India—a part of Indo-Pacific and the second most populous country in the world—is forecast to undergo a massive change in the adoption of EVs soon.

Electric vehicles (EVs) have taken the world by storm. These are being adopted more and more in different parts of the world. The global EV market, valued at around $162.34 billion in 2019, is forecast to be worth $802.81 billion by 2027, and a report by Allied Market Research points towards Indo-Pacific as the highest revenue contributor.

If a report by Avendus Capital is to be believed, the opportunity encompassing EV market in India will be around 500 billion rupees by 2025. With this mind-boggling figure, growth of companies like Tesla, and the government of India’s keenness to make EVs popular here, we try to answer here a simple question: Can India develop an EV company better, or at least as good as Tesla?

“When we talk about recreating the Tesla story, it is not about how we create a fancy car company, it is actually about how we recreate the success story of what Tesla has been able to give to the entire world. It is not about how cool the product looks, or how good it performs, but about building the entire ecosystem for creating EVs,” says Kislay Pankaj,” CTO, Micelio.

In the years 2019 and 2020, about 100,000 to 150,000 EVs were sold in India. This is less than one per cent of the total number of vehicles that were sold during that time. The EV ecosystem in India is dominated by startups, and investments in Indian EV startups by corporate, venture capital and private equity firms have seen a growth of around 170 per cent. A total of $376 million was invested in 2019 in EVs. These figures were $147 million in 2018.

Is the Tesla story relevant for India?

Tesla, no doubt, is the giant of four-wheel electric cars in the world. The company’s market cap has already jumped by a humongous $500 billion in 2020. It sells the base model of Tesla 3 north of 35,000 dollars. Several e-commerce car portals estimate that the entry price for the same model in India (once Tesla is in India in 2021) would be around six million rupees, which is almost double its price in the USA. The high cost, in itself, might be a big deterrent for Tesla becoming as good an EV company in India as it is in the United States.

“Tesla arguably created the EV ecosystem for the western word. That is what I look at Tesla as. It also is noted that Tesla has been supported significantly during its long loss-making period by the government of the United States of America. Elon Musk, himself had a very good capability of raising funds. That is how the company managed to sustain 14-15 years of heavy loss making,” explains Rajat Verma, founder and CEO, Lohum Cleantech.

While Elon Musk joined Tesla in 2004, the EV company was founded in 2003 by Martin Eberhard and Marc Tarpenning. Musk had initially invested $6.3 million in Tesla stocks during a Series A round of investment. It was in 2019 (around 16 years after Tesla was founded) that Tesla had posted figures claiming first annual profit.

“That is something that an EV maker based out of India may not be able to afford. But it is also very important to understand that we have opportunities in various other categories of EVs,” adds Verma.

Tesla, on an average, sells around 200,000 EVs in the USA annually. The same translates to around twelve gigawatts of energy capacity that the company delivers annually. In comparison, there are about 1.5 million E-rickshaws operating on the Indian roads, translating to around six gigawatts of energy capacity.

Rajat adds, “If we can even convert around five million vehicles into electric ones, we are talking about ten gigawatts in energy capacity. India has a lot of other variants in terms of EVs than just passenger cars. We have the ability to create a very large energy capacity in the market.”

As per Statista, the number of two-wheelers sold in India during 2019 was around 21.8 million, three wheelers 0.7 million, and commercial vehicles around 1.0 million. The number of passenger cars sold in the same year was 3.4 million.

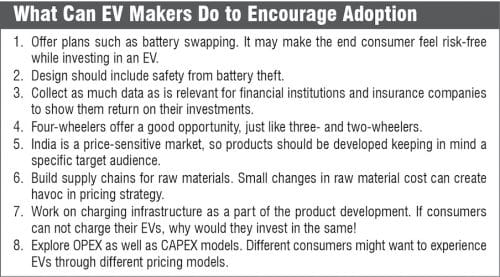

“Four-wheeler EV cars will not probably solve the ecosystem problems ranging from raw materials, battery recycling, motors, cell manufacturing, charging infrastructure, financing, and insurance. To do that I think we need an EV car company to lead the race, but two-wheeler and three-wheeler probably will come out as the surprise categories in India,” says Verma.

EV market, in India, as explained by Alwala Devender Reddy, CEO, E-ride E-mobility Company, is being created more by two-wheelers and three-wheelers than four-wheelers. The three-wheelers market is further divided into logistics and passenger categories. He explains that while e-commerce companies are adopting two-wheelers for deliveries, three-wheelers are mostly being used for last-mile connectivity.

“Data proves that the number of people who have used shared electric three-wheelers are more than the people who own their personal vehicles in India. A person sitting in an electric bus or electric metro will not understand the benefits offered by an EV unless he experiences owning one himself. In India, the easier way to own an electric vehicle would either be through a two- or a three-wheeler,” as per Reddy.

Ranjita Ravi, director, Orxa Energies, notes, “What I like about Tesla is the way they started and proved what electric vehicles can actually do. Tesla proved that electric vehicles could give high performance, be fast, be good-looking and very aspirational at the same time as compared to a normal internal combustion engine (ICE) powered car. And now they have proved that EVs are a good fit for the economical category too.”

Is focus on different EV categories a roadblock?

One of the prime reasons behind Tesla becoming a success story was the company’s capability to bring the entire EV ecosystem together. As of today, most of the parts and raw materials Tesla uses to manufacture cars in the USA are sourced from within the country, and for the ones that Tesla relies on outside sources, the process is so smooth that there are no chances of bottlenecks or roadblocks. It is like Tesla had a clear aim of being a specialist in the four-wheeler EVs from the beginning.

“Tesla has become what it is today because its aim from the very start was crystal clear. We, in India, already have EV categories that are on the brink of inflection. The three-wheeler and two-wheeler EV categories have already shown a lot of promise. It does seem that economic viability in these two categories is already there,” points out Verma.

He continues, “India should focus on two-wheeler and three-wheeler EV categories for creating a robust ecosystem for electric vehicles. These two have the potential to help create an ecosystem which will also suit more aspirational categories. We will have to address all the problems one by one.”

One of the biggest problems to solve around the EV ecosystem is sourcing of the raw materials used in manufacturing open cells and battery packs. The magnitude of this problem can be ascertained from the fact that big automotive companies like BMW have started acquiring stake in mining companies.

“Lithium, cobalt, and nickel are found concentrated in different parts of the world. Solving this problem is of utmost importance for creating a robust electric vehicle ecosystem. This problem intensifies its nature in India as we are a very price-sensitive country. Even small changes in sourcing costs can create havoc in the EV market here. We should start here and then move towards step two,” according to Verma.

Are EV prices a deterrent to the adoption rate?

The EVs available in India, in comparison to their ICE versions, are priced quite highly. For instance, an EV variant of Tata Nexon is retailed at a starting price of 1.4 million rupees (ex-showroom). However, Tata retails the ICE variants of Tata Nexon at starting prices that are almost half of that price tag (670,000 rupees, ex-showroom). Similarly, MG retails ZS EV at starting price of 2.8 million rupees, whereas MG Hector (ICE) is retailed at starting price of around 1.2 million rupees only.

“Compared to financing options available on ICE engine-powered cars, we do not get the same support in terms of EVs. This fact becomes more challenging when it comes to three-wheeler EVs. If bankers agree on giving loans in this category of EVs, it will help create trust in the minds of the people,” explains Reddy.

The finance options on EVs might also help in lowering the burden of upfront costs attached to owning these. As EVs come loaded with many more features than a normal ICE-engine car, their cost automatically goes up. But a lot of people buy cars, bikes, or commercial vehicles on a limited budget in India.

Reddy notes, “We build telematics solutions for EVs used in commercial operations. Usually, people are not willing to pay extra for such features. Even if we try to build a performance vehicle, the limited budgets of people would not allow them to invest in buying one. What we have done to help people test our EVs is that we are giving our EV models to them for use on the OPEX model.”

OPEX model, as per Reddy, can be a stepping-stone for increasing the adoption rate of EVs in India. In an OPEX model, a company or an individual does not generally buy a product. It is more like a pay-as-you-go service, or kind of a lease service, where one only pays for the time one uses a product.

“We also need corporates to encourage their employees to use EVs for daily transportation. These corporates can also encourage to invest in EVs for their day-to-day transportation needs. If the corporates start encouraging employees then the bankers will not hesitate in financing EVs,” opines Reddy.

The other way to bring down overall cost and make people experience what EVs can do is by offering them the battery-swapping model. As Kartikey Hariyani, founder and CEO, TecSo explains, a battery swapping programme by an EV company could be the answer to the most important question in India about vehicles: ‘Kitna Deti Hai?’ (What is the mileage?)

“At the customer end, we can remove half his headache by introducing the battery-as-a-service model. This simply means that the cost of ownership comes down as well as the trouble associated with EV batteries is done away with. The EV makers should tell the consumer that we are doing this to help minimise your risk,” advises Hariyani.

He adds, “If the customer knows that I am only buying a vehicle and the battery problems will be taken care of by the brand, he will feel empowered to buy and experience an EV.

Can data help in insuring and financing EVs?

In terms of ICE-powered car and bike models, there is enough data available for the insurance companies to gauge what can break down in an accident and how much they will have to pay. Accordingly, they plan the premium of the insurance. But for EVs, as the concept is still in its early adoption stage in many countries including India, it is relatively not that easy for insurance companies to assess premium.

However, a lot of EV companies in the world, including Tesla, collect a lot of data around ownership experience. This includes mileage, speed, every location, and time at which the car gets charged, and more. In some cases, there are also video clips captured from the car’s external cameras, which could include the car’s surroundings and driving conditions. This data, as Ranjita explains, can be a good encouragement point for the insurance companies for head start.

“Such data is something that still does not exist in EVs. We as OEMs can go on and on and say that there are lesser moving parts in EVs than in ICE cars, but the insurance and financing bodies need substantial amounts of data to ascertain this fact. The statistical models around EVs that would make insuring bodies’ traditional ways work are not just there,” explains Ranjita.

She adds, “We solved this problem by following an innovative idea that the Orxa Energies team came up with. Over the lockdown, we built a system that can track a battery pack and can be installed onto fleet operators. The data collected can be made accessible to our financing partner.”

Ranjita further explains that Orxa’s financing partner buys battery packs from them and then leases the same to fleet operators on per day, per week, per month, and so on basis. Through the data being fed by the system, the partner can know whether the fleet partner is using the battery packs cautiously or not.

“Talking about the levels of data, we have hundreds and hundreds of data points that can be made available to us and the partner. Now the question that needs to be asked is, which part of the data collected by this battery management system is relevant for whom. You can give financing people the data that can help them make decisions on financing EVs and similarly data to insurance companies for insuring EVs,” says Ranjita.

Financial institutions finance products following one condition, which is what kind of returns they are getting. In Delhi-NCR, a lot of financial institutions, as per Verma, had actively participated in the first round of e-rickshaw or three-wheeler sales. However, these financial institutions ran into two classical problems during the process. The first one was the customer’s inability to pay and unwillingness to pay. A lot of these were related to battery packs in one way or the other.

“There were customers who were not willing to pay and then there were customers who were not able to pay. Why did that happen? Because of the theft of the battery packs from these e-rickshaws. Some statistics suggested that almost 28 per cent of lead-acid battery packs were getting stolen. Now no insurance company will underwrite this heavy a burden,” explains Verma.

He adds, “The second problem was the battery packs starting to underperform six to eight months down the line. Now the guy who had invested in buying one had to invest again in battery packs. So, a lot of such guys just defaulted on the payments.”

The solution to these problems, as per Verma, is a push towards lithium-ion battery packs instead of lead-acid battery packs. The former is much more efficient than the latter. The former also have a longer life than the latter. Using lithium-ion battery packs can also help in controlling theft.

“Lithium-ion battery packs are not an easy problem to solve, but arguably it is a much easier problem to solve than the ones associated with lead-acid battery packs,” notes Verma.