much better approach than private, bank-sponsored blockchains, as the latter approach can lead to a further fragmentation of payment networks.

Hyperledger.

Hyperledger is a collaborative effort to develop a cross-industry open standard for distributed ledgers. The current implementation employs Bitcoin UTXO transaction model, which uses a system of public and private keys to ensure that transactions remain uncompromised while travelling to their destination. As of now, Hyperledger does not have any native currency. They believe that the technology will be useful for syndicated loans and capital markets infrastructure.

MultiChain.

An interesting innovation, MultiChain is a platform that lets banks and other organisations develop their own blockchain. Customers can customise various aspects of the blockchain such as whether it is private or public, target time for blocks, who can connect to the network, how they interact, maximum block size, metadata that can be included in transactions and so on.

They also have their own improvised mining technique called mining diversity. The process enables miners to approve transactions in a random rotation. The company claims that this structure allows more miners to participate in the approval of transactions, while ensuring there is no fixed order of verification that could be corrupted.

India can benefit from blockchain technology

Every other day, there is a press release about a new DLT or platform. It is clear that it will play a key role in the future of the finance industry.

“For the financial services sector in India or abroad, blockchain offers the opportunity to overhaul existing banking infrastructure, speed up settlements, organise assets and streamline stock exchanges, although regulators want to be assured that it can be done securely. According to Santander, the banking industry could save about US$ 20 billion every year with the implementation of blockchain processes,” explains Abhishek.

“According to many evangelists, the possibilities are limitless. Applications range from storing client identities to handling cross-border payments, clearing and settling bond or equity trades to smart contracts that are self-executing, such as a credit derivative that pays out automatically if a company goes bust, or a bond that regularly pays interest to the holder,” he adds.

The emergence of enterprise-grade DLTs including highly customisable blockchains and enthusiastic support that banks and tech majors are extending to such companies make it clear that DLT is the way ahead for the financial services sector.