Unmanned aerial vehicles, popularly known as drones, vary in size depending on their application. These are now finding use in numerous sectors including logistics, disaster management, agricultural services, defence, and even event and wedding planning. So, there is no doubt that their demand is likely to increase exponentially in the coming years. Read on for details.

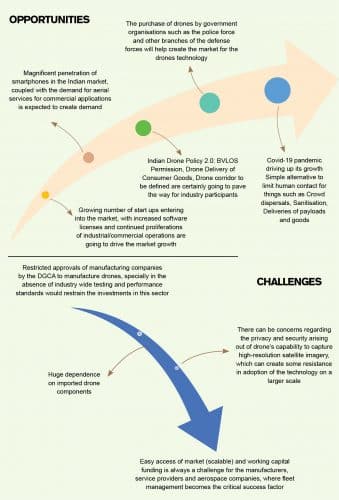

The drone industry is placed among the top priority in Prime Minister Modi’s Vision 2024. The current market of Unmanned Aerial Vehicle (UAV), also popularly known as Drone, is at nascent stage in India and is witnessing the emergence of a whole new ecosystem, value delivery model, and off course a new breed of entrepreneurs and start-ups. Though UAV market in India is at its entry stage, it has already drawn attention of the policy makers, tech start ups, and potential enterprise customers.The stakeholders are expected to join hands and create a sustainable UAV ecosystem.

The need of UAVs in the modern world is rooted to the paradigm shift in the modern world which is more data centric and exploring new possibilities of logistical evolution. Data acquisition has become the key for any strategic decision, mainly the visual data for planning, monitoring, and controlling. The enterprises are increasingly facing the challenges in bringing efficiency in the operations that are logistical in nature while keeping the risk exposure level low for the humans.

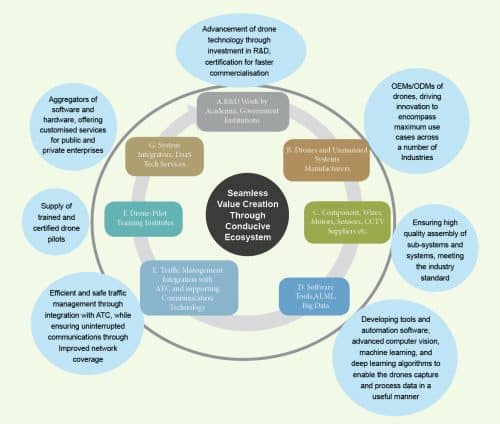

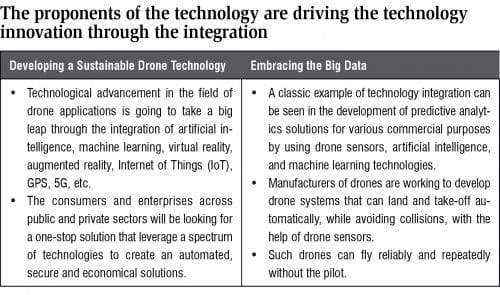

The technology proliferation is gaining momentum with continuously evolving use cases across a number of industries and applications. The stakeholders—including the OEMs, service providers, investors, government and policy makers, end-consumers, startup community, and enterprises are showing keen interest to participate across the value chain.

Innovative use cases to accelerate the pace of adoption of UAV technology

Indian market is already witnessing applications of nano and micro UAVs in the use cases requiring the UAV to fly within the visual line-of-sight. Availability of medium and large drones in India at a cheaper price will create new opportunities across a number of applications that require scalability and flexibility in payloads. While e-commerce, media & entertainment, disaster management and transportation seem to be the early adopters in the consumer UAV segment, other core industries such as healthcare, infrastructure, energy & utilities, mining, agriculture, etc will follow the suit, depending upon the development of specialised service offerings.

The industry is gearing up for a range of possibilities across the target market segments and creating a viable business case for nano, micro, small, medium, and large UAVs by integrating data analytics and communication technologies. In the short to medium term, the competition will be concentrated on those UAV types that can be used in generalised applications, such as goods delivery by e-commerce companies, cinematography, surveillance and safety inspections, search and rescue, etc. The enterprises in the power and infrastructure sector are exploring the possibilities of using drones for asset management. Solar power plant operators, for example, can automate the monitoring of the construction activities and inspection of the solar farms by using AI-powered drones, capturing the thermal images along with the geospatial metadata.

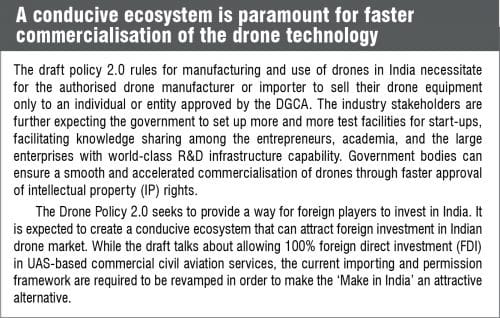

Government is all set to create the market demand through the introduction of UAS Policy 2.0 accompanied with a series of measures

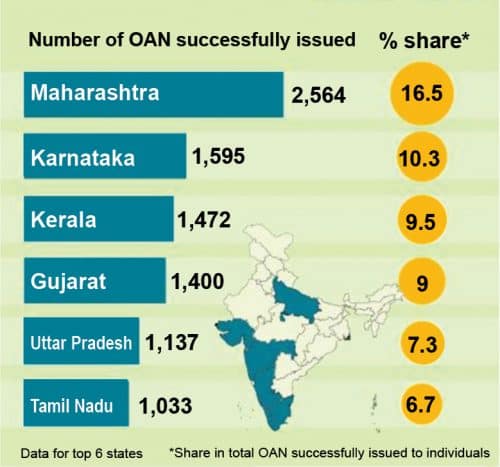

The intent of the Indian government is clear from its series of steps taken in the recent time to generate interest among the stakeholders and the influencers in the UAV industry. Ministry of Civil Aviation has released the draft UAS Rules (Unmanned Aircraft System) 2020 for public feedback on 4 Jun 2020. Subsequently, another draft CAR for drone training was released for public feedback on 14 Jun 2020. UAS Traffic Management (UTM) policy too is on the way, which will be expected to pave the way for a safe and scalable traffic management in tandem with the ATC (Air Traffic Management). Also, around 20,600 Drone Acknowledgment Numbers (DAN) were allotted by 30 Jun 2020.

The Ministry is opening doors for power and infrastructure sector to start using drones for the use cases such as powerline and pipeline inspections. GARUD (‘Government Authorisation for Relief Using Drones’) portal has been launched to offer fast track approvals to the government agencies across the key sectors including infrastructure, agriculture, healthcare, defence and national security for the incorporation of drones in their operations such as aerial surveillance, aerial photography and public announcements.

Ministry of Agriculture, Survey of India, Maharashtra Transco, Indian Oil, state governments have already got the approval for drone operations. Maharashtra Transco happens to be the first power utility company to get the DGCA approval for powerline inspection using drones.

Such initiatives are bound to create the market and business opportunity for drone entrepreneurs.

The government is also bringing efficiency in awarding the contracts to the industries through purely online applications. Around nine training schools were provided license to train drone pilots, an endeavour towards building a sustainable ecosystem of operations.

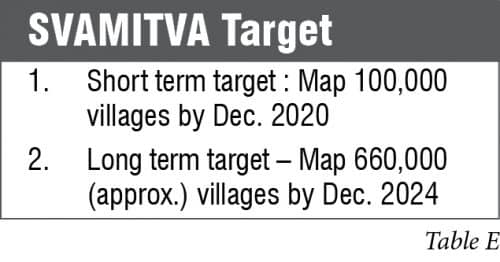

SVAMITVA (Survey of villages and mapping with improvised technology in village areas) creates an opportunity for drones to be used by the Panchaytiraj department in aerial land surveys for land demarcation in the rural areas in order to resolve land disputes faster.

NITI Aayog’s endeavour, DISHA (Drone for Infra Security and Agriculture) is being conceptualised to create an incubation fund for the drone industry. It aims to promote the R&D, bridging the gap between the academia and the industry, thus accelerating the growth of the ecosystem that is scalable and sustainable.

A counter-drone solution too is on the cards as reflected in the dialogues with the security agencies. BVLOS drones are already being planned to be flown, without having the UIN, on experimental basis by the consortia of thirteen operators, as approved by the MoCA, including Spice Jet, Nandan Nilekani backed ShopX, Google supported Dunzo, and drone maker Throttle Aerospace.

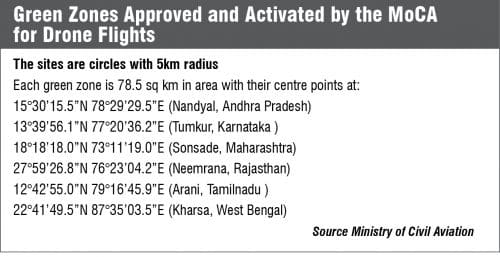

Though six green zones are already activated for drone flights, yellow zones too are going to be allowed, covering another 25-30% land.

In nutshell, a solid playground is being levelled to involve active participation of both public and private enterprises.

Enterprises Taking the Lead

- Enterprises are proactively taking steps to create demand for commercial drones.

- Food tech company, Zomato, for example, is looking at setting up a drone-based delivery network in India.

- Tata Steel has deployed drones at their Noamundi iron ore mines in Jharkhand with the help of Skylark Drones, a Bengaluru-based data analytics startup, in order to meet the compliance of reporting and monitoring volumetric production.

- A bauxite company hired Skylark to leverage their drone-based monitoring solution to ensure safe deployment of all equipment and manpower at the mines.

- The drone technology developed by Chennai-based DeTect Technologies acts like its own positioning system, more like an internal GPS helping in monitoring structures like a boiler inside a plant, autonomously. Hindustan Petroleum, Indian Oil, and GAIL have already roped in DeTect for developing similar solutions.

- Though still in the testing phase, IT-based businesses such as Amazon, Facebook, Google etc are slated to invest over $200 million in the use of drones for delivery and expanding internet access.

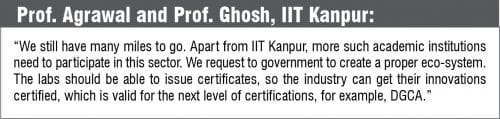

The academia to set the stage for innovation and advancement in drone technology

The academia is of the opinion that initially the funding should be routed through the academic institutions. There should be research grants from the government in order to make Indian drones competitive in the global market. IIT Kanpur and Indian Institute of Science are already providing mentorship and formal education to the entrepreneurs and the aspiring professionals.

The academia is going to play a pivotal role in commercialisation of drone technology. IIT Kanpur’s test labs accommodate a series of technology focused sections including propulsion set up, environmental testing, communication testing, etc. The institute is willing to broaden its scope of the technologies as the industry matures and more and more entrepreneurs join the bandwagon.

Though the government has not made any testing certification mandatory for commercial drones, Quality Council of India (QCI) and renowned Qualification Bodies (QB) are working with the government to develop a mechanism to provide quality certification to the drones. Additionally, the Ministry of Defense (MoD) is setting up a cluster of testing infrastructure for military equipment, including drones. With an allocated budget of four billion rupees, the proposed testing centres will be run by a private consortium from industry, planned to be set up in two defense corridors in UP and Tamil Nadu. Such testing centres can very well facilitate standardising the specifications and performances of commercial drones by enabling the manufacturers, service providers, software developers, sensor and other sus-system level manufactures to test and certify their products before they enter the market.

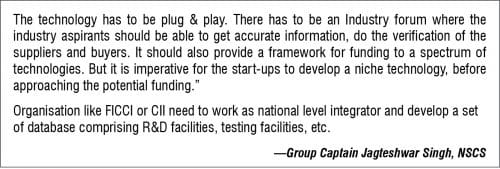

Group Captain Jagteshwar Singh, NSCS suggests to bring efficiency in the process of R&D by creating calibrated test facilities. He adds, “We should not waste time and resources in developing technology which is already developed. It will make sense to involve the drone users at the R&D stage itself. Also, it is crucial to test the parameters for flight testing on-field. Gather the information from the users and leverage the real-life experiences of the individuals.” He further adds, “there has to be harmony among the labs. For example, IIT Kanpur and other government labs should facilitate knowledge sharing, thus making the development work collaborative across the ecosystem to avoid duplication of work and bring more efficiency.”

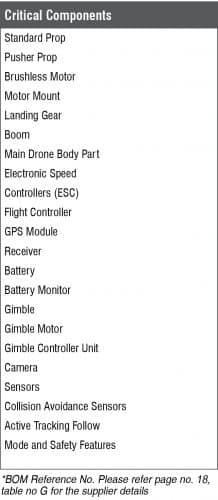

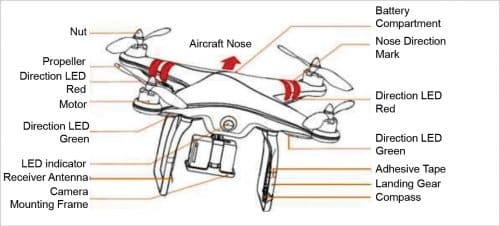

Manufacturing of drone equipment (OEMs/ODMs) expected to gain momentum post the standardisation

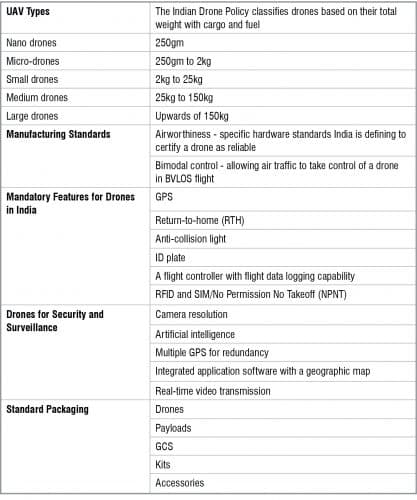

The Ministry of Civil Aviation has clearly set the guidelines for manufacturing drones which comply with the NPNT (No Permission-No Take off) and Data Protection & Privacy Policy. Additionally, the UAV equipment also need to meet the requirement of airworthiness, to be built around specific hardware standards and bimodal control features, allowing air traffic to take control of a drone in BVLOS flight. The Indian Drone Policy should be able to drive global standardisation of hardware and testing by working on airworthiness standards encompassing specific hardware standards. The drone manufacturers will be looking at the possibility of manufacturing efficiency in the supply chain and scalability in their target market before deciding to invest in their Bill of Material (BOM) and developing their network of suppliers in order to meet the required compliances.

While the policy has plans to allow 100% FDI (Foreign Direct Investment) in the manufacturing of Remotely Piloted Aircraft (RPA), the foreign manufacturers should be willing to change their design and meet the NPNT compliances

Component and sub-system level development in India to play the pivotal role in innovation and subsequent commercialisation

Currently, more than 80% components are imported, which poses the biggest challenge in front of the domestic manufacturers of drones. The supplier base of the battery packs, which being one of the most critical components in the system, is having poor presence in India and it requires to be enhanced.

Component level innovation encompassing the miniaturisation of sensor technology, low-cost 3D printing technology and assembly of kits holds the key and has the potential to provide an impetus to the continuous evolution of the design and development of low-cost, high-value UAVs. Sensors including hyperspectral imager, SAR (Synthetic Aperture Radar) and LiDAR (Light Detection and Ranging) are going to play the role of a most critical hardware component, which can help drone industry revolutionise agriculture, search and rescue, town and country planning, etc.

Sub-system development/component level R&D is going to play a strong role in increased commercialisation of innovative technologies in the drone industry. For example, a strong understanding BLDC specs, sensors, and propellers can be considered to be the first level of development. Value addition to the same can lead to innovative products on sub-system and system level, opening the doors for patents and further commercialisation.

Additionally, Indian landmass offering the most varied terrain across the nation will demand for high altitude engines in order to meet the varying climatic conditions.

UAV traffic management to create a ground for operational safety and efficiency

The UTM policy (Unmanned Aircraft System Traffic Management), once implemented, will be paving the way for operational scalability and safety by creating a carefully designed SOP (Standard Operating Protocol) to be followed by the start-ups.

The Digital Sky Platform is expected to be acting as traffic regulator, that can be effective in managing unmanned aircraft traffic based on ‘no permission, no takeoff’ (NPNT) policy, while helping the operators acquire licenses (UIN – Registration/UAOP – Driving License) with minimum effort.

The Drone Policy 2.0 also accounts for thorough monitoring of drones—for instance, monitoring how drones collect, use, store, and share data.

Standardisation to be driven by the government policy, that can lead to commercialisation and hence can attract the investors. Rahul Verma, an operational RPA instructor, thinks that the operational challenges can be overcome through the integration of ATC (Air Traffic Controller) with the UTC, thus integrating UAV and pilots with the existing airspace being controlled and managed by ATC.

He suggests that it requires a blend of operational and technological improvements. It involves new set of requirements of ATC to manage UAV that is scalable and should be used to develop an information sharing methodologies (sharing between operators and UTC). Accordingly, a workflow for RPA/UAV mission is required to standardise the operations with minimum acceptable flight risk. In short, UTC can be treated as a sub-system within a larger system of ATC.

Communication technology

The business viability of Drone operators in significant number of applications can only be established when the drone can be flown Beyond the Visual Line of Sight (BVLOS), or when it flies autonomously, in order to justify the operating cost involved and the ticket size of the projects.

In such cases of BVLOS flights, when the data is transmited to the ground stations beyond the remote-control station of the pilot it becomes the key success factor. This necessitates the drone manufacturers and the telecom infrastructure companies to invest in the hardware to meet following requirement:

- The BVLOS drones should be equipped with the mobile communication modules

- A strong network coverage through the 5G technology will be paramount in order to support the communication requirement

- The telecom industry should work in tandem with the drone industry to ensure availability of the coverage and bandwidth up to the lower part of the airspace

Training centres are emerging….

Services being at the centre stage of delivery of drone solutions, the pilot training too is expected to gain prominence, which is mandatory as per the DGCA norm, in order to get the licenses to fly drones for commercial purpose.

This, in turn, is going to encourage many drone technology providers and fleet management companies to set up training institutes to cater to the market demand in coming 2-3 years. The trained pilots will be playing a crucial role in providing operational sustainability to the ecosystem. Many drone manufacturers in India, including Aarav Unmanned Systems, Aero360, Johnnette Technologies, and Skyport innovations, are offering training solutions to the enterprises and individuals.

Drone operators and system integrators to play a key role in providing the scale through innovative business models

Data analytics and innovative business models offering flexible pricing are going to be the key differentiating factors. There are generalist drone operators for regular use cases such as cinematography, photo shooting, etc, and there are specialised geo-spatial solution providers that can include geospatial video survey and inspection to be used for 3D Modeling and volumetric analysis, etc.

In the wake of rapid adoption of drone technology, Indian entrepreneurs are showing keen interest in grabbing a pie in the continuously evolving value chain. A host of business models are taking shape as the demand for UAVs is accelerating. While drone manufacturers are key proponent of the technology, a number of variants of service models are expected to emerge including rental services, drone-as-a-service, system integrators offering specialised services, surveillance-as-a-service, etc.

Preferred business models for the investors

Seventy per cent of the start-ups can get funding subject to right business strategy and resources.

Experts suggest that the start-ups initially should focus on one idea and its successful execution. Ability to specialise will attract investors, who look for the market, expertise, differentiated disruptive capability, team capability, etc. There can be specific funding for various use cases, which necessitates to build differentiated lab facility and, most important, to build inclusive ecosystem.

Drone services are emerging out to be the most preferred business model among the start-ups on the backdrop of high scope of business scalability. The private equity and venture capitalists are looking for models that offer flexible pricing based on the actual value creation for the customers, which is measurable and replicable.

The industry is expected to witness partnership among various participants in the ecosystem, such as AI and Big Data service providers, who might partner with OEMs, system integrators, and large enterprise customers with hardware capabilities.

Innovation is going to be the prime focus of the start-ups and the enterprises as well in order to build a sustainable partnership among the eco-system participants. The large corporate houses can turn out to be the initial investors in the start-ups. The start-up companies are shifting their focus on data analytics software and communication capabilities in order to develop solutions which can be patented and, at the same time, are commercially viable.

The entrepreneurs look for long-term investors, who understand the technology.

Faster commercialisation and revenue generation through small contracts can help the small businesses in developing a clear-cut use case in a particular industry. Such proven track record can help them find the investors. Humanitarian services can be the trigger point to draw attention of policy makers and investors. To compete globally, the Indian firms can focus on software, system integration, high-value low-volume ecosystem, such as purpose-built border security, and disaster management. The commercial viability will be mainly driven by the application suitability of the solutions across a large number of use cases across the globe.

Future outlook

The UAV technology is going to be an enabler in implementing bigger ideas of advancement of the mankind including smart cities, EV charging, supply chain management, and precision farming, etc. The United Nations has estimated that by the year 2050, 68% of the world population will be living in urban areas. This projection is bound to put pressure on increasing the efficiency in town planning and resource allocation. Urban local bodies/municipal corporations are expected to induct UAV technologies for geo-spatial survey and geographical information systems, which, in turn, would help them plan the infrastructure development for smart cities in a shorter time span.

Precision farming is the future of Indian agriculture, where drones will be deployed for aerial survey for water resource planning, crop spaying, dusting, monitoring, and crop insurance, etc. The supply chain management is going to deploy drones for inventory management using RFID, QR code, and IoT technologies for warehouse monitoring, and delivery of goods as well.

Amazon has patented a wireless EV charging technology that can charge the batteries on the move, which is going to be a game changer if it is rolled out on a mass scale in future in India. Amazon has already taken initiative in this direction. In 2017, It filed a patent for a technology which encompasses delivering energy using an autonomous vehicle. The technology involves a drone carrying a charged battery to an electric vehicle, docking autonomously with it, and charging it.

Miniaturisation of drones and the possibility of equipping drones with solar panels, though at very experimental stage, can be the next level of evolution. The future is bright for the UAV technology in India on the backdrop of fast-growing use cases of the technology across a large number of industries.