Have you ever looked at the world from above? One thing that defines its beauty and grandeur is the movement down under. This movement, in technical terms, is called mobility. What our world needs today is Green Mobility

Trains, buses, taxis and trucks are always on the move, forming the networks that lead to the growth of cities and towns. Mobility and the supply chain are important to many businesses, to deliver goods and services. In fact, mobility has become the lifeline of human existence. Yet, it comes with its own hazards – living spaces can become noisy, congested, polluted and give rise to airborne viruses, which can impact human life for years to come. That’s the reason why alternate forms of fuel, power and mobility drivers are now being explored.

Trains, buses, taxis and trucks are always on the move, forming the networks that lead to the growth of cities and towns. Mobility and the supply chain are important to many businesses, to deliver goods and services. In fact, mobility has become the lifeline of human existence. Yet, it comes with its own hazards – living spaces can become noisy, congested, polluted and give rise to airborne viruses, which can impact human life for years to come. That’s the reason why alternate forms of fuel, power and mobility drivers are now being explored.

Research dollars are being spent in these fields to drive growth and create new business lines that will take the automotive sector into new realms. And one domain that is showing the maximum promise in terms of delivering sustainable transportation and mobility is electric vehicles (EV).

Global trends in the Electric Vehicles (EV) segment

Growing business opportunities in green mobility, increased government understanding, reduced costs, higher demand and changing consumer habits are giving a fillip to the EV industry. As per industry trends and estimates, global EV sales are slated to touch 41 million by 2040 and constitute 35 per cent of new car sales. This could happen because of wider acceptance of the technology and allied industrial support.

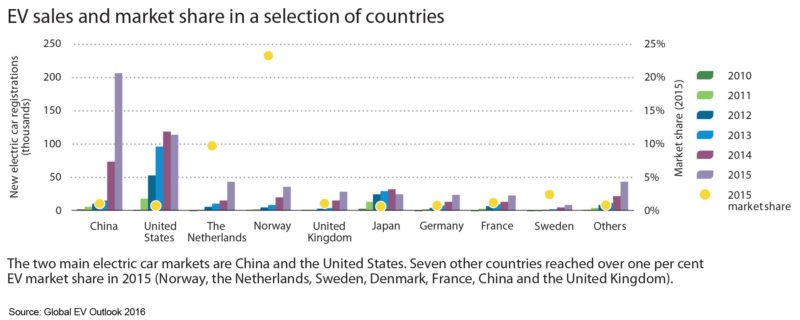

Countries like China, USA, Japan, the Netherlands and France are currently the prominent markets for investments in EV. The growth drivers in these markets are: increased collaborative IP sharing, stakeholder interest, funding, advocacy for the technology, development of infrastructure to support EVs in terms of adequate charging facilities, and continuous investments in R&D.

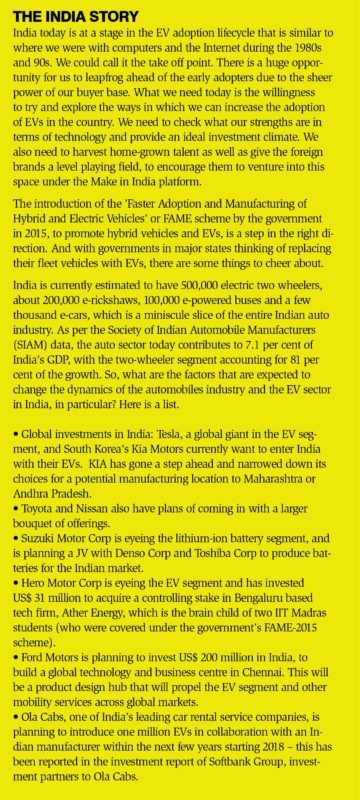

Government policies are being driven to adapt to these changes, which is encouraging. And it is expected that the global mass markets will follow the trends set by the early-adopter countries. Industry bodies and early adopters have succeeded in delivering practicality, sustainability, safety and cost effectiveness to the EV sector, but it still needs support in terms of governance, which can help wider deployment and faster adoption.

China is now adopting the EV culture in a big way, supported by government initiatives like restrictions on the use of conventional fuel engine vehicles in certain major cities, a step taken in the public interest to reduce pollution. Allied industries like the manufacturers of batteries, components and electronic accessory manufacturers have been given tax holidays to catalyze this growth.

These are bold moves that are expected to drive exponential growth in the segment, setting an example for others to follow. One major move made by China is in public transport. Today, more than 200,000 buses on China’s roads are electrically powered, and 20 per cent of all new orders annually are being equipped with EV features.

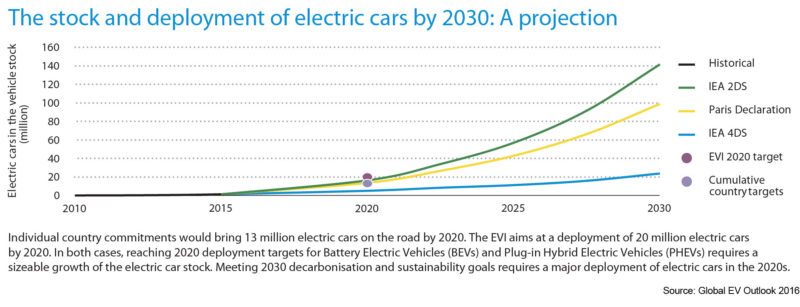

After the climate change conference held at Morocco in 2016, it is widely believed that EVs are the future for a sustainable transport system, and that’s why there is a global impetus to shift public transport systems towards optimal adoption of EVs. There is a consensus that by 2020, 20 million cars globally must be electrically powered — this is being championed under the Electric Vehicles Initiative (EVI).

Prior to the Morocco convention, the Paris Declaration on electro–mobility and climate change focused on the fact that transport contributes almost 23 per cent to greenhouse gas (GHG) emissions, and this is increasing at a faster rate than in most sectors. If the right steps are not taken in time, it could contribute to 50 per cent of GHG emissions by 2050. This will lead to rising temperatures and global imbalances. Are we ready to counter this trend?

Therefore, it is advisable for governments to invest in sustainable energy sources that can impact human life in a positive way. The steps that can lead to this transition are: a dramatic change in the transportation portfolio, with a set target to replace fossil fuel powered vehicles with EVs; investment in global research to understand the dynamics across temperature zones; incentives to manufacturing industries with EVs in their product portfolio; and creation and implementation of global agreements as well as policy frameworks to drive change.

There are various encouraging government initiatives, too, for this sector. The Indian government has set up a Green Urban Transport Scheme (GUTS) with an initial investment of Rs 250 billion. This will help propel green energy initiatives and infrastructure at the national, state and city levels, all of which will impact the EV market. Another promising policy initiative is the National Electric Mobility Mission – 2020, mandated under the FAME scheme. This is an ambitious plan launched by the Ministry of Heavy Industries, which is set to change the way transportation is perceived in India. It aims to get seven million electric and hybrid vehicles plying on Indian roads by 2020.

To drive this change, the government is offering incentives to new manufacturing units interested in the technology; R&D support is being provided for players who want to get into segments like EV technology, power electronics, motors, systems integration, testing infrastructure; and help is provided to the EV industry to participate and represent India at various trade shows. Nationally, the government is aiming to set up charging infrastructure with the help of local electric supply units, and is encouraging retrofits wherever possible.

The battery for EVs, the largest component in the vehicle, currently accounts for nearly 50 per cent of the overall cost, which is substantially lower than what it was six years ago, and prices are dropping even further. One area of concern is that China, Argentina, Australia and Chile have the highest lithium reserves across the world, while India doesn’t have any viable lithium deposits.

So, if we need to grow Indian businesses and make them competitive, much more research needs to be done to find lithium alternatives. One potential option is the aluminium battery, which Stanford University has reported can reduce charging time and mitigate the various health hazards associated with lithium-ion batteries.

In short, while India is at the cusp of growth in the EV segment, it would need to introspect and invest in newer technologies.

What to expect in the future

With new players coming in, backed with adequate funding, we should see some cost effective, integrated and innovative solutions. Knowledge-sharing will be critical in speeding up technology development and adoption. Collaborative commerce will be a building block for the industry, and it will be championed by government initiatives in sustainable transportation.

For the global automobile segment, the forecast is a CAGR of more than 7 per cent over the next two years.. This figure, backed by the right government initiatives, should make the EV segment attractive to any Indian entrepreneur.

References: SIAM, Global Outlook on E – Vehicles report – 2016, Government Policy Declaration sheets and Documents

Send us your feedback at: [email protected]