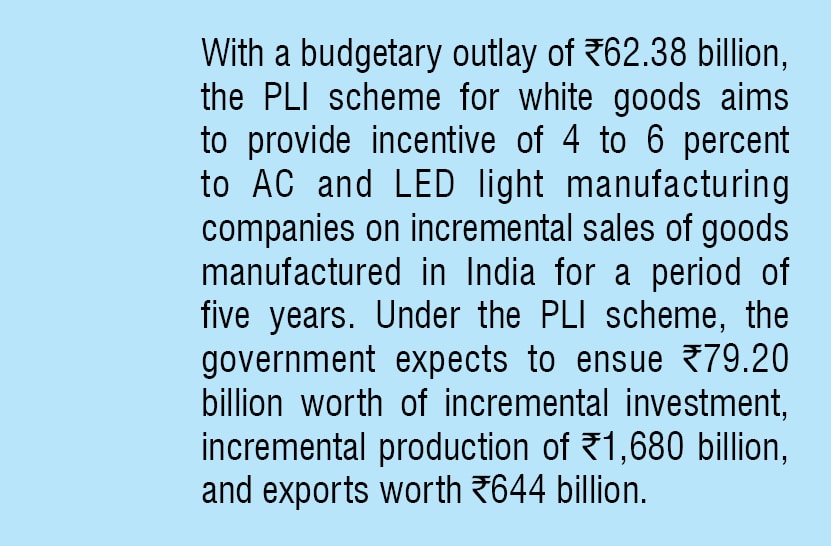

In April, the Department for Promotion of Industry and Internal Trade (DPIIT) notified the PLI scheme for white goods (air-conditioners and LED lights) to be implemented over five years with a budgetary outlay of 62,380 million rupees. What are the opportunities hidden in this news for components manufacturing? Let us find out.

Unlike other PLI schemes, the PLI scheme for air-conditioners (ACs) has made a clear distinction between the components that can be manufactured and covered under it. Aluminium foils, copper tubes, and compressors have been termed as high-value intermediates, while PCB assemblies for controllers, BLDC motors, service valves for ACs, and cross-flow fans have been jostled under lower-value intermediates. Experts believe that this is the right mix of materials that are not only essential for the manufacture of ACs but are also the biggest contributor to imports in this sector.

The inclusion of these components under the PLI scheme gives manufacturers a chance like never before to produce these components, and not just serve the Indian market but also contribute to exports and grow on a global scale.

“I have been in the electronics industry for two decades now. However, I cannot think of a more exciting period than the present times. It would not be out of place to say that the next few years can be a golden period for the electronics industry, just like how the past decade was for the IT industry,” says Anurag Dhoot, MD, Epitome Components.

Air-conditioners: Cool opportunities

The biggest contributor to the bill of materials (BoM) for manufacture of ACs is compressors, forming almost 25-28 percent of the same and making it one of the lowest hanging fruits for any component manufacturer. Another key AC component is aluminium, which saw heavy imports despite being generously produced in the country by leading companies like Hindalco.

“Almost 65 percent of the AC industry has shifted to inverter ACs. If you look at the BoM of an inverter AC, the main component after compressor is inverter PCB. But 67 percent of inverter PCBs are imported,” says Jasbir Singh, Chairman and CEO, Amber Enterprises India Ltd.

While PCBs provide a lucrative business opportunity, Singh reveals that manufacturers can try their hands at producing other components as well. These include compressors and copper tubes. Cross-flow fans is another item that can be easily tapped into since these are easy to produce, as per experts.

Although compressors, copper tubes, and aluminium producing facilities would need an assembly time of at least a year, cross-flow fans are the lowest hanging fruit with an assembly time of 6-9 months. This will provide the AC component ecosystem in India a much-needed boost, following which we can expect to see almost 75 to 80 percent of the requirement being catered within India in next 2-3 years. Consequently, it will also lead to considerable domestic value addition.

In fact, experts believe now is the right time for the domestic AC industry to grow. The import ban on air-conditioners with refrigerants in October 2020 has already shown encouraging results with 80 percent of the imports curtailed. According to data presented by Directorate General of Foreign Trade (DGFT), October-November 2019 period saw ACs worth ₹1,500 million being imported, while the same period in 2020 saw only ₹520 million worth being imported. Although a small step, these figures present some interesting data on how the domestic market is growing and is only expected to grow further with the PLI scheme implemented in full swing.

LED lights: Bright opportunities

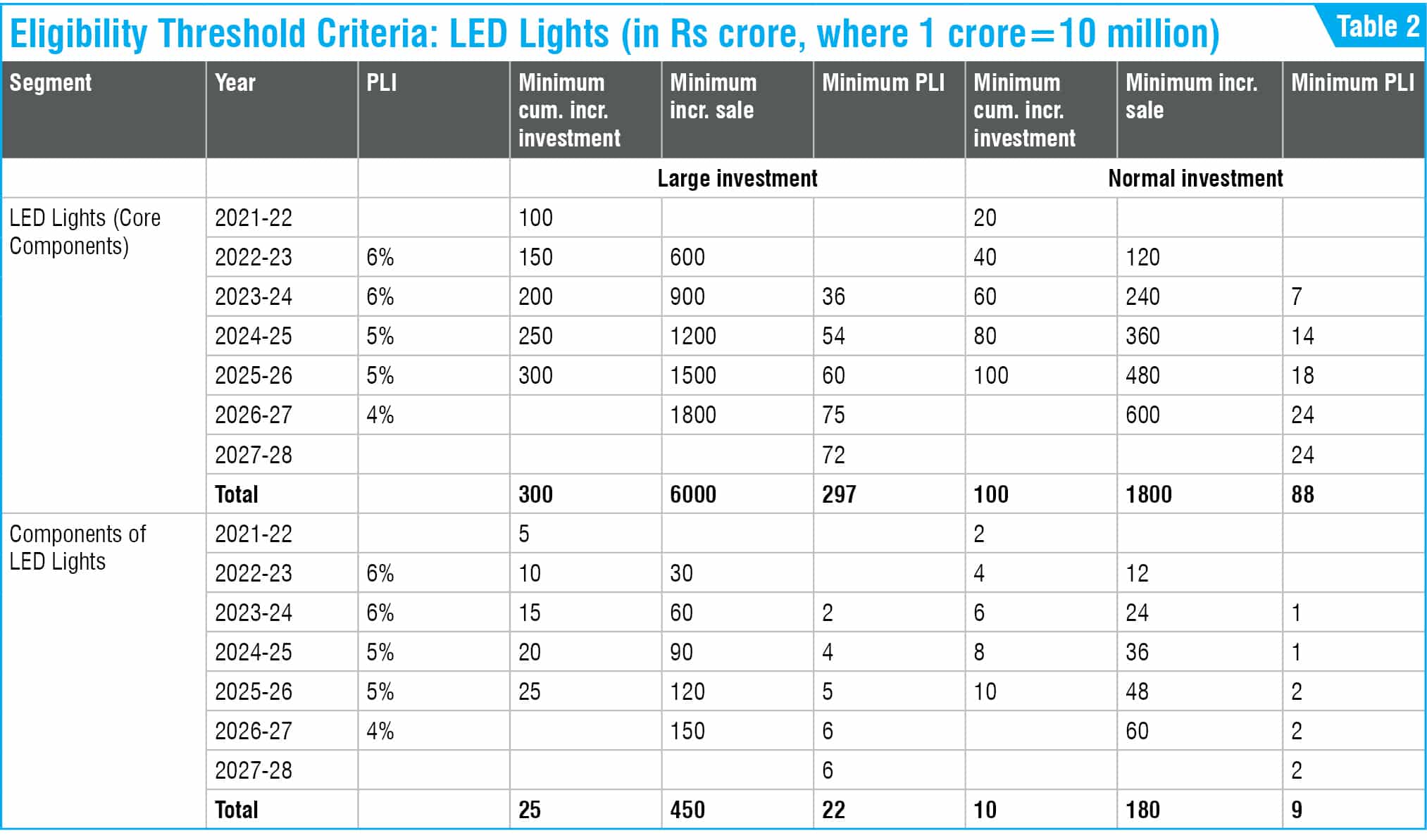

Coming to the PLI for LED lights, incentives would be given for the production of LED chip packaging, resistors, ICs, fuses, etc, and for components of LED lights like LED chips, LED drivers, LED engines, mechanicals, packaging, modules, wire-wound inductors, and so on. In LED industry, the largest product category is LED bulbs, followed by tube lights, batons, etc.

An LED bulb comprises a driver circuit, an LED engine, and the mechanical part for managing optics and thermals. All these three components are equitably distributed in the value chain as far as the BoM is concerned. “But the easiest hanging fruit is the mechanicals,” as per Atul Lall, Managing Director & Vice Chairman, Dixon Technologies India Ltd.

Metal-core printed circuit boards (MCPCBs) present another interesting opportunity. Though PCBs form an integral part of LED lights, the variety produced in India is limited even with many PCB manufacturing companies’ presence in India. This forces companies to look for import substitutes.

“Somehow, we are not able to get MCPCBs in India. The economics is not working out. I feel that there should be a major push to source this from within India,” says Lall.

Robust ecosystem: A joint effort

The lack of indigenous components is a key reason for imports. However, another reason to opt for imported components instead of locally made components is the price disparity. This results in low sales for the domestic component manufacturers, and thus low indigenous value addition to the end product.

Addressing this price disparity is an important step that could boost the usage of domestically produced components. One way to do that, Singh suggests, is to increase the import duties being levied on electronic components. Similar to how the government raised customs duties for the automotive industry a few decades ago, a higher customs duty may actually discourage imports and result in AC makers using India-made components.

But this is on the policy front. What can component makers do to leverage this opportunity right now?

An innovative approach that can help boost the domestic market is building a joint roadmap by component makers and EMS/OEM companies. In other words, if component makers collaborate with EMS companies to ink pacts and partnerships, it can result in a win-win situation for both. Component makers get to sell their products while EMS companies succeed in adding domestic value to their products.

“A joint roadmap can be made because it is of strategic importance to our survival now. Our capital allocation, our operational efficiency, our scale, our cost of manufacturing, and our BoM have to be much ahead of others,” explains Lall.

“There’s a need for the industry to aggregate the demand now. I think the time has come for this change, otherwise this whole ecosystem will not be developed,” agrees Singh.

This highlights the need for a collaborative effort between the government and industries, and also between different industries, if India is to compete in the global electronics market with completely domestically made products.

The other major factor that can decide the industry’s fate is intensification in the efforts to build a strong design base in the country. While India boasts of a large design ecosystem, its size has little to do with the impact it creates on a global scale.

Bringing about these two changes within the ecosystem could help build a roadmap that might just be the answer to see the growth that the government is looking for while rolling out the PLI schemes.

The road to global dominance

It’s time to think big. Going global is one of the most important goals for any company within the electronics component industry right now.

Lall says, “The theme playing in the market today is ‘China+1’. It’s an extremely important theme. Creating a business that can scale up to a global level is of utmost importance.”

Although a daunting task, it is possible to achieve this vision under the benefits that have been provided by the government. A strong business model that aims to be on the same level as their Chinese counterparts, if not ahead, can help achieve the goal.

“Be cautious on your balance sheet. Do not leverage it (too) much. Have your capital structures right, even if you have to part with ownership. Raise funds in a prudent way,” advises Lall.

“The only thing is that the entrepreneurs in the component sector side have to break off their mental barrier and think of a much larger global scale. I feel that it’s time for the component sector to now accept the challenge,” says Vinod Sharma, MD, Deki Electronics.

The electronics component and equipment market is growing at a tremendous rate and the upsurge is expected to continue in the coming years. Albeit a little slow, India has finally decided to hop on the train. Ultimately, no matter where they choose to invest or how, if their goals are set right, there is little that can stop the component manufacturing sector in the country from shining.

This article is based on a panel discussion ‘Strengthening electronics component manufacturing through PLI schemes’ hosted by ELCINA