Mobile money is an electronic wallet service that allows users to store, send and receive money using their cellphone.

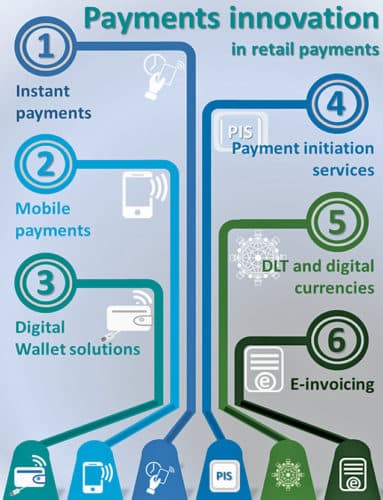

Consumers today demand a higher level of convenience and choice in how they manage payments and transactions. They want speed, round-the-clock access, real-time information, and flawless and secure execution. More than any other technology, mobile banking is driving this revolution.

The mobile money model entails providing financial services such as payments and banking, transferring money or paying for goods and services through a mobile device.

Using this solution, money can be transferred almost anywhere, even when there are no banks nearby, increasing accessibility in rural areas. It enables cashless payments, reduces dependency on cash and allows tracking of transaction records.

A digital wallet is a virtual wallet that stores all contents in a digitised format and allows easy payments and other money-related transactions. It can hold money, coupons, loyalty points, value and membership cards.

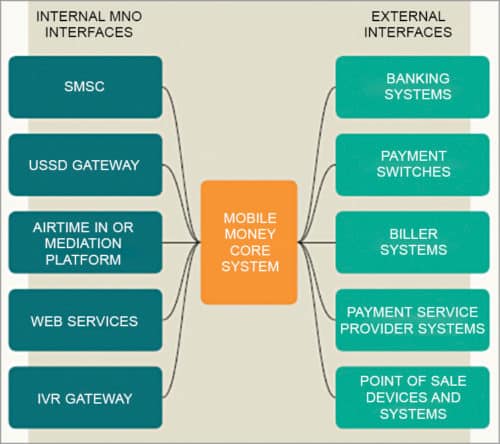

Basics of a mobile money platform

In this system, cardholders can access their account information, check balances and transfer funds easily using their cellphones. In addition, they can self-manage activities and monitor fraud with specialised alerts. The system operates as a Back-end as a Service model from a secure cloud, with offerings such as:

- Automated user and merchant onboarding

- e-Wallets

- Card payments acquiring and clearing for merchants

- Affiliates management

- e-Shop integration

- Payment switch

- Closed- and open-loop card scheme management

- Mobile money and mobile banking

- Peer-to-peer loans

- Remittance solutions

The target audience in a mobile money model are banks, mobile network operators (MNOs), payment gateway providers, payment processing agents, payment platform providers, mobile subscribers and customers.

There are various transaction modes in this model, such as NFC/smart cards, direct mobile billing, mobile Web/WAP payments, SMS, STK/USSD, mobile apps, IVRS and others like Wi-Fi, QR codes and Bluetooth.

Three examples of mobile money solutions are:

Alepo is a complete mobile money solution, which offers functionalities like peer-to-peer (p2p) money transfer, cash-in/cash out (from banks, credit cards and agents),

international remittances, merchant payments, government subsidy distribution, enterprise payments, micro-saving, micro-credit, recharge and bill payments, among others.

Obopay offers payment products, solutions, services and business consulting to companies across sectors, such as telecom, banking and retail. The company has played a key role in digitising payments in various countries in Africa (including Uganda, Kenya, Zimbabwe, Tanzania, Cameroon, etc), Latin America, South East Asia and the Middle East. It has handled three billion transactions with zero fraud cases and zero variance. Its Evolys platform is available in 10 languages, such as English, French, Spanish, Arabic and Swahili.

Thailand-based DeeMoney is positioned as a flexible and API-friendly remittance platform for both inbound and outbound money transfer services. Its mobile app has the flexibility to pay for an order in three ways.

- Bank account (direct debit)

- K Plus (Kbank mobile banking app)

- QR/barcode (payment using any mobile banking app, wallet or bank ATM using QR and bill payment platform)

For inbound services, customers can pick up cash at DeeMoney outlets and deposit the same into any bank account.

Components of the mobile money model

Mobile banking is conducted through a technology platform developed by a mobile financial service (MFS) provider. While it is easily conducted on smartphones, this model has a simple interface that can be used on the most basic cellphone, making it accessible to people living at the base of the pyramid.

Most services can be accessed through SMS, so people are not reliant on an Internet connection. In most cases, no user fee is charged for registration or making deposits, transfers and cashing-out services. Since companies have designed their platforms to work with even the most basic phones, in some cases, voice-based systems are integrated into the service to ensure that those who are not tech-savvy or are under-educated can also benefit.

MFS providers set up and develop technology platforms to enable mobile money services.

But, there are a number of critical partnerships required for it to work successfully.

1. If the company is not an MNO itself, then partnering with operators is critical. Most MFS providers partner with several operators to ensure their service is available as widely as possible.

2. The financial regulator of the country where the service is in operation needs to provide a licence to the company to offer the MFS.

3. Businesses that offer banking services need to find banking partners.

Security features

Reduced transaction failure leads to higher customer satisfaction. In the mobile money model, a mobile PIN (mPIN) is required to make money transfers and other functions to reduce the risk of fraud. In cases of theft or loss of smartphone, the subscriber’s wallet amount cannot be used without entering mPIN. The application must be compliant with regulatory and industry standards.

Some mobile money applications also include a PCI-compliant platform and triple-DES password encryption with hardware security module key exchanges. There is also an implementation of internal risk and fraud management suite augmented with external APIs.

Different platforms have different security features and follow different protocols as per the regulation set by their country’s government. For example, Alepo mobile money system follows Payment Application Data Security Standard (PA-DSS). Rafael Avigad, vice president – marketing, Alepo Technologies, says, “Blockchain-based ledger improves security by providing a simple auditing mechanism for regulators as well as making the ledger tamper-proof for participating parties (partners, regulators, internal auditors and so on).

Additionally, multi-factor authentication, cryptographically-secure personal data, and tokenisation of payment methods and credentials are used.

Shailendra Naidu Somarouthu, chief executive officer, Obopay, says, “Our processing platform embodies various back-end functions and logics to drive payments. It is based on Java2 Enterprise Edition (J2EE) foundation and supported by a highly-reliable Oracle Real Application Cluster (RAC) database environment. It includes services such as know your customer (KYC), fee engine, velocity limits, reporting and various adapters to financial institutions and payment networks.”

Open APIs with high security promise secure encryption to prevent fraud (through hardware security modules), multi-factor authentication and a variety of processes to deliver a PCI/SAS-compliant technology platform that meets the highest standards and best practices for the payments industry.

Aswin Phlaphongphanich, chief executive officer, SawasdeeShop Co. Ltd, Thailand, says, “Since we partnered with leaders from countries like Malaysia, we adopted similar processes and standards in our operations, to ensure the same operating-level procedures.

We follow the same IT guidelines for data centres, disaster recovery, network securities and system securities as do all banks in Thailand. This is strictly governed and monitored by Bank of Thailand under licence regulations.”

How mobile money system works

Avigad says, “The mobile money system consists of components that allow interoperability, a unified rules engine that ensures regulatory compliance and helps drive commissions and incentives, and a blockchain-based private ledger that improves auditability and multi-factor engagement in the ecosystem. To fulfill various operations, the mobile money system interfaces with various utility billers, banks, payment gateways and other components of the ecosystem. The customer can use the system for these functions.

“Alepo mobile money, however, is not a cryptocurrency system. It relies on liquidity being maintained by holding the equivalent amount of money as that which is circulating in a third-party account.”

Somarouthu adds, “Developers can leverage open APIs to create and deploy Obopay widgets easily. Moreover, Deploy Once, Run Global model offers economies of scale for payment initiatives and a single-core platform for powering carrier money and customised partner deployments in a multi-country, multilingual environment.”

Phlaphongphanich explains, “There are three simple steps to complete payment and money transfer in a mobile money system. Simply download the app, complete e-KYC and remit money. On completing the transaction on the app, customers receive the e-invoice via SMS, which helps them track the transaction.”

Advantages of mobile money in evolving markets

Most credit card companies charge a 2.5 to 3 per cent transaction fee. Eliminating the card lowers this cost. Mobile money has low transaction costs with improved security. It generates new employment opportunities and creates a platform on which other businesses can grow.

Mobile money services have reduced customers’ reliance on cash, thus increasing their financial security and reducing the inherent risks of cash handling, such as loss, theft or fraud. Customers need not use middlemen for money transfers anymore and, therefore experience increased transparency.

Mobile money allows easy access for customers who would otherwise have to travel long distances to send and receive money or pay bills. Purchasing online goods and services has become easier. There is also an option for manual or automatic payouts and inclusion/exclusion of blocked accounts.

Mobile money provides banking services to out-of-reach, low-income people who are geographically inaccessible. These platforms can be accessed through most basic cellphones, have low transaction costs and are distributed by vast networks of agents that provide person-to-person contact and training to those unfamiliar with the technology.

Government regulations for making mobile money model a success

The Indian government is working with major MNOs to send payments for welfare schemes directly to people’s phones. Non-bank providers of mobile money services can also help in improving financial inclusion. So, the government is setting up more enabling regulatory frameworks.

1. An open and level-playing field allows non-bank mobile money providers to operate freely in the market.

2. Regulations ensure that customer funds are protected by non-bank providers, who are licensed to provide mobile money services.

3. There are regulations involved with interoperability, such as ensuring compliance and KYC rules.

4. Establishment of a collaborative and consultative environment between regulators and private providers is found to be an important pre-condition for a successful regulatory framework.

Development challenges

Low levels of financial and technological literacy among target customers have made demand a difficult proposition for businesses. Person-to-person interactions and demonstrations, integrated trainings and developing easy-to-use products have helped overcome this.

Lack of interoperability between networks is a key constraint in some areas. Being able to use the service on only one network restricts reach and makes transactions cumbersome.

Mobile money requires compelling use cases to bring customers onboard. Adoption of mobile money usually requires multi-party involvement (agents, governments and corporations). Hence, a system that can support a wide variety of use cases and facilitate trust between various organisations is needed.

Multi-regulation, socio-political-economic environment differs from region to region. Hence, the solution should be customised to adhere to all of the above.

The roadmap for mobile money

Avigad concludes, “Eventually, e-payments will take over the cash completely. But it will take time.

“In the coming days, mobile money will play an important role in micro-finance, which covers services like micro-saving, micro-credit, micro-insurance and so on. The lines between mobile money and traditional financial services will continue to blur, and the number of non-financial institutions entering the space will increase.”

Somarouthu adds, “Over the last few years, India has experienced exponential growth in digital financial transactions. What began primarily as a convenient mode of payment for booking cabs and ordering meals has expanded into a necessity, especially post demonetisation of old ` 500 and ` 1000 bank notes, in November 2016. From bill payments to buying groceries, the country has come a long way in accepting, adapting and, eventually, preferring digital money over cash.”

The government has been pushing digital payments in a much stronger manner now. This has resulted in significant changes in consumer behaviour. With focused government policies, there is a sea of change in the mindset of Indian customers and enterprises.

Mobile money is experiencing fast-track growth in Indian and international markets. It has disrupted traditional banking and financial systems.

Cost per transaction will follow the universal law wherein it will keep reducing until it hits a steady state and the business model changes. Already newer commercial models are coming into play, offering unlimited transactions for a flat fee.

Phlaphongphanich agrees, “As more consumers get the feel of the cashless economy using mobile banking and mobile wallets, e-payments will take over the cash completely. Ease of transfer and cost to consumers for using cashless services outweighs the convenience and cost of using cash. Merchants, mobile banking and mobile wallets along with government initiatives and policies to adopt this technology will be major drivers.

“The future is digital banking or digital financial platforms, where financial services are all integrated to better suit the requirements of a cashless economy. The financial industry will see huge changes with the introduction of decentralised services like blockchain and digital assets being introduced to consumers.

“Surely, consumers will choose lowest fees and most efficient services. Thus, cost of transactions will have to be lowered, and branchless and AI technologies to cater to this vision will have to be adopted.”