After decades of sluggish demand, the Indian electronics industry is on a roll—largely due to increased digitisation (making electronics an inseparable part of almost all types of products) and an insatiable local demand for electronics goods. In fact, India is currently one of the largest growing electronics markets in the world.

With increased affordability, the demand for electronics products in India—such as smart TVs, phones and tablets—has skyrocketed. It is pegged to grow annually at 41 per cent between 2017 and 2020, creating a $400 billion market, according to a joint study by Assocham and NEC Technologies.

Increased digitisation of products like automobiles and communication equipment has also boosted the demand for electronics. Advanced technologies like the Internet of Things (IoT), artificial intelligence and augmented reality/virtual reality all require electronic components at the heart of their hardware systems.

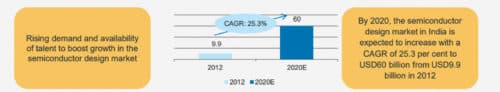

Growth of the electronics market has also translated into an opportunity for the Indian electronics design industry as the semiconductor design market in India is expected to grow at around 25 per cent annually from $9.9 billlion in 2012 to $60 billion in 2020 (Fig. 2). While the Indian electronics system design and manufacturing (ESDM) industry as a whole depends on imports to plug the huge demand-supply gap, domestic design services are still its key strength with huge potential.

Market potential

The growing customer base and increased penetration have provided excellent scope for the growth of Indian electronics design houses. Some of the recent government policies like Make in India and Digital India have instilled confidence and aided this momentum.

Advanced product development focusing on miniaturisation, IoT, automation, LED lighting, AI and defense applications is likely to be the biggest growth driver in the electronics design market. In addition, there are a few emerging technologies that could emerge as key areas of focus in the near future. These include:

1. Next-generation wireless

2. Artificial intelligence

3. Silicon photonics

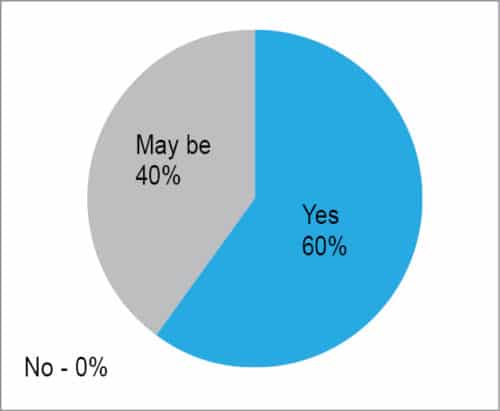

India has become the hub for electronics design with nearly 2000 chips being designed every year and around 500,000 engineers working in various aspects of electronic design starting from chip design and verification to different stages of product design. Though still lagging behind chief competitors in the Far East (China and Taiwan), the country has significant potential as it seeks to continually raise the bar and increase the breadth and depth of its offering. At least 60 per cent of surveyed respondents (Fig. 3) feel that India has the potential to become a design house for the global electronics industry.

Greater digitisation across segments has led to the increased penetration of Indian electronic design houses in such application areas as LED illumination, communications and broadband equipment, and automotive electronics. The focus is on localising the technological changes while maintaining global competitiveness.

India’s design strength is driven by:

1. Strong capabilities in embedded system design

2. Large number of electronics engineering graduates (even though the number of employable talent is still around 10 per cent)

3. Increased demand due to a sizeable number of Indian SMEs and startups focusing on the IoT

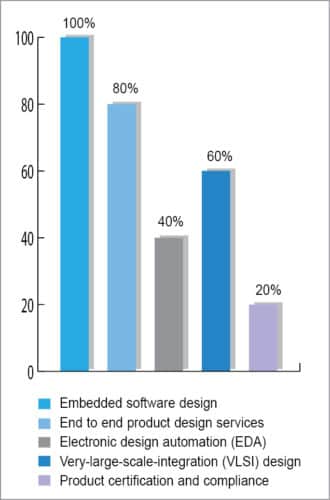

According to survey participants, design services in demand (Fig. 4) are:

1. Embedded software design

2. End-to-end product design services

3. Electronic design automation (EDA)

4. Very-large-scale-integration (VLSI) design

5. Product certification and compliance

Market challenges

In recent years, independent design houses like Wipro and HCL have grown in stature and are increasingly involved in design and development for global firms. While conditions are indeed favourable for the growth of the design industry, there are a few impediments that need to be removed for the industry to live up to the expectations.

Over the last couple of decades, the Indian electronic design industry has gradually shifted focus from manufacturing towards assembly. Earlier, the entire production and assembly of products was done in India. However, now semi-finished items are imported from China and only the final assembly is done in India. For example, mobile phones and smart TVs are designed in China and assembled in India. Only a small percentage of design for local brands is done in India.

One of the prime reasons behind this trend is the requirement of significant investment for R&D in a sector where margins are already thin. Pressed for margins, firms prefer to shop for products that are suitable for the Indian market and arrange for imports of semi-knocked-down kits back to India for assembly.

Other factors impeding the industry growth include:

1. SMEs and startups lack experience in complex system design and are completely unaware of outsourcing opportunities in both design and manufacturing.

2. Design (CAD) tools are expensive, while open source tools are not of acceptable quality. As engineering design is capital-intensive, educational institutes with relevant CAD and T&M equipment could offer their labs on hire, helping startups and SMEs to develop products at low cost.3. There is dearth of hardware accelerators supporting board design and FPGAs/EPLDs.

4. Governance/policy related challenges:

(i) Prototype ecosystem is yet to mature, leading to a lot of time wastage in customs and other processes.

(ii) Duty-free components are still being charged at 28 per cent GST.

5. While there is a steady supply of graduates in the market, there is still a significant gap between skill sets required by the industry and skill sets acquired by graduates through higher education institutes. Effective collaboration programmes between the industry and institutes can go a long way in developing more employable candidates for the industry.

Supportive policies

The government of India is determined to resolve these issues by developing policies and frameworks that can catalyse growth in the design sector. Initiatives like Make in India and Digital India, and impetus to existing schemes like the modified special incentive package scheme (M-SIPS) and electronic development fund (EDF) will have a significant impact in driving this change.

The industry has responded positively to the government’s support. As many as 159 new ESDM units were established in 2015 itself. According to industry experts, while Make in India is an initiative in the right direction, the agenda could also include ‘Make for India’ with focus on Indian priorities.

Other supportive measures taken by the Indian government include:

1. 100 per cent FDI allowed in the electronics hardware manufacturing sector under automatic route

2. Duty relaxation and schemes such as EPCG, EHTP and SEZ to provide tax sops; duty exemption on equipment required for setting up semiconductor plants

3. National Policy on Electronics (2012) and setting up of National Electronics Mission