The government of India has announced various production linked incentive schemes, in addition to the several schemes that are already running, to make India ‘atmanirbhar’ for manufacture of various electronic goods and components. So, this is the best time to invest in India for the MSMEs and startups, besides the MNCs.

The best time to be in the business of electronics, and to be in India, is right now. The government of India, during the pandemic caused by the outbreak of the coronavirus, has launched several schemes that are meant not only to make India atmanirbhar in terms of electronics it consumes but also make it for the world. Most experts and electronics industry associations all over the country have mentioned these to be some of the best schemes they have seen in the history of the country.

“We have to attract cutting-edge technology and maximum investment in the sectors related to our core competency,” Prime Minister of India, Narendra Modi, has said while addressing a webinar on Production Linked Incentives recently. “Earlier, industrial incentives used to be open ended input based subsidies, now they have been made targeted and performance based through a competitive process,” he added.

Let us take a close look at some of the policies under the Production Linked Incentive (PLI) Scheme.

IT hardware

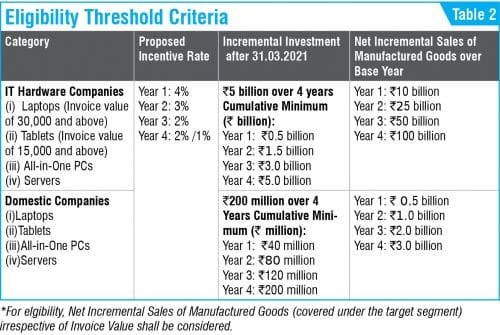

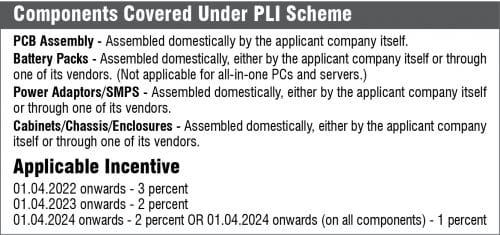

The scheme shall extend an incentive of four percent to two/one percent on net incremental sales (over base year) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four years. The target segment under PLI for IT hardware includes laptops, tablets, all-in-one PCs, and servers.

“PLI for IT Hardware products will be a game-changer for the electronic manufacturing industry. The scheme will help in generating more value addition in the country and exports too. We hope to see a strong electronic component chain also developing alongside with the help of these schemes,” noted Manish Sharma, Chair, FICCI Electronics & White Goods Manufacturing Committee. Sharma is also president and CEO of Panasonic India.

This scheme was announced by the Ministry of Electronics and IT (MeitY) as the IT hardware manufacturing sector in India faces lack of a level playing field vis-à-vis competing nations. This disability of around 8.5 to 11 percent is on account of lack of adequate infrastructure, domestic supply chain and logistics, high cost of finance, inadequate availability of quality power, limited design capabilities, very little focus on R&D in the industry, and inadequacies in skill development. There is a need for a mechanism to compensate for the manufacturing disabilities vis-à-vis other major manufacturing economies.

The objective of the PLI scheme is, therefore, to provide a financial incentive to offset the disability to some extent in order to boost domestic manufacturing and attract large investments in the value chain.

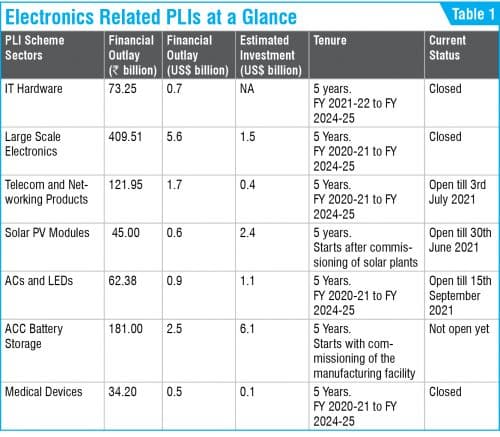

Announced with a total incentive outlay of 73.25 billion rupees, the yearly incentive amount for the first year was fixed at 7.20 billion rupees, for the second year at 13.05 billion rupees, for the third year at 18.20 billion rupees, and for the fourth year at 34.80 billion rupees.

“The government is trying to build a robust ecosystem for the sunrise sectors. This is an attempt to build up India’s manufacturing capabilities. With Covid-19, the world got very alert about China. A lot of companies that were overdependent on China were badly affected. There existed Chinese vendors who stopped selling components to several companies and told them to buy finished products. India has great potential to be a competitor of China. This is where the game of volumes can help us, and PLI for IT hardware will enable us to do the same. This is one of the best schemes to have surfaced during the entire history of India,” feels Nitin Kunkolienker, President, MAIT.

It is worth mentioning here that top five brands including Dell, HP, Lenovo, Acer, and Asus accounted for over 85 percent share of the total personal computers (PCs) sold in India during the 2020-21 period, as per an IDC report. Similarly, the top five players including the likes of Dell Technologies, Lenovo, Super Micro, HP Enterprise, and Cisco had more than 60 percent share in the server market here during the fourth quarter of year 2020. On average, these five companies have been commanding over 60 percent presence in the market since the last five quarters.

Large scale electronics manufacturing

The PLI scheme for large scale electronics manufacturing targets segments like mobile phones and specified electronic components including SMT components, discrete semiconductor devices such as transistors, diodes, thyristors, etc, passive components including resistors, capacitors, etc for electronic applications, printed circuit boards (PCBs), PCB laminates, prepregs, photopolymer films, PCB printing inks, sensors, transducers, actuators, crystals for electronic applications, system in package (SIP), micro/nano electronic components such as micro electro-mechanical systems (MEMS) and nano electro-mechanical systems (NEMS), and assembly, testing, marking and packaging (ATMP) units.

The objective of this scheme, as per MeitY, is to provide a financial incentive to boost domestic manufacturing and attract large investments in the electronics value chain including electronic components and semiconductor packaging. The scheme extends an incentive of four to six percent on incremental sales (over base year) of goods manufactured in India and covered under target segments, to eligible companies, for a period of five years subsequent to the base year. Financial Year 2019-20 has been taken as the base year.

Announced with a total incentive outlay of 409.51 billion rupees, the incentive amount allocated in billions of rupees is 53.34 for first year, 80.64 for second year, 84.25 for third year, 114.88 for fourth year, and 76.40 for the fifth year.

While this is the second round of the scheme, and the government is considering to approve 30 companies to be a part of this, Samsung, Foxconn Hon Hai, Rising Star, Wistron, and Pegatron were approved last year under the PLI for smartphones. AT&S, Ascent Circuits, Visicon, Walsin, Sahasra, and Neolync were the six companies approved under the Specified Electronic Components Segment during the first round.

Under this PLI scheme for large scale electronics manufacturing, mobile manufacturers produced goods worth 350 billion rupees and invested 13 billion rupees in the December 2020 quarter, as notified by the Ministry of Commerce and Industry through an official statement.

Telecom and networking products

One of the most recent PLI schemes to be introduced in India, the PLI for telecom and networking products, as the name suggests, targets to boost local manufacturing of these products in India. The Ministry of Communications, while announcing this scheme, noted that globally, telecom and networking products’ exports present US$100 billion market opportunity, which can be exploited by India.

“We welcome the issuance of detailed guidelines on implementation of the PLI scheme on telecom and networking equipment by DoT. Telecom is the backbone of a digitally connected India, and this initiative will further boost local manufacturing, exports and also create employment opportunities. India is already the second largest telecom market globally and this will go a long way in making the country a global hub for telecom innovation,” said Lt Gen. Dr S.P. Kochhar, DG, COAI.

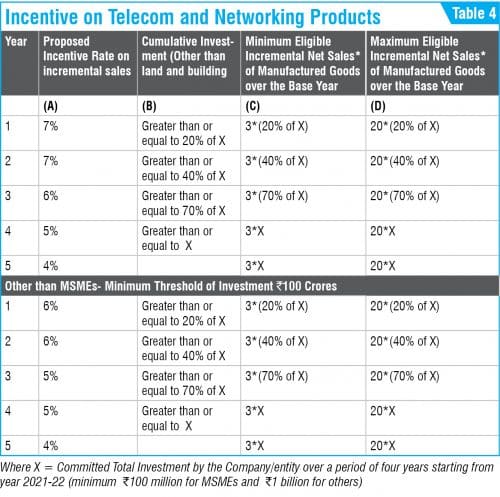

A minimum investment threshold of 100 million rupees has been set for MSMEs with incentives from seven to four percent. A ten times larger threshold has been set for the others with incentives from six percent to four percent over five years. The government of India expects this scheme to attract more than 30 billion rupees investment and generate huge direct and indirect employment.

“This is much needed effort and will result in Indian global champions with ₹ 12,195 crores (121.95 billion) incentive over next five years. One of the great initiatives is that for the first time, ₹ 1,000 crores (10 billion) has been earmarked for the MSME category,” noted Prof. N.K. Goyal, Chairman Emeritus, TEMA.

Big names including Nokia and HFCL have shown interest in applying for this scheme. VVDN Technologies also noted that it was thinking of investing very big amounts in this scheme.

“With the 5G revolution set to kickstart in India, we will require new investments, software and hardware development. The PLI scheme will complement the 5G ecosystem. By the time we see an increment in demand, the telecom manufacturing sector will be ready with new products and innovations,” Telecom Equipment and Services Export Promotion Council (TEPC) Chairman Sandeep Aggarwal had said earlier.

A total budgetary outlay of 121.95 billion rupees has been announced for the scheme. The year 2019-20 has been set as the base year of this scheme. The list of specified telecom and networking products under the scheme include core transmission equipment, 4G/5G, next-generation radio access network and wireless equipment, access and customer premises equipment, IoT access devices and other wireless equipment, enterprise equipment including switches and routers.

Prof. Goyal added, “TEMA is particularly happy that threshold limit for investment has been made quite reasonable at ₹ 10 crores (100 million) for MSME and ₹ 100 crores (1 billion) for non MSME. TEMA believes that the scheme will result in investment of ₹ 3,000 crores (30 billion) and increased production for ₹ 3 lac crores (3,000 billion).”

Solar photo-voltaic modules

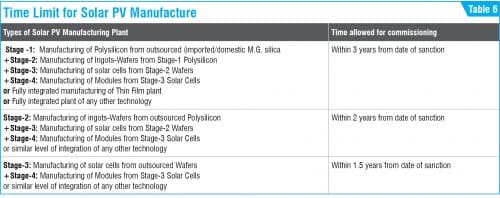

Solar is slowly becoming the go-to-source of renewable and clean energy. Keeping the importance of solar power in focus, the government of India announced on 28th April this year the guidelines for solar modules PLI scheme. Announced by the Ministry of New & Renewable Energy (MNRE), the scheme entails a budgetary outlay of 45 billion rupees. It is worth noting here that the solar capacity addition at present depends largely upon imported solar PV cells and modules, as the domestic manufacturing industry has limited capacities of solar PV cells and modules.

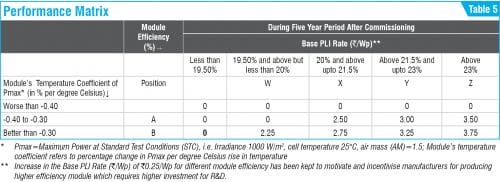

The objectives of this policy include building solar PV manufacturing capacity of high-efficiency modules and bringing cutting-edge technology to India for manufacturing these modules, among others. The scheme was also formulated keeping in mind India’s ambitious target of setting up 175,000MW capacity of renewable energy by 2022 and 450,000MW by 2030. To achieve the target, around 25,000MW solar energy capacity is needed to be installed every year, till 2030.

Investment Information and Credit Rating Agency of India (ICRA) noted that the PLI scheme along with imposition of BCD on imported modules and cells from April 2022 will improve the cost competitiveness of domestic manufacturers vis-a-vis imports. The scheme would support 21GW of module supplies from domestic original equipment manufacturers (OEMs) over a five-year period.

“The benefits available under the PLI scheme, along with the imposition of basic customs duty (BCD) on imported solar PV cells and imported solar PV modules, are likely to improve the cost competitiveness of domestic PV module manufacturers against imported modules by more than 10 percent at the prevailing imported module prices, under assumption of backward integration up to cells,” ICRA said in a statement.

The selection of the beneficiaries, as MNRE informed, will be done by the bucket filling method, keeping in view the overall PLI limit of 45 billion rupees, and the PLI requirements quoted by the bidders. The bidder getting highest marks/inter se position will get PLI amount for five years as quoted by him followed by second bidder, and so on, till the PLI amount of 45 billion rupees is exhausted.

The criteria for the solar PLI scheme includes minimum integration across cells and modules, minimum manufacturing capacity requirement of 1GW, and a certain minimum level of module performance.

Air-conditioners and LED Lights

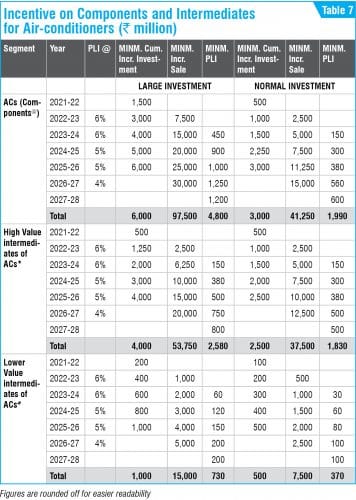

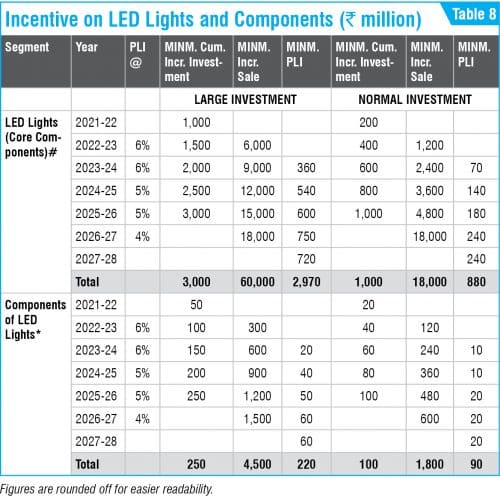

India is one of the largest consumers of LED lights in the world. Air-conditioners (ACs), on the other hand, are a consumer electronics category that is yet to penetrate the country on a larger scale. Keeping in focus the importance of these two categories, the government of India has announced PLI for ACs and LEDs also. Announced by the Ministry of Commerce and Industry, the PLI for ACs and LEDs includes an incentives allocation of 62.38 billion rupees.

The primary aim of this PLI is to remove sectoral disabilities, create economies of scale, enhance exports, and create a robust component ecosystem and employment generation. The components of the ACs included in the scheme are aluminium foil, copper tube, compressor (rated as high-value intermediates) and PCB assembly for controllers, BLDC motors, service valves for ACs, cross-flow fans along with other components (rated as lower-value intermediates).

Similarly, the components of LEDs included in the scheme are LED chip packaging, resistors, ICs, fuses, and large scale investments (rated as core LED components), and LED chips, LED drivers, LED engines, mechanicals, packaging, modules, wire-wound inductors (rated as components).

The PLI scheme for white goods promises to extend an incentive of four to six percent on incremental sales of goods manufactured in India for a period of five years to companies engaged in manufacturing of ACs and LED Lights.

The government of India expects that this PLI scheme will lead to incremental investment of 79.2 billion rupees, incremental production worth 1,680 billion rupees, exports worth 644 billion rupees, earn direct and indirect revenues of 493 billion rupees, and create additional 400,000 direct and indirect employment opportunities. The government has made it clear that mere assembly of finished goods will not be incentivised.

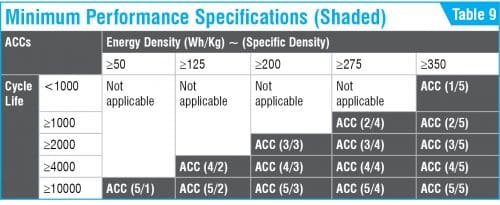

Advanced-chemistry cell batteries

Keeping everything in mind including smartwatches, smartphones, electric vehicles, and almost everything that runs on a battery, the government has also approved PLI for ACC battery storage. Announced by the Ministry of Heavy Industries and Public Enterprises, a total of 181 billion rupees has been placed as the budgetary outlay of the scheme. ACCs, in simple language, are the new generation of advanced storage technologies that can store electric energy either as electrochemical or as chemical energy and convert it back to electric energy as and when required.

“With PLI, we will not only reduce import but also enable production of the batteries which are not yet being manufactured in the country. These batteries will accelerate e-mobility in the country. Long-lasting, efficient, and quick charging capable batteries are the need of the hour. Till now, the battery storage segment was not growing fast because we were not manufacturing the batteries,” The Minister of Environment, Forest and Climate Change, Information and Broadcasting and Heavy Industries and Public Enterprises, Prakash Javadekar said in the Parliament. It is worth mentioning here that India, on an average, imports almost 200 billion rupees worth of batteries for energy storage every year.

Each selected ACC battery storage manufacturer would have to commit to set up an ACC manufacturing facility of minimum 5GWh capacity and ensure a minimum 60 percent domestic value addition at the project level within five years. Further, the beneficiary firms have to achieve a domestic value addition of at least 25 percent and incur the mandatory investment 2.25 billion rupees per GWh within two years (at the mother unit level) and raise it to 60 percent domestic value addition within five Years, either at mother unit in case of an integrated unit, or at the project level in case of ‘hub & spoke’ structure.

While year 2022-23 and 2023-24 have been marked as the timeframe for setting up the manufacturing facilities, an amount of 27 billion rupees has been earmarked as incentive for 2024-25 period. Similarly, amounts of 38, 45, 43, and 28 billion rupees have been earmarked as incentives for year 2025-26, 2026-27, 2027-28, and 2028-29, respectively.

“We thank the government for approving the PLI scheme for promoting battery storage. It would strengthen our ‘Make in India’ initiative and also attract huge investments in the EV industry in the next 1-2 years. Battery occupies a larger portion of any electric vehicle’s cost. Thus, the right policy move will help us steer towards green growth in the industry, while exponentially increasing our manufacturing capacity. Once we fully start battery manufacturing operations in the country, it will lead to the reduction of cost on purchase of electric vehicles owing to increased accessibility,” Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV) said earlier.

Medical devices

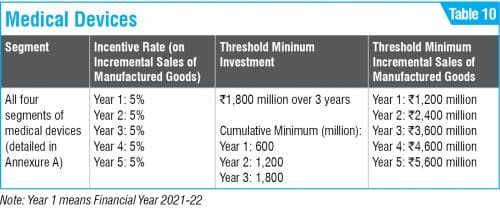

The coronavirus pandemic has taught not just India but the rest of the world too, to be self-dependent in terms of any medical emergencies. Medical devices like oxygen concentrators and ventilators were in great shortage during peak of the pandemic. The domestic medical devices market in India is heavily dependent on imports, which contribute to more than 85 percent of the market.

Announced by the Ministry of Chemicals and Fertilizers, the medical devices PLI scheme encompasses a financial outlay of 34.2 billion rupees for the period 2020-21 to 2027-28. The financial incentives will be given to selected companies at the rate of five percent of incremental sales (over base year) of goods manufactured in India and covered under target segments, for a period of five years, that is from FY 2021-22 to FY 2025-26.

The target segments include cancer-care/radiotherapy medical devices, radiology and imaging medical devices (both ionising & non-ionising radiation products) and nuclear imaging devices, anaesthetics and cardio-respiratory medical devices including catheters of cardio-respiratory category and renal-care medical devices, and all implants including implantable electronic devices like cochlear implants and pacemakers.

Siemens, Allengers Medical Systems Limited, Allengers OEM Private Limited, Wipro GE Healthcare Private Limited, Nipro India Corporation Private Limited, Wipro GE Healthcare Private Limited, Sahajanand Medical Technologies Private Limited, Innvolution Healthcare Private Limited, Integris Health Private Limited have already been approved under the PLI. These companies have committed a total investment of nearly 7.3 billion rupees under the medical PLI scheme.

The big picture

The total outlay of these schemes, when added together, comes out be around 927.3 billion rupees, and the figure does not include other incentives or schemes such as Modified Electronics Manufacturing Clusters (EMC 2.0) scheme, Scheme for Promotion of manufacturing of Electronics Components and Semiconductors (SPECS), electronic manufacturing clusters, Modified Special incentive Package scheme (M-SIPS), Electronics Development Fund (EDF), and several other. On top of these, the government of India has been trying to encourage local players of the country by increasing custom duties on many electronics products.

The latest example of the same came in the form of Indian government increasing custom duty from zero to 10-20 percent on various components including PCB assemblies, base-station controllers, system modules and cables that are required for manufacturing telecom equipment. There is also an additional 10 percent surcharge applicable on the custom duty.

“Along with these schemes, the government is also engaging in broad-base outsourcing of electronic parts and raw materials along with making available the indigenous counterparts of the Chinese electronic products by promoting domestic manufacturing,” Minister of State for Electronics and IT Sanjay Dhotre said recently.

It is estimated that these schemes, put together, will be able to attract investments of approximately US$12 billion, and that is without taking into consideration the PLI schemes that are yet to be announced. The total jobs created by these schemes will be to the tune of 1.5 million. And as the ecosystem of electronics develops in the country, the big names will look to collaborate with MSMEs and startups in order to create supply chains for raw materials, components, and finished products.

Looking at these PLI schemes, it looks like the best time to be in the field of electronics in India is now! As minister Dhotre said, “The government has announced the production linked incentive (PLI) schemes for various sectors, including telecom sector, to become a part of the global supply chain.”