“If we are serious about moving towards energy independence in a cost-effective way, we should invest in solar energy. If we are serious about cutting air and water pollution and reducing greenhouse gas emissions, we should invest in solar energy”—Bernie Sanders

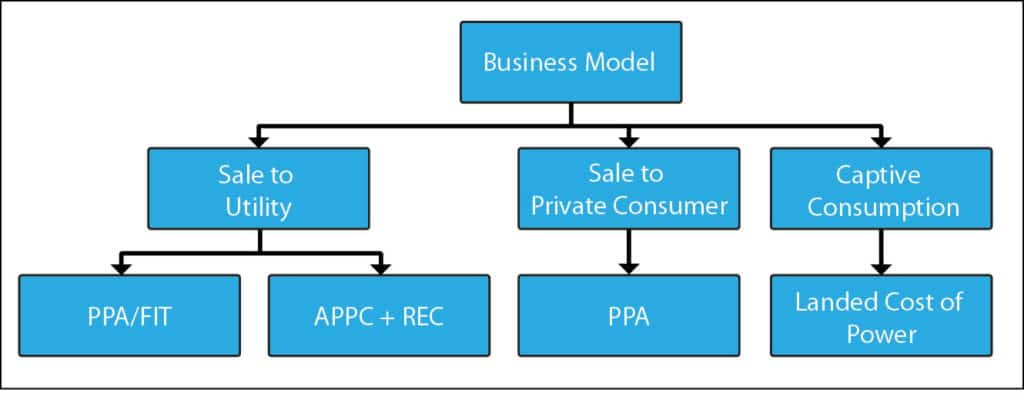

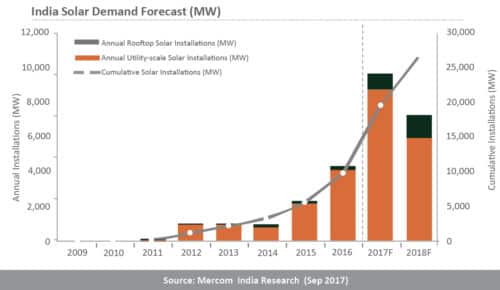

Solar energy is a definite solution to the increasing energy needs of our times. This is evident from solar rooftop installations growing at a rate of over 18 per cent in 2017. Solar power generation offers various avenues of business profitability. But, for investors, the fundamental questions remain: How can I go about it? Should I go online with solar ecommerce platform? Should I invest in commercial rooftop model? Should I buy my own land or leverage a third-party model?

To solve the dilemma, a few distinguished solar business models in India have been explained in this article. Your choice of a model should depend on the investment required, state government’s policies for solar power generation and its commercial usage, and natural conditions of the region.

Sale-to-utility model

It refers to selling the solar power generated by you to state power authorities like NTPC.

Power purchase agreement (PPA)/feed in tariff (FIT). An agreement is signed with the private business supplying solar power to the state/government body or DISCOM. Normally the stated period is 25 years and the prices are decided through competitive bidding and tenders. This is the most popular business model for commercial power supply usage.

GMR Infrastructure has installed a rooftop solar power plant at Delhi Airport for consumption by ‘Celebi’ for Cargo Terminal 2 of the airport. The plant has the capacity to produce 2MW per day. An approximate capital of 100 million rupees was invested to set up the power plant infrastructure. For almost 8000 units of solar power produced per day, ‘Celebi’ now saves 64,000 rupees per day—as against tariffs paid to DISCOM at the rate of 8 rupees per unit. The project’s expected ROI time is five-and-a-half years. The project has been operational for almost two years now.

Selling to private companies

A private solar power generating company is free to sell power to other private companies through a power purchase agreement.

Captive consumption

If the power generated by one unit of a business conglomerate is utilised by the same and other units of the business, it is defined as captive consumption. A classic case is that of Tata Steel, which utilises the power generated by Tata Solar.

Karan Sharma, managing director, SunSmith Infra, shares, “We have installed a 200kW rooftop solar plant at OM Furnishers in Gujarat. The initial capital investment required to set up the plant was 9.6 million rupees. The plant will produce about 1000 units of electricity per day, thereby saving 7000 rupees on a daily basis which would otherwise would have been paid to Dakshin Gujarat Bijli Vidyut Nigam Ltd as tariff.”

“It has become challenging to pin down an installation number as so many projects that are completed are stranded and unable to commission due to evacuation delays. It will all depend on what can get connected to the grid by the end of the year,” said Priya Sanjay, managing director of Mercom India.

Government adaptation

Presently, Solar Energy Corporation of India undertakes solar rooftop power generation under two models:

CAPEX

Within this model, the complete rooftop system is owned by the private entity (third party). Lifetime (25 years) operations and maintenance is also within the purview of the third-party rooftop owner. Developers are responsible only for the first two years. They are selected through an extensive bidding process and are offered 30 per cent subsidy on the cost of the total system.

RESCO

In this model the entire system is owned by the developer. Operations and maintenance also remain the developer’s responsibility. Rooftop owners can consume electricity on the basis of a pre-decided tariff. Excessive power is transferred to the grid, based on the local government’s rules and regulations. For this model as well, the developers are selected through a bidding process.

Online solar ventures

Like any other business today, solar also has immense growth potential in the online space. One may opt to open an online solar market place of products or invest in creating an exclusive job portal for the same.

India Go Solar is an online ecommerce platform that sells solar related goods and services. India Solar Talent is an online recruitment platform for solar jobs.

Benefits provided by the government

The government provides 30 per cent capital subsidy to residential, government, social and institutional sectors for solar rooftop installations. The country has increased its rooftop budget by a significant 730 per cent since 2016. For states like Sikkim, Uttarakhand, Jammu and Kashmir, Lakshadweep, and Andaman and Nicobar, the subsidy is as high as 70 per cent.Haryana, Rajasthan and Maharashtra have already started reaping the benefits of solar power, while Delhi and Punjab are promoting them in a big way for faster adoption by the masses.

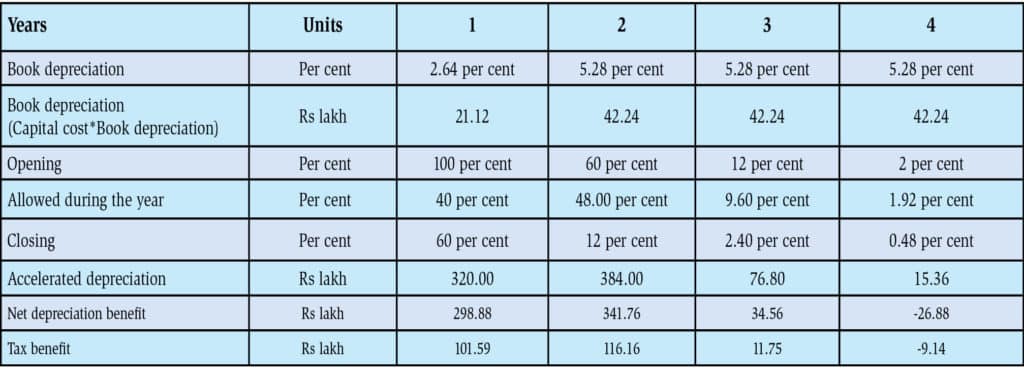

For clarity of the thoughts exchanged here, we discuss below a project with total generation capacity of 1MW per day. Section 32 of Income Tax Act provides for accelerated depreciation of 80 per cent invested capital into solar PV projects to professional companies with tax liabilities. Investors can set off tax liability on their taxable income to the tune of 80 per cent in the first year, and subsequently 20 per cent from second year onwards.

Example: If your company paid Rs 33 as tax on a profit of Rs 100 earlier, by installing a solar plant at a cost of Rs 100, you can simply claim a deprecated expense of Rs 80 (80 per cent) in the first year, thus reducing your profit for tax purposes to Rs 20. Now, you need to pay just Rs 6.6 as tax. In other words, you end up saving Rs 26 on your investment of Rs 100 in the solar plant. The inherent impacts of these tax provisions are cost saving on infrastructural development to the tune of 20 per cent and reduced electricity payout load of Rs 2 per unit.

For reference and understanding, let’s consider:

1. Project cost (capital cost) Rs 80 million

2. Depreciation amount 90 per cent (assuming 10 per cent scrap value)

3. Book depreciation (on fixed assets) 5.28 per cent (dep. as per Companies Act)

4. Tax depreciation rate 80 per cent (under accelerated depreciation benefit)

5. Effective tax rate (as per government) 33.99 per cent

The discussion above shows that the market for solar businesses is ripe, but some hiccups remain in the form of anti-dumping duty, which is adding to its volatility. As the solar business is currently import-dependent, government regulations could lead to cuts in profit. So the question is: Is this the right time to invest in this business? Or what should be done to make the solar business more viable?

Waiting to hear back from you, you may mark your mails to [email protected]