Finding the right investors that genuinely see the value of your startup is an absolute halo moment. It is like finding the right pair of shoes. It may take time, but the effort is absolutely worth it. We try to make the process a little easier for you by breaking down the investor’s psychology, which investors to look at, and how you can shine in the eyes of an investor.

Anybody who has ever tried the bare minimum will know that raising funds is possibly one of the most painstaking aspects of building a startup. Founders become nothing short of salesmen going door-to-door (in this case, investor-to-investor) to convince them to invest in them. The bottom line is: Fund-raising is HARD!

Raising funds as an electronics startup is even more cumbersome than it would be, say, for an IT startup, or a software startup. And no matter how exasperating it is, it is something that has to be done. But how?

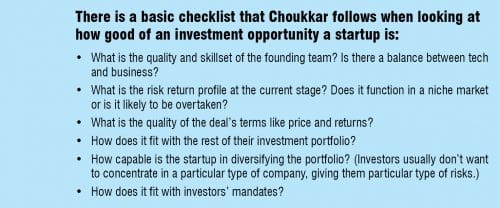

“Your channels need to be overly broad. You will end up having a lot of conversations with a lot of investors with only one or two clicking at the end. Statistics say that startups need to engage in 98 to 100 conversations with investors before even one of them can materialise into something,” says Rohan Choukkar, VP, Bharat Fund.

The hurdles

The general distaste of investors for electronics startups has multiple reasons behind it. The first being that companies in the electronics or hardware space tend to have a substantially longer product development cycle than other technology companies, which means that the technical and execution risks are a lot higher, with the tolerance for faults being incredibly low.

Another reason for investors to shy away from funding electronics startups is that such companies require a lot of money upfront during the initial days of introducing a product in the market as they are much more capital-reliant.

On top of that there is no guarantee the product will be a hit in the market and yield the investor good returns. If, inadvertently, the product fails to perform, the investors may have to pay heavy price for it.

This brings us to the next point: Hardware companies are harder to exit.

Having said that there are still some ways to attract the investors such that your startup looks like the most lucrative offer there is.

Attracting investors

As per Ganapaty Venugopal, Co-founder and CEO Axilor Ventures, most of the successful startups stand out in three key areas: The product, the market, and the founding team.

Choukkar and Venugopal give us an insider perspective of what elements would help an electronics startup to attract valuable investments for valuable investors.

1. Relevance of your product. Venugopal says, “On the product side, the first question that we ask is how core is your product to your customer’s business?”

The relevance of this question has been greatly amplified by the Covid-19 pandemic, which has made companies realise that, at the end, only that product which can reduce customers’ hardship is going to survive. Unless you are solving a real pain point of your customers, it is extremely difficult for them to develop any interest in your product.

2. Focus on economics. Having a clear idea of the revenue and costs per unit of product is one of the fundamental basis of building a valuable startup. It is important as an electronics startup to pay extraordinarily strong attention to your margins. Gross margins and contribution margins, essentially revenue margins after deducting all the incurring costs, are a good number to present to investors to immediately spark their interest, especially if it’s a high enough number.

This, says Choukkar, is a lot more important than providing big financial models or projections that most people tend to discount because it is nowhere near what the business might end up looking like in the upcoming years. Unit economics on the other hand are more verifiable.

3. Scalability. Knowing the market you would function in is just as important as knowing the nitty gritty of your startup. Being aware of the market size and strategy for commercialisation are all part of the same game. A product that is based in a large market instead of a niche or dying one is crucial to convince investors and VCs that your product will work.

“To assess the market size, we ask: Who would go out of business?” explains Venugopal.

Irrespective of whether you’re a deep-tech startup or any electronics startup, if the answer to the question is that a mammoth organisation could go out of business with the introduction of your product in the market, that validates the market size.

Second, having a clear vision for your technology offering or product is another noteworthy aspect. Are you selling components? Or is this the final electronics product itself? Is there some suggested offering that is built around it?

“Investors typically like the latter because it’s a lot harder for competition to essentially take what you’re doing and reverse engineer it,” informs Choukkar. Essentially, having a vision which involves multiple product offerings or incrementally improved product offerings is a key aspect to be focused on.

Choukkar gives his insight, “If you are a company with a single product, typically it is not going to be viewed as an attractive enough investment proposition because the risk is concentrated and not distributed, and you stand a substantial chance of being overtaken with developments which most people cannot realistically foresee.”

4. Higher barriers to entry. When we say your startup and product should have a high barrier to entry, we do not just mean you show a big list of IP. “A lot of entrepreneurs who pitch to us are people who essentially come with a provisional patent filed here and there. This is not as important,” says Choukkar.

You see, there are a lot of frivolous patents in the system. This makes it an unreliable judge of your IP’s value. Instead, opt to talk about WHAT those patents are about and HOW that serves as a shield of protection for your product.

Filing patents may not even be such a big deal if you are just able to communicate your trade secret. Even if you are not filing patents, you should be able to articulate what your trade secret is. Explain the kind of networks you are building, how you are driving usage of your product and, most importantly, why no one can do it better than you.

5. A strong team. While the product and market are conducive elements for any startup’s success, the founding team has a big role to play in putting them together to bring out something of value. Afterall, the product and its present and future performance lies with the knowledge of the founding team.

“We certainly look for proprietary insights and, most importantly, what are things that the founders know that most other founders in their business wouldn’t know,” informs Venugopal.

The founders’ profile, skillset, as well as the profiles and skillset of the core employees are a big deciding factor. A team with a strong yet mixed skillset is the one who almost always takes home the prize. Something that may leverage a founding team’s credibility is having a deep vertical domain knowledge.

It is also important to remember that an electronics startup is a business opportunity at the end of the day. This means that only having terrific technical knowledge is not enough, terrific business knowledge is what is going to bring the product into the limelight.

Interestingly, Choukkar mentions that it would particularly be wise to have more than one founder of a startup. “Because you never know what may happen to the founder. There is a possibility of the person not being competent enough or some unforeseen health condition to develop.”

Getting the right investors – you just need to look

Any startup is initially funded by the founders’ or other close sources themselves. Scouring for investors right off the bat is going to end in vain. But once you have invested enough cash into your startup to get it up and running, you can move on to the second stage of funding, which is looking for incubators, accelerators, university tech parks, and grant schemes.

Getting a combination of funds from all these sources can provide your startup a much needed boost to scale up. Here, research is your biggest ally, according to Choukkar. “Most of the top-notch engineering or management institutes in the company have an incubator associated with them. There are a good number of non-academic incubators as well. While looking for academic incubators, in particular, pay attention to what kind of grant schemes their institutions work with.”

The government has also been very receptive towards building a healthy electronics startup ecosystem in the country. The I-STEM scheme is one such offering that has a large number of schemes to provide early capital as well as mentorship and physical resources that are available for free. “This is some of the best money that you can get. This is non-dilutive funding where you don’t have to surrender any kind of stake in your company to be eligible for this money, nor do you have to pay back,” says Choukkar.

The next category of funding that startups would typically have access to are angel investors.

While there are a large number of angel investors who will be willing to invest in your startup, Choukkar advises that one should be wary of whether they would actually be a good fit for your startup. Understanding how you see your company growing and what are the expectations of angel investors you are dealing with is a good way to start.

Angels are lucrative investments that you can look for since they come with more staying power and, if chosen wisely, can also help you with some much-needed mentorship and networking opportunities.

Crowdfunding is another great way to get some funds in the early days of your startup. It can help you put together at least a few batches of your product that you can show as evidence of traction to future investors. What’s more is crowdfunding, while being a great source of investment, can also provide you an avenue to test your product’s market acceptance. Although it is hard to accomplish, the speciality of this kind of funding is, again, that it comes with no stake surrender or debt.

Finally, venture debt and conventional debt is something that you may access after you have got a couple of sales cycles running and have a better understanding of your business. Being aware of how their choice is dictated is particularly important if you have to have them investing in you, as per Choukkar.

Choukkar advises, “Within a VC itself there are other large number of different funds. You should look at venture funds which have a consistent theme and sector that matches the theme and sector that you are in.”

But with so many funds, we are cursed with the option to choose. Choukkar gives a simple plan that will help you make a wise choice,

Knowing the structure and lifecycle of a fund is important. Essentially, a fund is an 8-10 year journey where it spends a couple of years fundraising, which is followed by a deployment phase where they would be investing in companies for 2-3 years. In the remaining years, a fund is looking at nurturing and growing their investments and then exiting. If you happen to choose them at any point when they are not investing, you are almost bound to be rejected, even if you meet their criteria. So research, again, is your friend here.

The pitch

So, you have taken care of your business model, developed your product, built a strong business model, and finally made it to the investor’s table. Now what?

It is natural to feel a sense of restlessness before presenting your proposal to the investor. In that case, it is wise to keep answers to a few common, yet fundamental, questions mentioned below ready.

What is your startup about? Srinivas Raghavan, CTO and Advisor at Startupxseed, says, “Most people present some jazzy graphs, reports or newspaper headlines to show us where the problem is.”

But it is not a problem statement, and definitely not an answer to what your startup does. Problem statements are those that are driven by deep insights based on the conversations you have with customers or from your deep domain knowledge of the problems in a particular sector, and how these can be solved. Simply put, what are you doing that is going to solve the problem?

But articulating the solution is sometimes easier said than done. Here, again, a tip that may come in handy is to not tell them WHAT your product is, but rather HOW that product is bringing about a change.

How are you different from other similar companies? A common mistake that many founders fall prey to while answering this question is they start rambling about every way their startup is superior to other companies.

But the answer to the question is, simply, the USP of your product over your competitors’. Ultimately, the product is the true king of your startup, and that is what should grab the spotlight in any discussion.

What makes you think you’ll succeed? While you can answer this question in various ways, depending on your startup and its uniqueness, make sure to include an important aspect in your pitch—your customer base, for instance. Getting your customer segmentation right is most important. In fact, Raghavan says, it is necessary to not only be specific about who your target customers are, but also who are not your target customers!

This segmentation is important because otherwise every person might look like a potential customer. A simple way to look at it is at customers who have the same needs and the same willingness to pay.

“Sometimes your challenge is not your competition but compelling the customer to change from the status quo to adopt your particular solution and demonstrate a willingness to pay,” says Raghavan. If you are able to convince your customers, it would not be so hard to convince the investors to see how you are already on the path to success with a loyal customer base right from the get-go.

Can your business actually generate cash? As mentioned before, investors need to know that the business they are investing into is capable of providing them with profits in the long term. For that to happen, founders need to present a truly clear picture of their revenue generation to the investors. Raghavan explains, “Since revenue equals volume x price, if you need to generate revenue, you should be in a position to control both the price as well as the volume.”

But to be able to control that is not easy. First, volume increases with a rise in number of customers, which again draws us back to the importance of specifying your customer base. Some key points to consider while devising a working strategy, as per Raghavan, would be to specify if you are going to reach them directly or through channels.

The next thing to focus is the pricing power. The way you set your prices in the initial stage of your product’s launch is crucial for your business’ future revenue generation. “For instance, you charge a customer ₹250 per product. Why is it ₹250 and not ₹500? You can strategically offer a discount, but if you lower your pricing at the beginning, there is no way you can subsequently increase the price,” adds Raghavan.

What will the proposed funding be used for? Raghavan says, “Most of the time what investors would like to hear is that the money is going to be used to solve certain operational or scaling problems. Because from a funding standpoint, one can say that by overcoming this problem there is a clear path for higher revenues and higher profitability. There is generally not much of an interest if you use it to add fancy features to your existing solution.”

The outcome of the presentation lies, ultimately, in your convincing power. A boring presentation where you read out from the slides is definitely a no-no. It is your responsibility to get the investors engaged in the conversation, and to do that it is important for you to demonstrate your product’s capability through your words. A great 15-minute speech can have a much greater (and positive) effect on your investor’s final decision than a 20-slide presentation.

The goal, as Venugopal says, is that the investors should be more interested in your startup at the end of your presentation than they were in the beginning.

Finally, building hardware is expensive as well as risky. If you want an investor to fund your startup, you have to be clever about how you position and package your company. A little bit of innovation on your business model is good, and so is adding a software component to make it more appealing. At the end of the day, a hardware company is evaluated as any other company. The elements for what would make a good pitch or a good company that would excite an investor remain the same.

Having a strong belief in why your startup is bound to succeed, despite all odds, is necessary to convince an investor of the same. Afterall, if you don’t believe in your dreams, why should someone else?